- BTC would possibly eye $84K subsequent, based on CryptoQuant information.

- There was extra headroom for BTC development amid renewed whale bets.

On the twenty ninth of October, Bitcoin [BTC] tapped $73K and prolonged its market dominance to a brand new excessive of 60%. The additional rally made it nearer to a contemporary all-time excessive (ATH) as analysts projected extra development potential.

Is $84K the following goal?

In line with CryptoQuant’s head of analysis, Julio Moreno, the following goal can be $84K if March’s ATH of $73.7K was cleared. He stated,

“Bitcoin is near a fresh ATH. Under a valuation perspective, $84K would be the next target (the “upper” band.”

Supply: CryptoQuant

For the unfamiliar, the dealer on-chain realized value band is a valuation metric based mostly on historic BTC value information.

It makes use of realized value (the typical value foundation for BTC short-term merchants) as a reference level, with higher and decrease bands as resistance and assist ranges.

For the reason that present value motion was above the realized value, the following and speedy goal was the higher band (resistance) at $84K, offered BTC costs stayed above $60K.

Effectively, the $84K goal isn’t far-fetched, provided that BTC choices merchants eyed $80K by the top of November, no matter subsequent week’s US elections end result.

That stated, the present market construction additionally confirmed extra headroom for development, as famous by Mathew Siggel, VanEck’s head of digital belongings analysis.

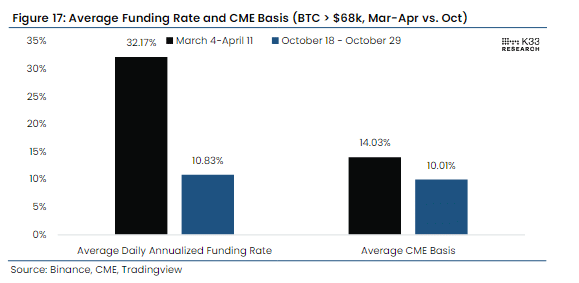

Siggel stated that regardless of BTC nearing contemporary ATH, the market was not as overheated as seen throughout March/April.

“Past BTC peaks have coincided with surging perp premiums, hardly the environment today. Also, current spot volumes are half of March/April, indicative of substantially less panic buying from retail participants – a welcome observation for continued strength.”

Supply: K33 Analysis

In brief, the market was extra steady and more healthy, not like the huge euphoria seen in March when BTC hit a brand new ATH.

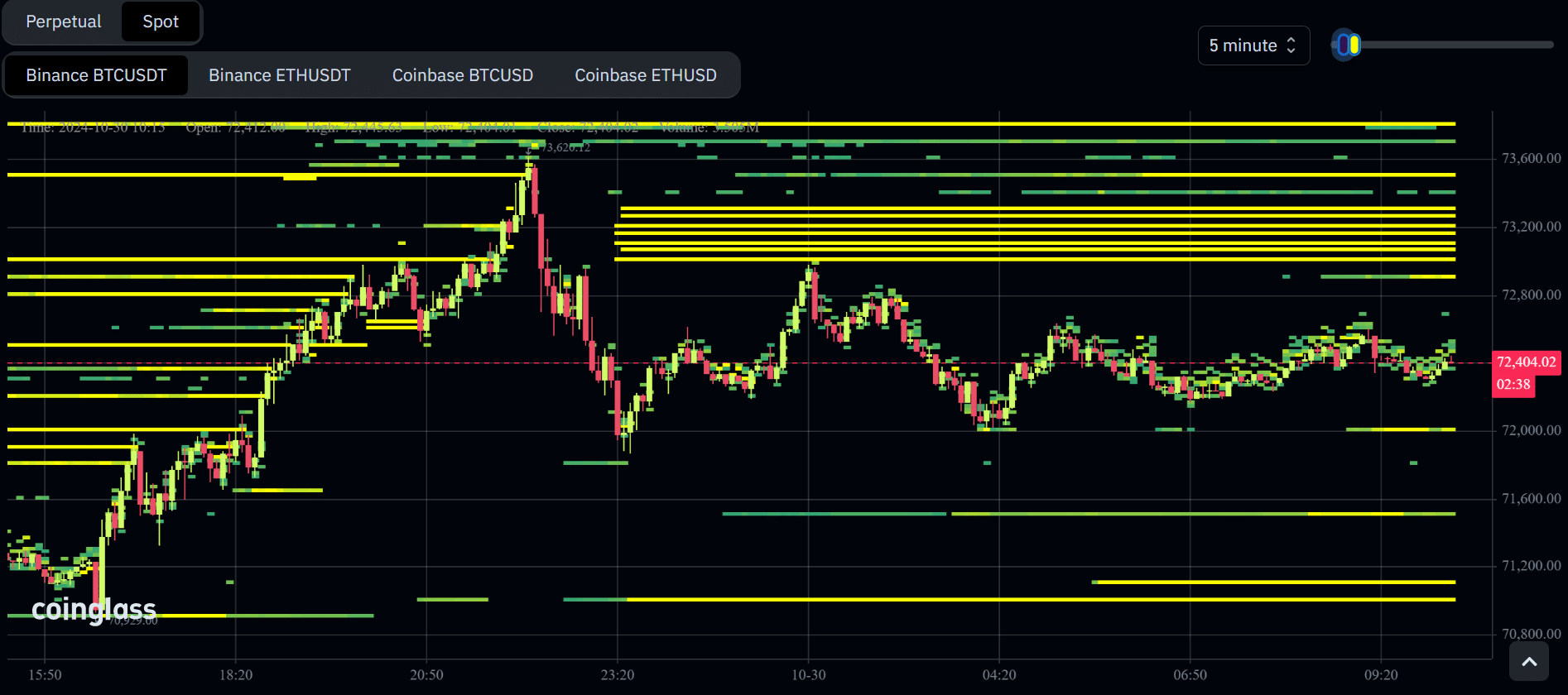

However there was a slight caveat within the brief time period. There have been appreciable promote partitions (yellow strains at $73.2K and $73.8K) on the Binance spot, proper on the March ATH, which might develop into a roadblock for just a few hours or days.

Supply: Coinglass

Learn Bitcoin [BTC] Value Prediction 2024-2025

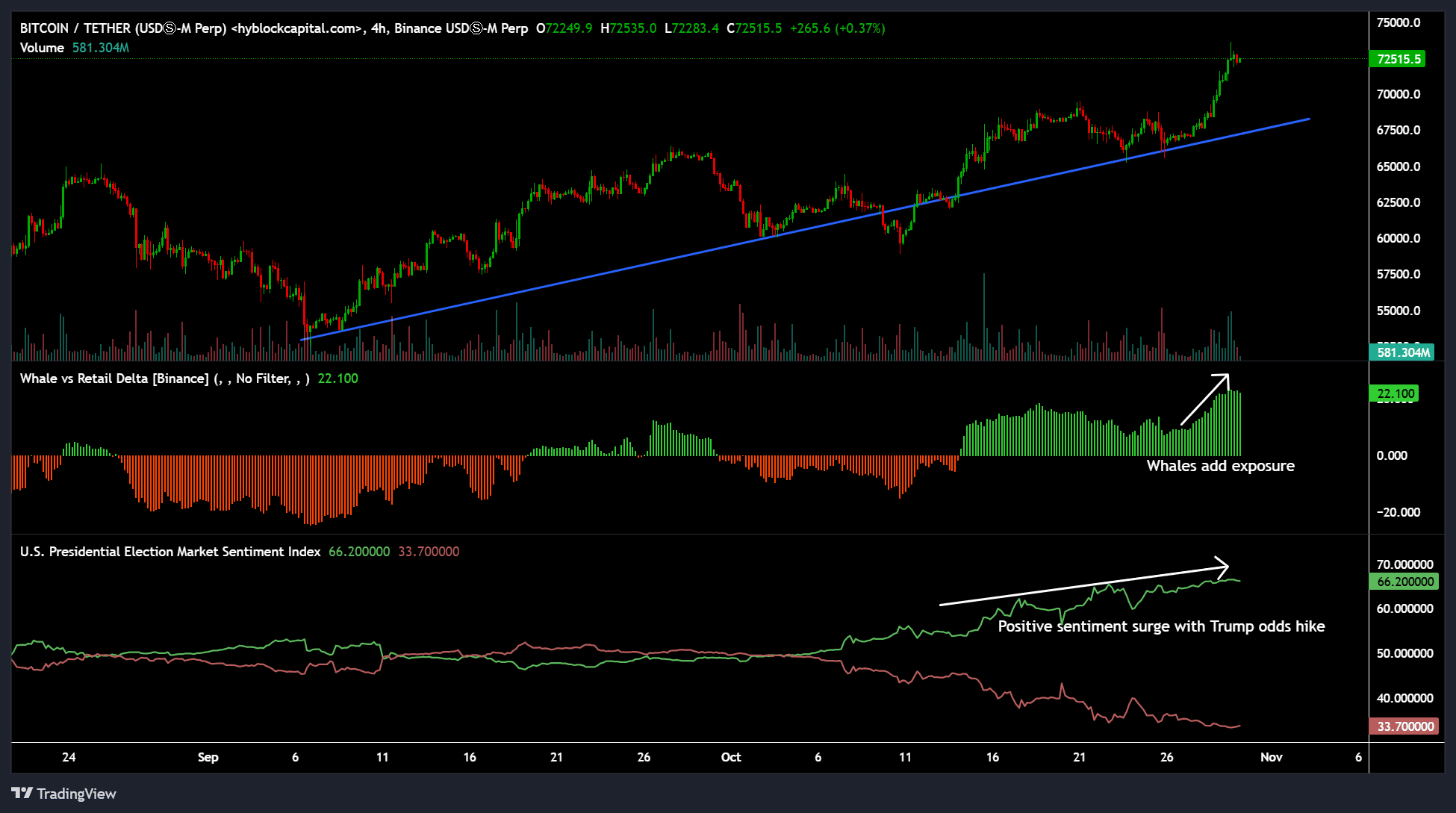

Nonetheless, whales remained adamant and confirmed excessive optimistic conviction. In truth, the run-up to $73K gave the impression to be pushed largely by massive gamers as they added extra publicity prior to now 5 days.

This was illustrated by the rising Whale to Retail Delta indicator, suggesting that giant gamers had been extra bullish on BTC than retail at present ranges.

Supply: Hyblock