- Bitcoin MVRV ratio advised potential market shifts, with an important assist stage to observe at 1.75.

- Retail and whale exercise confirmed blended indicators, with energetic addresses rising however massive transactions barely declining.

Bitcoin [BTC] just lately surged above $66,000, marking a quick rally that excited traders and analysts a few potential bullish development for October, known as “Uptober.”

Nevertheless, this worth bounce was short-lived, as Bitcoin encountered a big correction shortly thereafter.

Over the previous week, the main cryptocurrency has seen a downward trajectory, declining by 6.6% and buying and selling beneath $62,000 on the time of writing, with a further dip of 0.4% within the final 24 hours.

Amid this fluctuation, a CryptoQuant analyst recognized has shed mild on a important development occurring within the background. In response to the analyst, this rising sample might probably have notable implications for Bitcoin’s future market habits.

MVRV ratio suggests a serious transfer for BTC

The CryptoQuant analyst’s focus was on Bitcoin’s Market Worth to Realized Worth (MVRV) ratio. This can be a key metric that assesses whether or not BTC is at the moment overvalued or undervalued by evaluating its market worth to the value at which all cash final moved.

The MVRV ratio has been helpful traditionally in figuring out vital market highs and lows throughout Bitcoin’s halving cycles.

The MVRV ratio, as defined by the analyst, has been in a downward development, with an important assist stage recognized at 1.75.

At the moment, the ratio stands at 1.9. This raises a pivotal query: if the MVRV ratio breaks out of this historic downtrend and reverses route, might it rise to a spread between 4 and 6?

Supply: CryptoQuant

Such a spread has traditionally indicated a market peak for Bitcoin, as noticed in prior cycles. The analyst’s deal with the MVRV metric highlights its significance in offering a gauge for potential market sentiment and future worth actions.

Different metrics present blended developments

Given this potential shift in market circumstances, it’s price exploring different indicators that would supply perception into Bitcoin’s future trajectory.

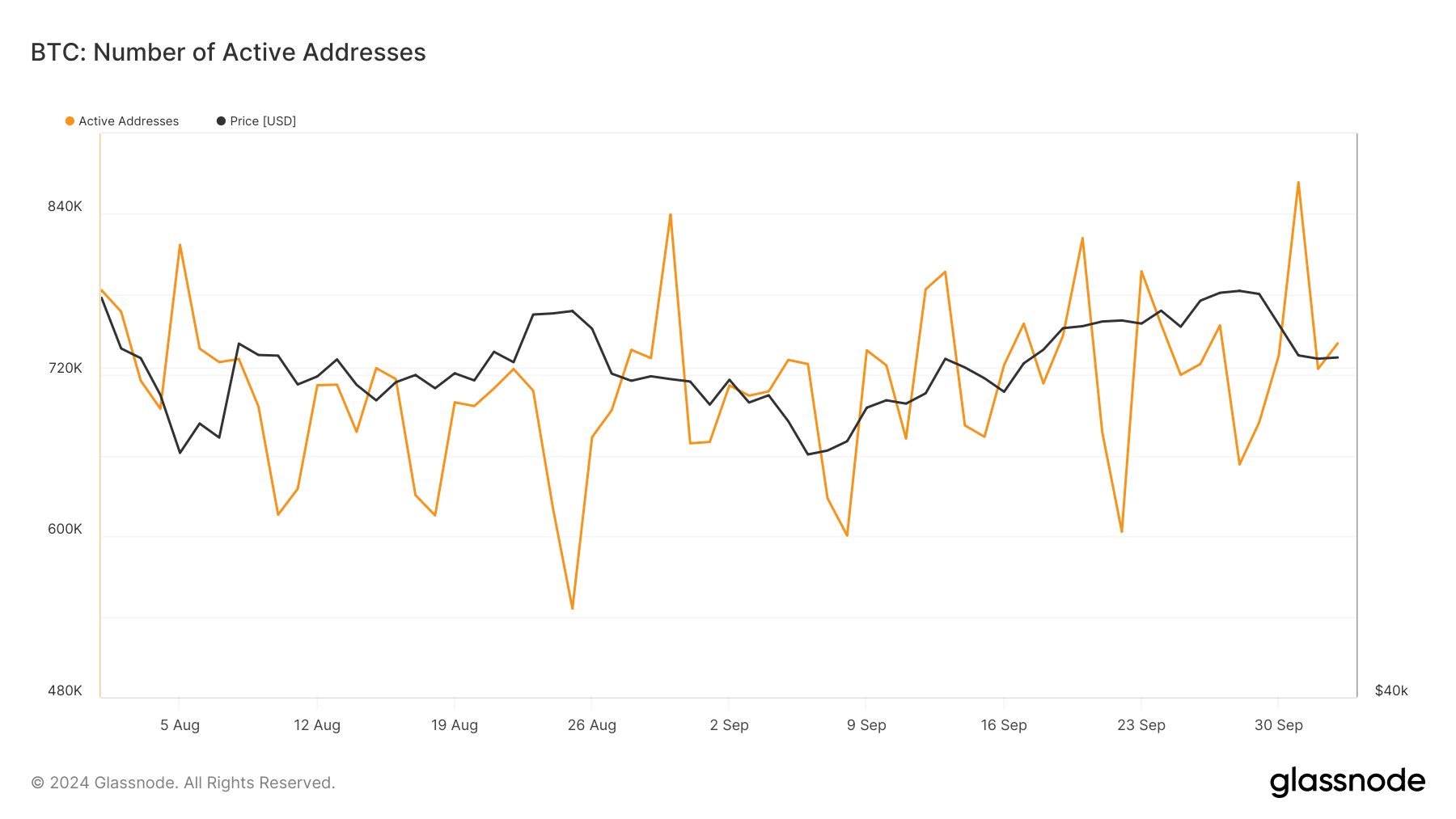

As an example, one key metric to observe is Retail Investor Exercise, which is commonly mirrored within the variety of energetic addresses. In response to information from Glassnode, this metric has been on a gradual rise month-over-month.

Supply: Glassnode

After reaching 832,000 addresses in August and barely declining to 822,000 in September, Bitcoin’s energetic addresses have continued to develop, at the moment standing at over 863,000.

This rising development suggests renewed retail curiosity and involvement within the Bitcoin market, even amid latest worth volatility.

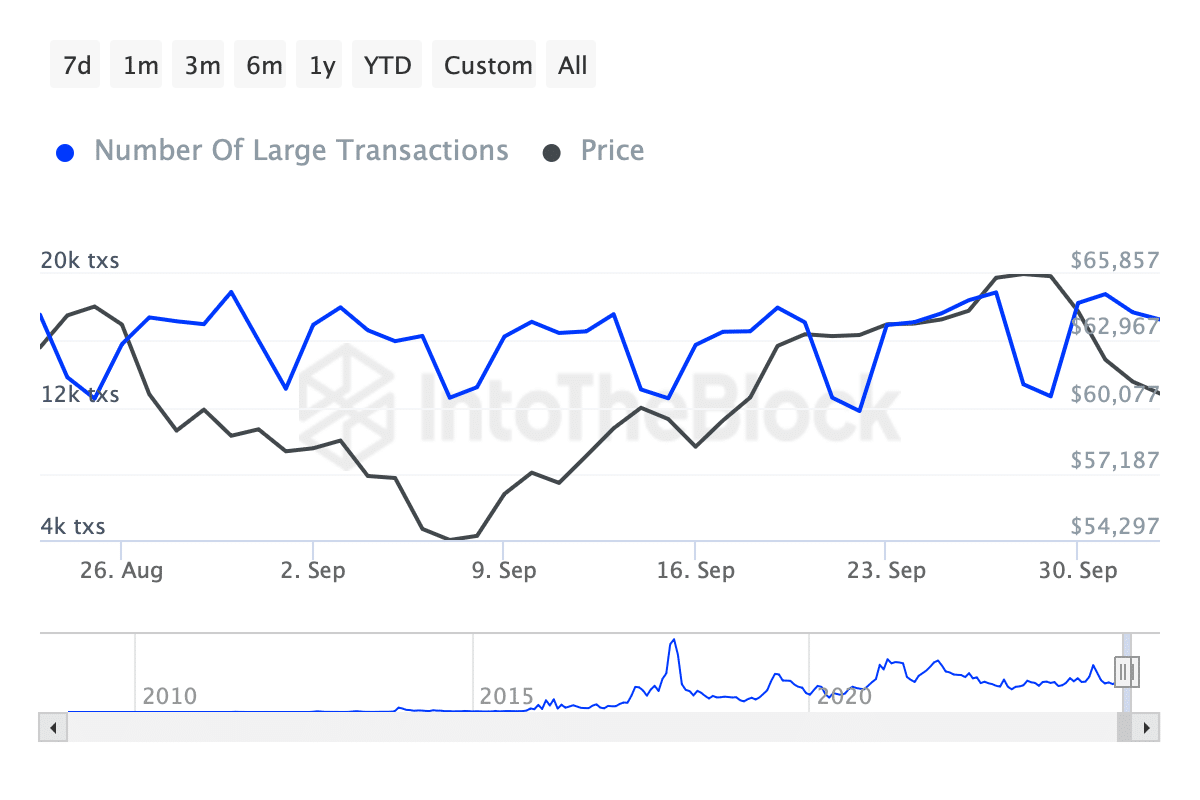

Whereas retail curiosity gives one facet of the image, understanding the exercise of bigger traders, usually termed “whales,” is equally essential. An necessary indicator on this regard is the quantity of transactions exceeding $100,000, as tracked by information from IntoTheBlock.

Supply: IntoTheBlock

Learn Bitcoin’s [BTC] Value Prediction 2024-25

This metric noticed a noticeable uptick between August and September, rising from beneath 14,000 transactions to over 18,000.

Nevertheless, since that surge, there was a gradual tapering, with whale transactions just lately reducing to round 17,700.