- Crypto liquidations hit almost $300 million in simply 24 hours, pushed by Bitcoin’s sudden worth surge.

- Brief positions confronted the largest losses, with over $206 million liquidated as Bitcoin broke key resistance ranges.

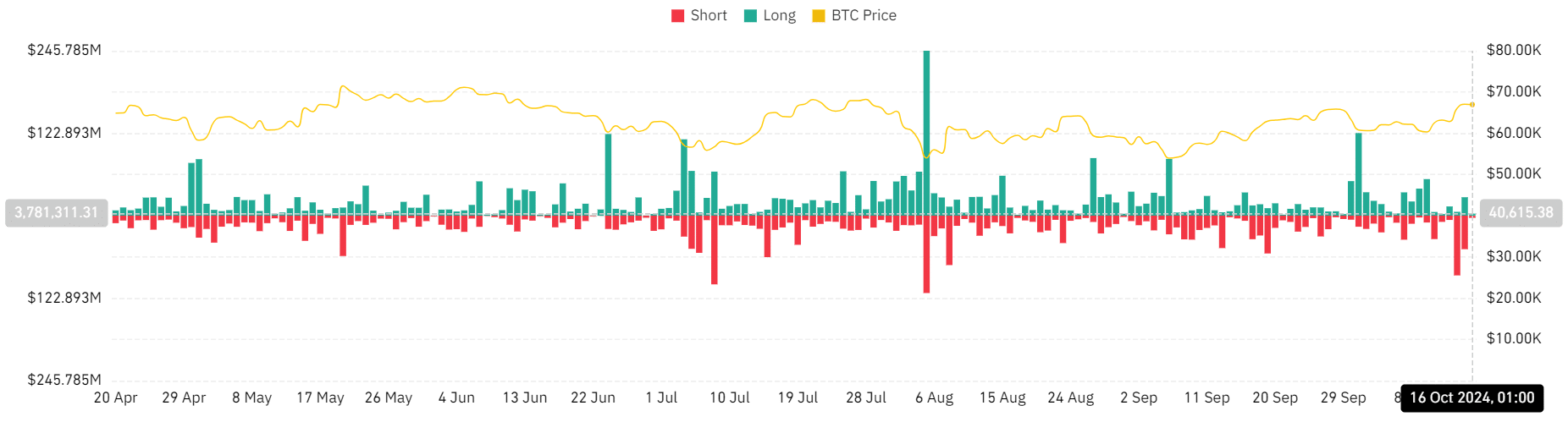

Previously few days, each lengthy and quick positions have skilled important liquidations, with crypto liquidations reaching almost $300 million in simply 24 hours.

The catalyst for this surge in liquidations was a sudden worth bounce in Bitcoin [BTC], which broke by a key resistance degree, inflicting a wave of compelled liquidations throughout the market.

Crypto liquidations close to $300 million

Information from Coinglass revealed that crypto liquidations climbed to nearly $240 million on the 14th of October.

Brief positions have been hit the toughest, with roughly $206 million in liquidations, whereas lengthy positions accounted for about $35 million.

Nonetheless, the state of affairs shifted within the following buying and selling session. The following day, lengthy place liquidations surged to over $187 million. Brief positions continued to really feel the strain, dealing with over $123 million in liquidations.

This mixed whole represented the second-largest liquidation occasion of the month, trailing solely behind the huge $500 million liquidation that occurred on the first of October.

Supply: Coinglass

As of this writing, lengthy positions proceed to endure, with greater than $25 million in liquidations already recorded within the present buying and selling session.

Bitcoin liquidations present sturdy consistency

The speedy worth motion in Bitcoin triggered the current wave of crypto liquidations. After a protracted interval of minimal worth motion, Bitcoin surged, resulting in a collection of liquidations, particularly for brief positions.

AMBCrypto’s evaluation of the liquidation chart confirmed that on the 14th of October, Bitcoin liquidations totaled over $94 million. Brief positions bore the brunt, accounting for $89 million.

Within the following session, quick liquidations dropped to nearly $50 million, whereas lengthy liquidations climbed to $27 million.

Supply: Coinglass

This sample means that Bitcoin’s current worth surge has disproportionately affected quick merchants because it continues to construct momentum.

Bitcoin worth developments

Wanting on the Bitcoin’s worth chart, on the 14th of October, the worth surged by greater than 5%. This induced a serious affect on quick positions, which noticed over $200 million in liquidations.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The next day, Bitcoin continued its upward momentum, posting a 1% enhance. This time, lengthy positions took nearly all of the hits within the liquidation market.

At press time, Bitcoin was buying and selling within the $67,000 worth vary, displaying a slight enhance and additional including to the complexity of the crypto liquidations development.