Picture supply: Getty Pictures

The IAG (LSE:IAG) share value has slumped 10% over the previous 5 days, marking an finish to the broad upward trajectory of the final six months. So what’s occurring?

Airways are delicate

Airways are notably delicate shares relating to geopolitical occasions, wars, and oil value fluctuations. As we’ve seen with current and ongoing conflicts, tensions and wars usually result in airspace closures, route disruptions, and decreased journey demand, instantly affecting airline revenues.

Western airways are nonetheless having to keep away from Russian airspace, whereas Iran’s ballistic missile barrage on Israel brought about extra non permanent disruptions. I used to be a type of unhappy individuals watching flightradar24 as airways diverted and Iranian belongings flew out of hurt’s approach on Tuesday (2 October) night.

In the meantime, aside from the dreadful human value, wars are inclined to have a profound influence on oil costs, in flip, severely impacting airways’ backside traces. Gas accounted for round 25% of IAG’s expenditure final yr.

So what occur right here?

Iran’s ballistic missile assault on Israel is unhealthy for a lot of causes — most of them don’t have anything to do with investing. For one, this represented an arguably anticipated however tragic escalation of the continuing battle between Israel and Iran’s proxies.

However that is additionally a priority as a result of Iran stays a notable oil producer — representing round 3% of worldwide output — and exporter with over 1.7 million barrels a day leaving the nation — a lot of it heading to Chinese language refiners that don’t recognise US sanctions.

We are able to speculate as to how Israel would possibly retaliate. Nevertheless, US President Joe Biden mentioned publicly on 3 October that Israeli strikes on Iranian oil services have been being thought of.

The result’s oil spiked. On the time of writing, Brent Crude — a benchmark for oil — is up 8.9% over the week at $78 a barrel. Some analysts have even begun forecasting $100 a barrel by the top of the yr.

Gas hedging

It goes with out saying that as oil turns into costlier, so does jet gas. And that will influence the underside line of airways like IAG.

Nevertheless, European airways follow hedging. This entails fixing a gas value for a set interval, which may help corporations enhance value administration.

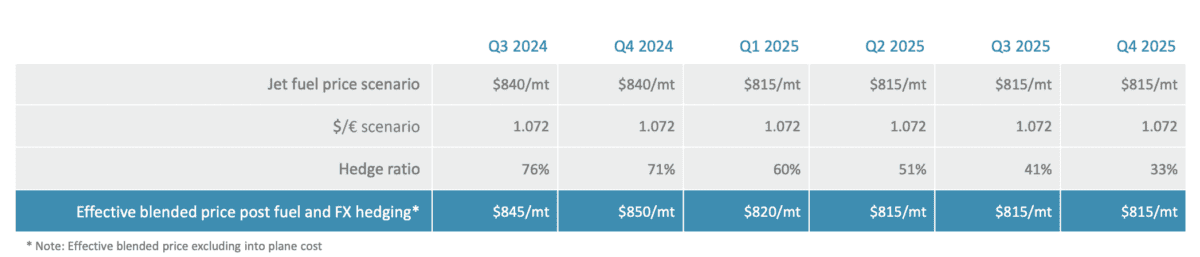

IAG, the proprietor of British Airways and Iberia, has a robust hedging place, with simply 24% of Q3 gas — the present quarter — bought at dwell or near-live costs.

As we will see from the above, IAG’s hedged round 74% of gas prices via to the top of the yr. This could put it in a robust place to handle prices even when oil spikes.

Nevertheless, wanting additional into 2025, the corporate’s extra uncovered to market costs. Which means whereas IAG has secured a degree of value stability for its gas prices within the fast future, it faces larger uncertainty and potential danger from oil value fluctuations as we transfer into 2025.

My take

Buyers are at all times in search of good entry factors as shares fall. And it’s attainable the market’s overreacted to the escalation chance, one thing all of us fervently hope doesn’t occur.

There’s quite a bit to unpack right here, together with OPEC’s spare capability, slowing oil demand, Iran’s capability to dam key oil provide routes, and IAG’s valuation.

This may very well be a possibility for traders, however there are dangers hooked up.