Picture supply: Getty Photos

Authorized & Basic Group‘s (LSE:LGEN) been one of many FTSE 100‘s hottest dividend shares lately.

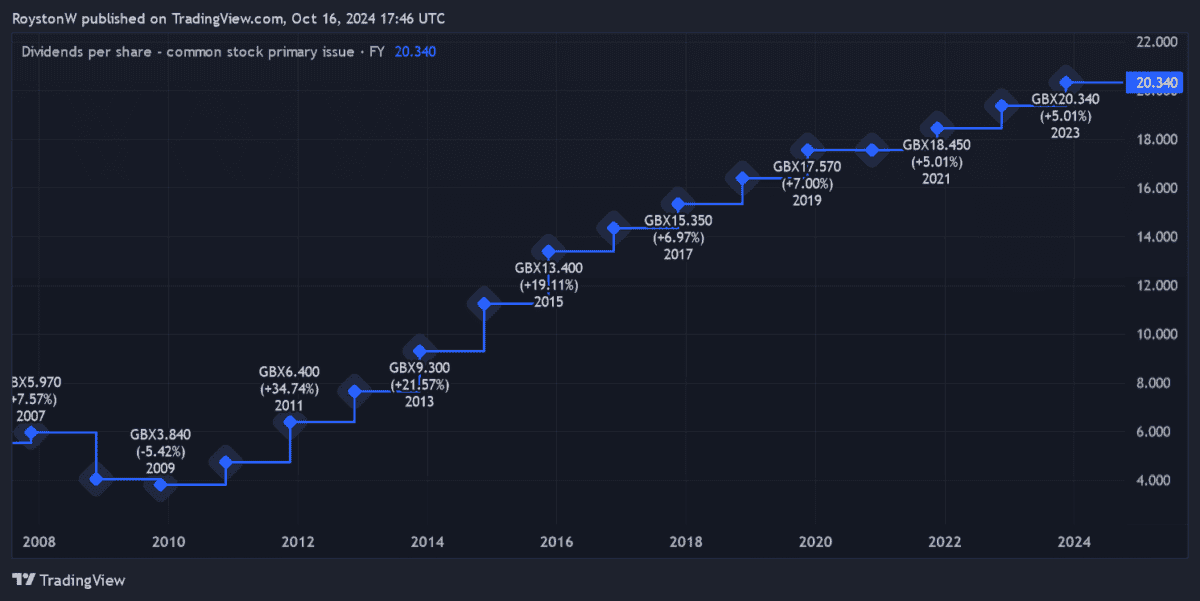

The monetary companies large hasn’t simply hiked annual payouts virtually yearly for the reason that 2008/2009 monetary disaster (as proven under), however its dividend yields have additionally trounced the Footsie common over the interval.

Dividends are by no means, ever assured. However there’s excellent news for homeowners of Authorized & Basic shares like me. Metropolis analysts are tipping the corporate to pay a big and rising dividend by way of to 2026, no less than.

Utilizing a £10,000 funding right this moment, how a lot passive revenue might I generate?

9.8% dividend yield

As an asset supervisor, life insurer and retirement product supplier, earnings right here can disappoint when shoppers reduce and rates of interest rise. Certainly, these elements contributed to double-digit earnings declines in each of the previous two years.

Nevertheless, the corporate’s wealthy steadiness sheet means it’s been in a position to maintain mountain climbing dividends. In 2023, the annual dividend on Authorized & Basic shares rose 5% to twenty.34p per share.

Encouragingly, Metropolis analysts suppose money rewards will maintain rising by way of to 2026 no less than, as indicated within the desk under.

| 12 months | Dividend per share | Dividend development | Dividend yield |

|---|---|---|---|

| 2024 | 21.32p | 5% | 9.3% |

| 2025 | 21.83p | 2% | 9.5% |

| 2026 | 22.36p | 2% | 9.8% |

These forecasts are according to Authorized & Basic’s plans. And as you may see, dividend yields sail above the historic FTSE 100 ahead common of 3-4%.

I’m anticipating dividends to proceed rising over this era too. However even when dividends fail to develop past 2026, a £10,000 lump sum funding might nonetheless present me with a month-to-month passive revenue above £600.

£623 a month

If dealer estimates are correct, I’d make £980 in dividend revenue in 2026, and £9,800 over a decade. Over 30 years, I’d take pleasure in a £29,400 passive revenue.

However I might make much more if I had been to reinvest these shareholder payouts. Due to the mathematical miracle of compounding, after 10 years, I’d have generated £16,539 in dividends.

And after 30 years, I’d have made a complete passive revenue of £176,913, greater than six instances the £29,400 I’d have made with out reinvesting.

After including my £10,000 preliminary funding, my portfolio can be price £186,913 (assuming no share value development). If I then drew down 4% annually, I’d have an annual passive revenue of £7,477 and a month-to-month one in all £623.

A prime choose?

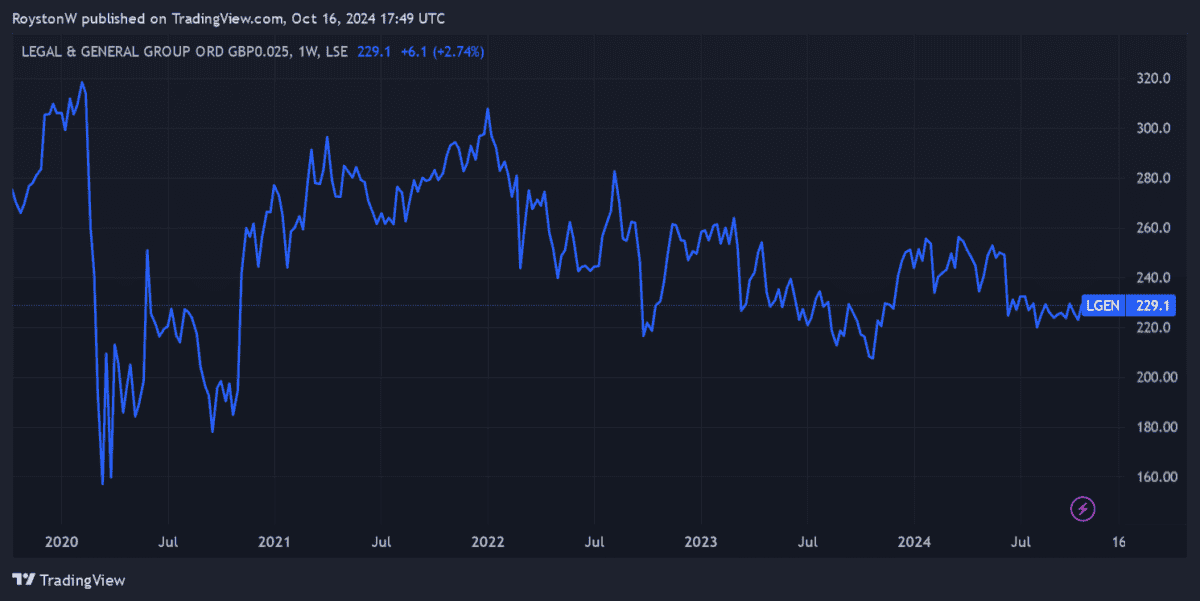

Authorized & Basic’s share value has struggled for traction since late 2022, as proven above. This displays the influence of upper rates of interest — which stay a menace going forwards — on its buying and selling efficiency.

Nevertheless, over the subsequent 30 years, I’m anticipating the enterprise to ship wholesome share value positive aspects and plentiful dividend revenue, pushed by altering demographics. And so I might need a fair greater passive revenue to reside off than that £623 talked about above.

So long as Authorized & Basic’s steadiness sheet stays sturdy, it’ll be capable to proceed paying massive dividends and make investments for development. Issues actually look good proper now, with the agency concentrating on £5bn-£6bn price of operational surplus money era between 2025 and 2027.

I feel Authorized & Basic shares are price a severe look from dividend traders.