- BTC.D has declined by 2.24%, as an investor predicted a brand new altcoin season.

- 75% of altcoins have outperformed Bitcoin over the previous 90 days.

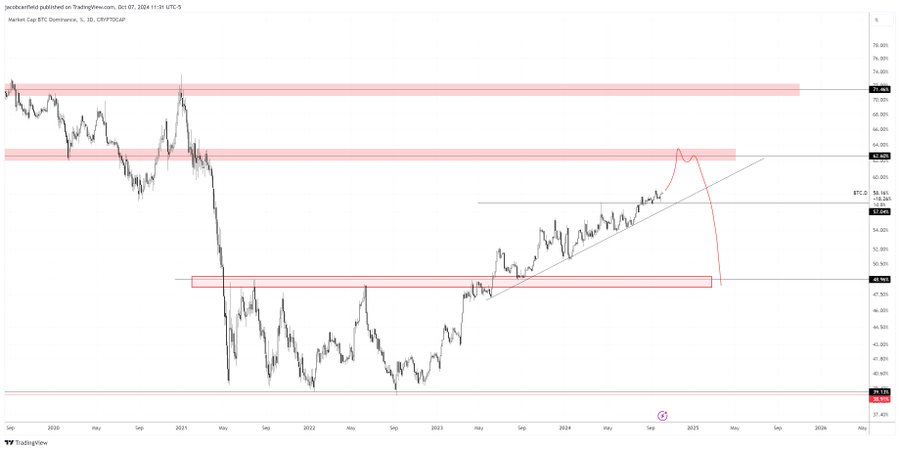

Over the previous month, Bitcoin’s [BTC] dominance [BTC.D] has skilled sustained rejection at $58 resistance degree.

The fixed failure to interrupt out of this cussed resistance degree has introduced elevated enthusiasm amongst altcoin holders.

Bitcoin dominance was at 56.71 at press time after seeing a 0.03% lower over the previous day. This can be a sharp decline from 58% witnessed per week in the past.

As such, its market cap stood at $1.24 trillion, whereas the whole crypto market was at $2.18 trillion.

Supply: CoinCodex

Subsequently, this decline leaves BTC taking 1.55% of the worldwide property, which is manner beneath 2.75% of the whole crypto property.

Traditionally, the BTC.D decline is nice information for altcoins, as they have an inclination to surge. Thus, the present pattern has left analysts deliberating over BTC and altcoin’s future trajectory.

Inasmuch, Johncy Crypto has instructed a possible altcoin season, citing the formation of a rising wedge sample.

What BTC.D’s decline means for altcoins

In his evaluation, Johncy posited that Bitcoin dominance was forming a rising wedge sample on weekly charts, which is a bearish sign.

Supply: X

Subsequently, a breakdown from this channel will affirm a bearish outlook for the crypto.

As such, if BTC stays buying and selling sideways because it has down over the previous week, or bullish whereas dominance declines, this will sign altcoin’s season.

What this implies is that if Bitcoin dominance continues to say no, altcoins will achieve extra market share, thus positioning altcoins to outperform BTC.

Nonetheless, among the best methods to find out altcoin’s efficiency in opposition to BTC is utilizing ETH/BTC ratio.

Supply: Coinmarketcap

As such, ETH/BTC reveals a 2.40% lower over the previous 24 hours. Nonetheless, total, ETH has outperformed BTC. The truth is, it has surged by 6.28% in opposition to BTC over the previous 30 days.

This implies improved efficiency by altcoins in opposition to BTC on month-to-month charts, as dominance has dropped from 58% to 56. 71.

Supply: CoinMarketCap

Equally, memecoins have made a powerful bounce, rising in market cap from $43.7 billion to $50.9 billion on weekly charts.

Supply: Blockchain Middle

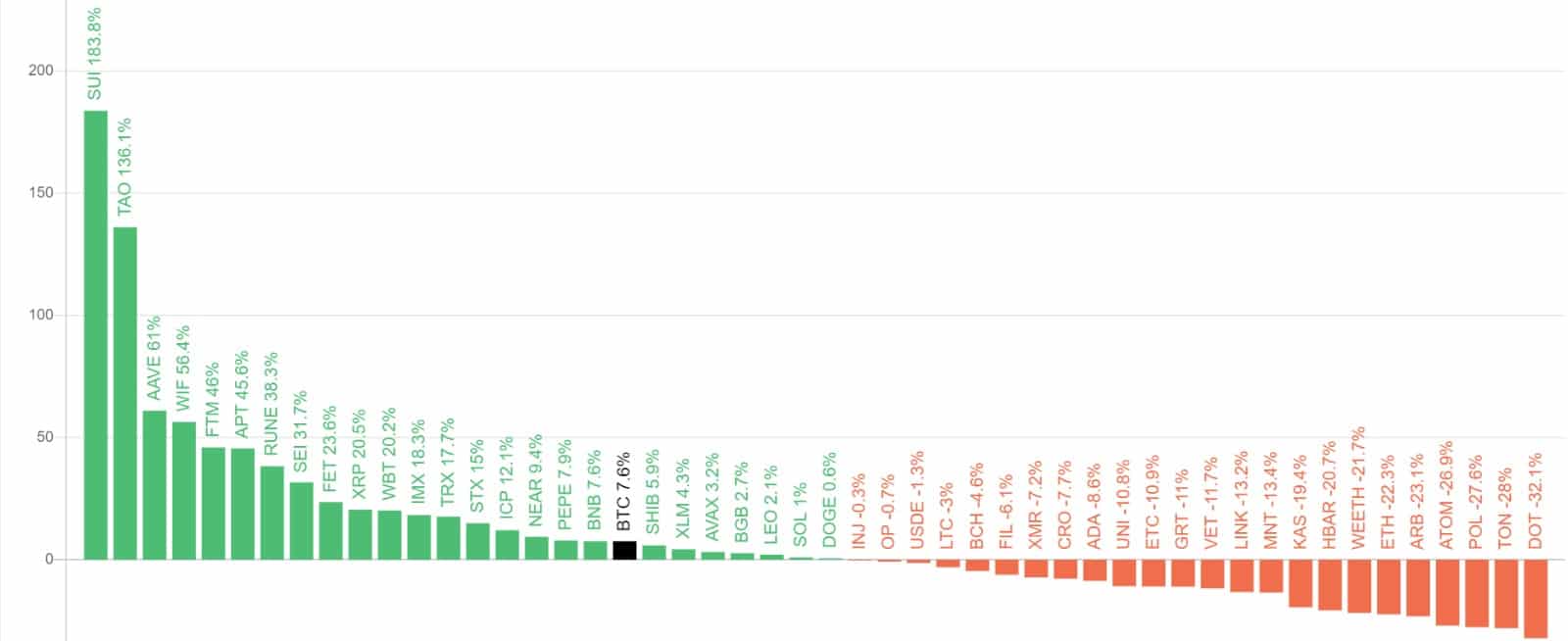

Moreover, numerous altcoins have outperformed Bitcoin over the previous three months. Notably, Sui [SUI] is main by 183.5%, Bittensor [TAO] by 136.1%, Aave [AAVE] by 61%, and dogwifhat [WIF] by 56.4%.

Subsequently, 75% of the High 50 cash carried out higher than Bitcoin over the past 90 days.

Supply: Blockchain Middle

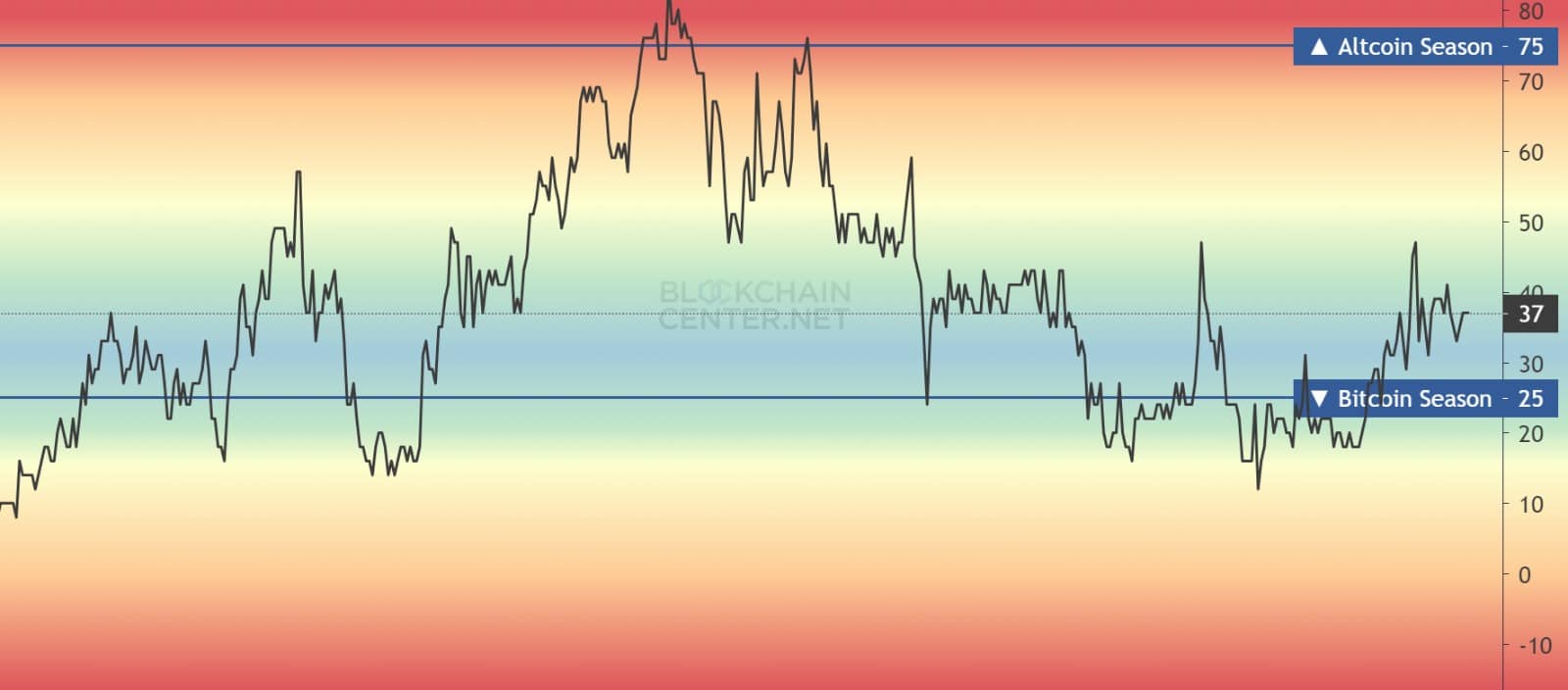

Lastly, at press time, the Altcoin season index was at 37, an increase from 33 over the previous week and a decline from a excessive of 47 reached 15 days in the past whereas the BTC season index was at 25.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Such a situation signifies elevated demand for altcoins amongst buyers in comparison with Bitcoin.

Merely put, the altcoin season is slowly gaining momentum and the potential for an upside continues to rise.