- Bitcoin has seen a slight decline, pausing the revisiting of its ATH.

- The market is now in greed as many anticipate BTC hitting its ATH once more.

As Bitcoin’s value surged towards the $72,000 mark, a noticeable spike briefly liquidations swept via the market. The rise in liquidations alerts the extreme volatility in current days, as many quick positions had been caught off-guard by Bitcoin’s upward momentum.

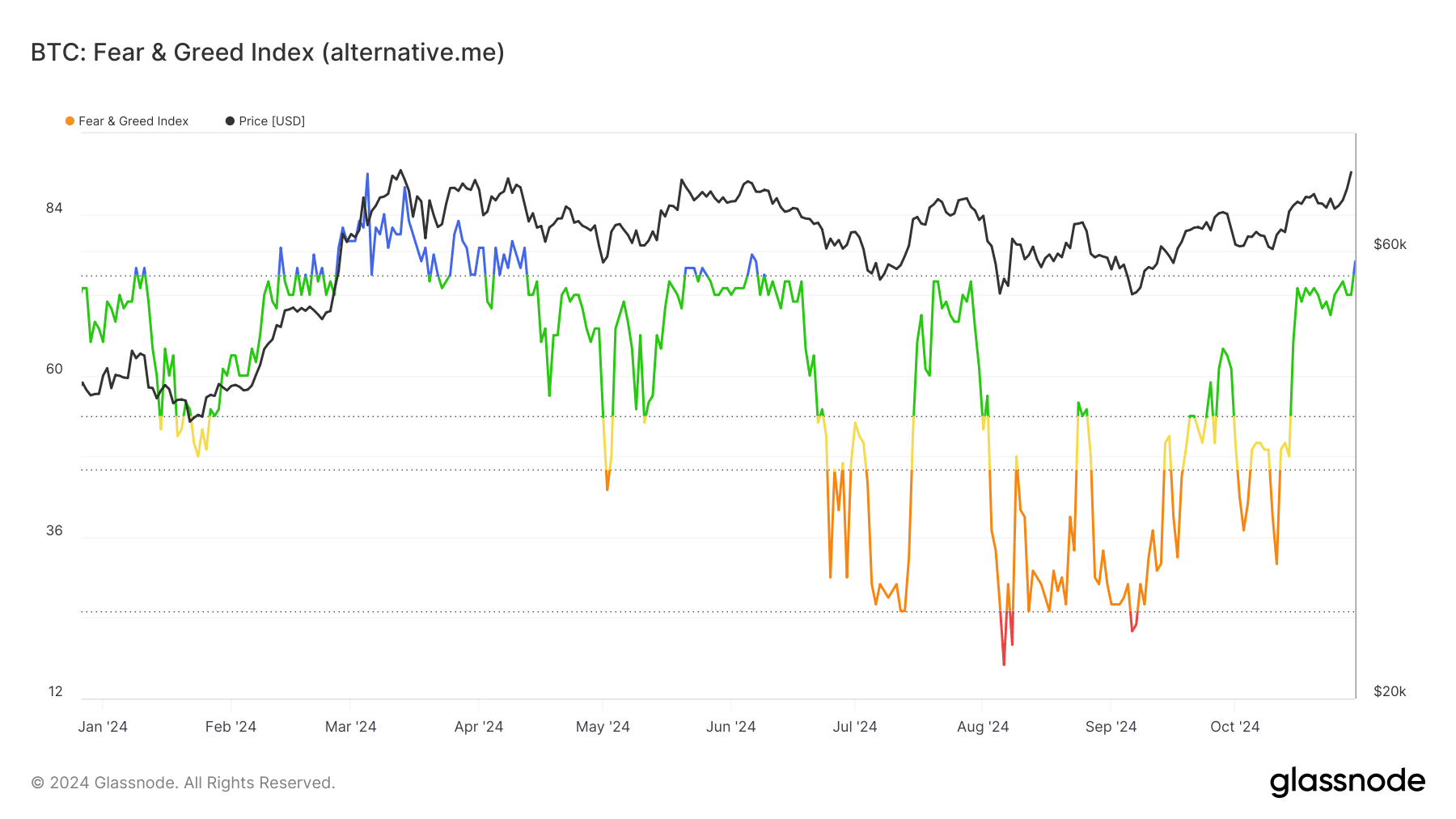

The convergence of Bitcoin’s value actions with the Worry and Greed Index reveals the underlying sentiment driving these fluctuations.

Brief liquidations hit new highs amid Bitcoin rally

Bitcoin’s value rally over the previous week has led to a major uptick in futures quick liquidations throughout main exchanges.

Based on information from Glassnode, whole quick liquidations reached unprecedented ranges, with over $48 million worn out in a single day as BTC pushed past crucial resistance ranges.

This spike in liquidations illustrates the market’s response to the bullish momentum, as merchants betting on a value decline had been pressured to exit their positions in fast succession.

Supply: Glassnode

The liquidation quantity highlights the sensitivity of leveraged quick positions to Bitcoin’s value fluctuations. With the market now pushing the $72,000 threshold, quick merchants are retreating to keep away from additional liquidation losses.

The cascade impact of liquidations tends to gasoline value momentum additional, as pressured buy-backs on quick contracts drive Bitcoin’s value upward.

Rising Worry and Greed Index displays shifting sentiment

Alongside the spike in liquidations, the Worry and Greed Index has proven a gradual climb, reflecting the shift from a cautious market stance to a extra optimistic outlook.

At first of October, the index oscillated within the “fear” territory, suggesting market hesitation.

Nevertheless, as Bitcoin’s value continued to interrupt resistance ranges, the index has transitioned into “greed,” reaching its highest studying for the reason that mid-year.

Supply: Glassnode

The Worry and Greed Index has traditionally been a barometer for potential market corrections, as excessive greed typically precedes short-term pullbacks.

Nevertheless, the present stage of optimism, pushed by sturdy market fundamentals and institutional curiosity, would possibly maintain the rally. However elevated greed might recommend an overheating section, the place corrections change into probably if sentiment turns too exuberant.

What’s subsequent for Bitcoin amid excessive volatility?

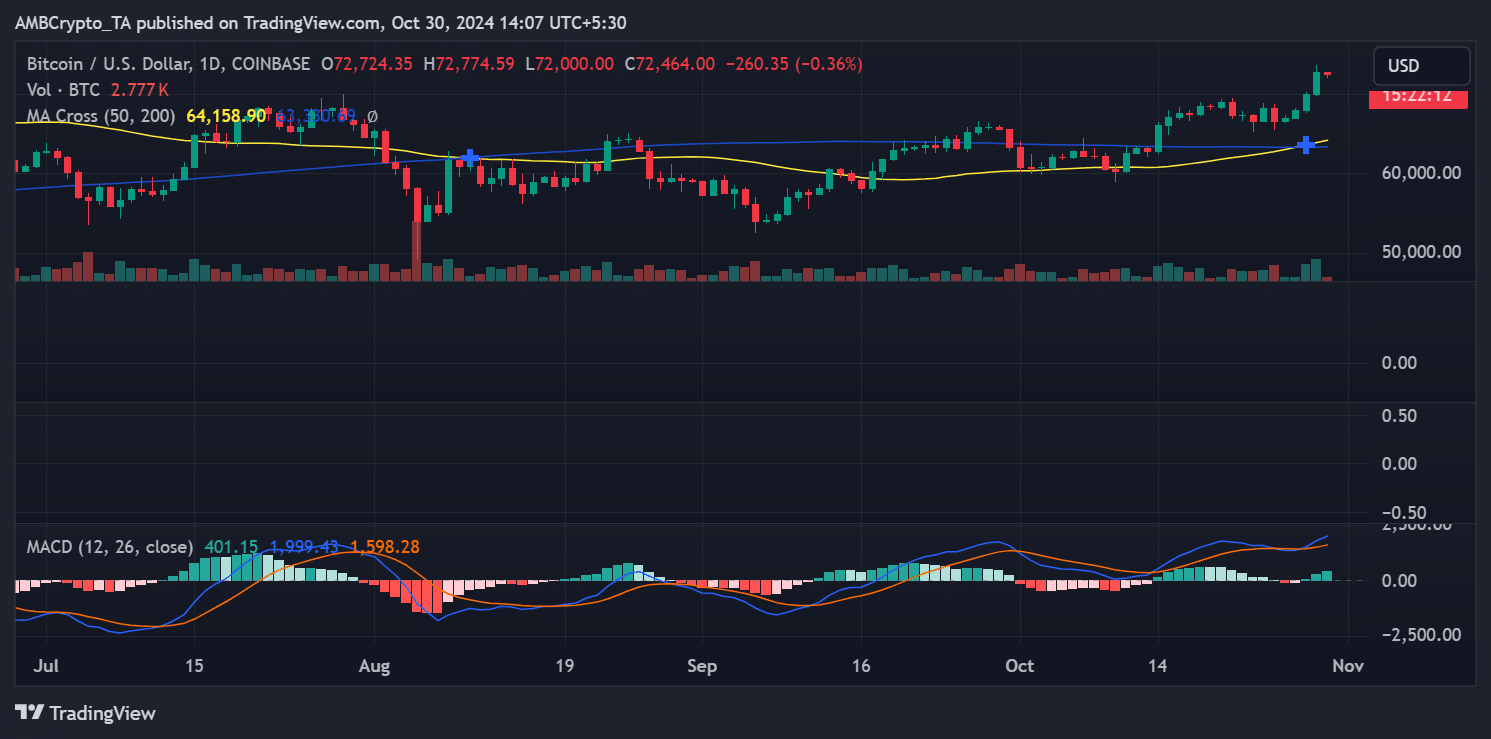

With Bitcoin edging nearer to its all-time excessive, the market is poised for heightened volatility. The MACD indicator on the every day chart reveals bullish momentum.

On the identical time, the Worry and Greed Index implies that sentiment is strongly in favor of additional upside.

Supply: TradingView

But, as historical past reveals, excessive greed ranges can lead to sharp reversals, particularly if the value fails to ascertain a brand new excessive above resistance.

Learn Bitcoin (BTC) Worth Prediction 2024-25

Bitcoin’s trajectory will probably rely upon sustained shopping for curiosity and potential profit-taking pressures. Brief merchants might undertake extra cautious methods, given the current liquidations.

General, Bitcoin’s path seems bullish, but merchants ought to brace for doable corrections on this extremely dynamic atmosphere.