- Bitcoin has skilled its largest single-day change outflow since mid-September.

- Open Curiosity has surged to $20.3 billion, reflecting elevated speculative exercise.

Bitcoin [BTC] has skilled its largest change outflows since mid-September, a key sign of elevated shopping for exercise as traders take their BTC off exchanges and into personal wallets.

The information comes as BTC hovers lower than 10% beneath its all-time excessive, sparking optimism available in the market. Alternate outflows are sometimes considered as a bullish indicator.

Bitcoin change outflows sign accumulation

Based on information from CryptoQuant, greater than 15,000 Bitcoin have been withdrawn from exchanges on the twenty second of October, marking the biggest single-day outflow in over a month.

When vital volumes of BTC are moved off exchanges, it usually alerts investor confidence in its future worth actions.

This shift displays a want to carry belongings for the long run, as BTC nears vital resistance factors near its all-time excessive.

Supply: CryptoQuant

The sample of change outflows has been constructing as BTC’s worth steadily climbed above $67,000.

With withdrawals aligning with rising costs, there’s a clear indication of bullish sentiment taking form available in the market.

This accumulation development usually precedes rallies, as much less BTC on exchanges can scale back sell-side stress, supporting a possible worth breakout.

Open Curiosity reveals elevated speculative exercise

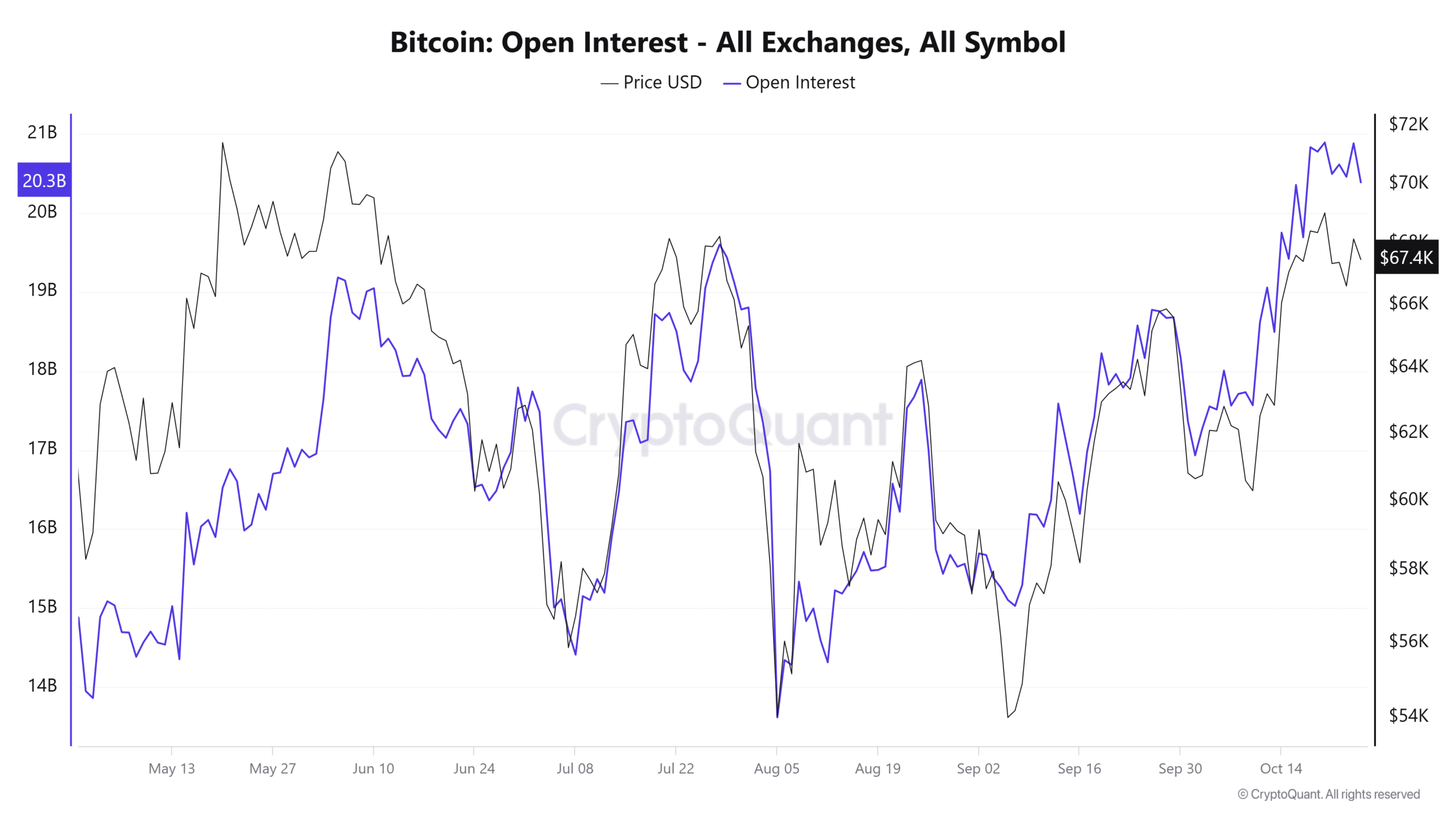

Alongside the change outflows, Bitcoin’s Open Curiosity in futures contracts has risen to $20.3 billion, suggesting a surge in speculative exercise.

Open Curiosity represents the full worth of energetic by-product contracts. When it rises together with outflows, it usually signifies each long-term investor accumulation and short-term speculative positioning.

This development signifies that merchants are making ready for potential worth fluctuations, both by hedging positions or betting on additional upside.

Supply: CryptoQuant

Nonetheless, excessive Open Curiosity can even sign impending volatility. Any fast worth motion may set off leveraged place liquidations, making a ripple impact available on the market.

Such exercise usually results in short-term worth swings, even amid an overarching bullish sentiment.

Bitcoin worth motion nears key resistance ranges

Bitcoin was buying and selling round $66,900 at press time, nearing a resistance degree that, if breached, may pave the way in which for additional beneficial properties.

The Chaikin Cash Stream (CMF) indicator, which measures capital inflows and outflows, stood at 0.13, indicating optimistic momentum as capital flows into Bitcoin.

Supply: TradingView

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Merchants are intently waiting for a breakthrough of this resistance degree, because it may doubtlessly set off a robust rally.

The heightened Open Curiosity serves as a cautionary signal, suggesting that elevated volatility may very well be on the horizon. If Bitcoin manages to surpass this resistance, it could result in a major upward development.