- Bitcoin has a robust bullish bias this week.

- The latest dip is perhaps to engineer liquidity and extra volatility was doubtless.

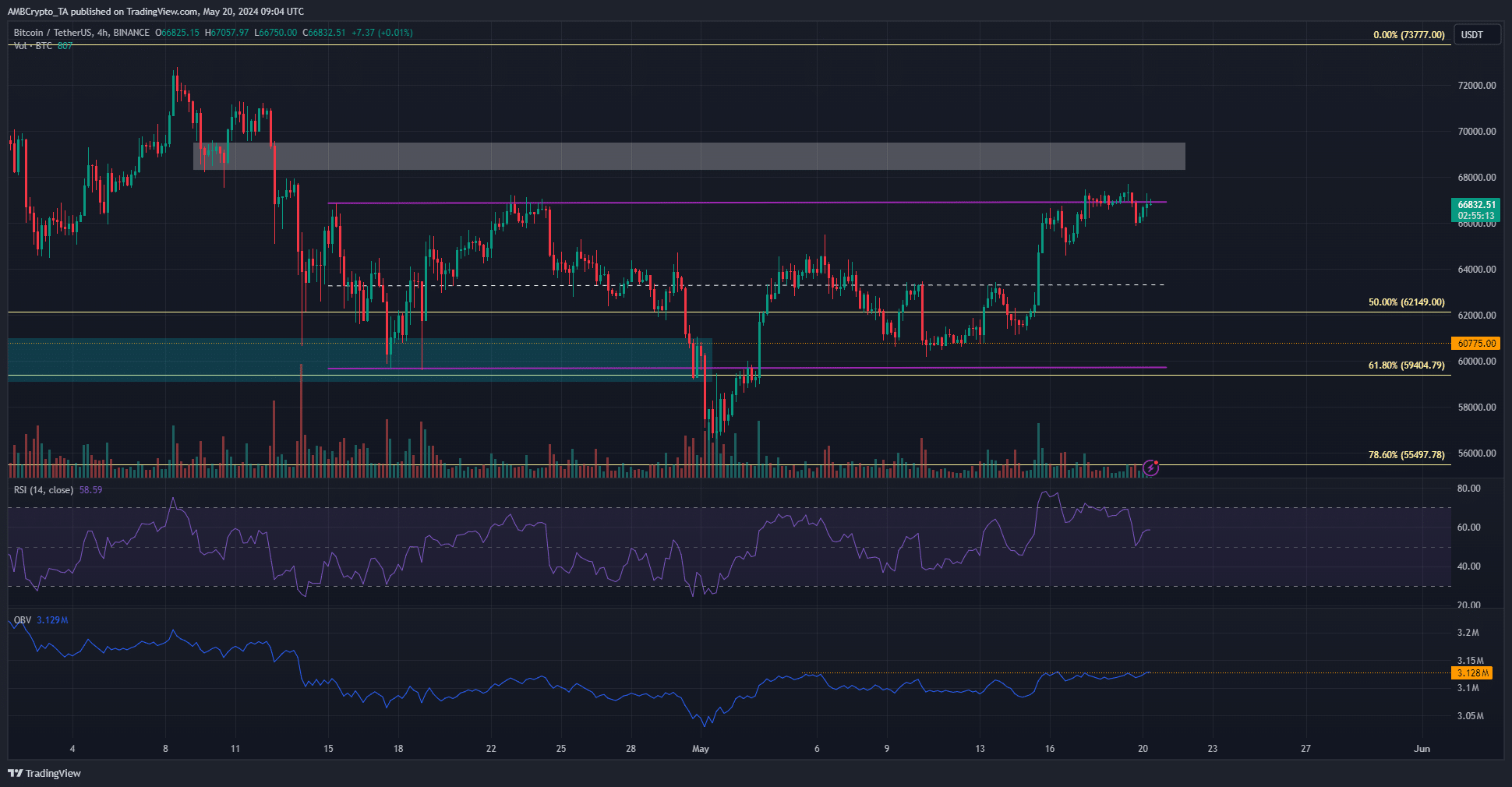

Bitcoin [BTC] was buying and selling on the vary highs at $67 at press time. This vary has been in place since mid-April. The previous few days’ momentum, significantly the restoration previous $65k, satisfied bulls that additional beneficial properties have been doubtless.

Different indicators from on-chain evaluation highlighted bullish sentiment available in the market. But, the liquidity within the $68k-$69k area may see a bearish reversal. What are the probabilities that this state of affairs would play out?

How liquidity runs could be engineered

Crypto analyst CrypNuevo identified in a publish on X (previously Twitter) that the $69k area had a big cluster of liquidation ranges. This degree may appeal to costs within the coming days, nevertheless it might be accompanied by some volatility.

The thought is {that a} sharp, fast downward transfer earlier than this massive liquidity pocket is hit may encourage extra quick positions. It may additionally create false confidence in merchants who’re already quick, which builds much more liquidity across the $69k area.

Supply: Hyblock

He additionally identified that these aggressive strikes occur in the beginning of the week. The 50-EMA on the 4-hour chart at $65k was one other potential assist for Bitcoin. Such a deep drop may encourage much more short-selling.

Supply: CrypNuevo on X

Nevertheless, the liquidation heatmap showcased the $68.6k-$69.2k as a essential resistance zone. The analyst expects a drop to $65k this week, adopted by a rally to $69k.

What does the 4-hour timeframe technical evaluation reveal?

Supply: BTC/USDT on TradingView

The H4 RSI continued to maneuver above impartial 50 and indicated robust bullish momentum. But, the BTC buying and selling quantity has been low since Friday. Nevertheless, the OBV was on the verge of clearing an area resistance degree, which may add to the bullish impetus.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

The 4-hour chart revealed robust resistance at $69k-$69.5k, however quick liquidations may gasoline a surge previous this difficult resistance zone.

Therefore, merchants needs to be ready for some volatility however continued bullish progress this week.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.