- BTC dropped 3.5% on Monday following Powell’s remarks on Fed fee cuts.

- The asset held above key short-term help at $63K, however will it proceed to carry?

Bitcoin [BTC] and US shares dropped throughout Monday’s, thirtieth September, intra-day buying and selling session. BTC dropped 3% and hit $63000, which coincided with Fed chair Jerome Powell’s remarks on fee minimize expectations.

Throughout his Nashville tackle on the Nationwide Affiliation for Enterprise Economics convention, he confirmed no desire for a sooner or slower tempo of rate of interest discount.

He foresaw one other two rate of interest cuts, every 25 bps (foundation factors), earlier than the tip of the 12 months.

“If the economy evolves as expected, that would be two more cuts by year’s end, for a total reduction of half a percentage point more.”

Market reprice Fed fee minimize expectations

As of final week, the market anticipated an additional aggressive 50 bps minimize in November, just like the transfer seen in September.

Supply: CME FedWatch

Nevertheless, at press time, rate of interest merchants priced increased odds of 25 bps at 61.8% following Powell’s remarks.

Quite the opposite, the possibilities of a 0.50% minimize dropped to 38.2% from 53% seen final Friday, twenty seventh September.

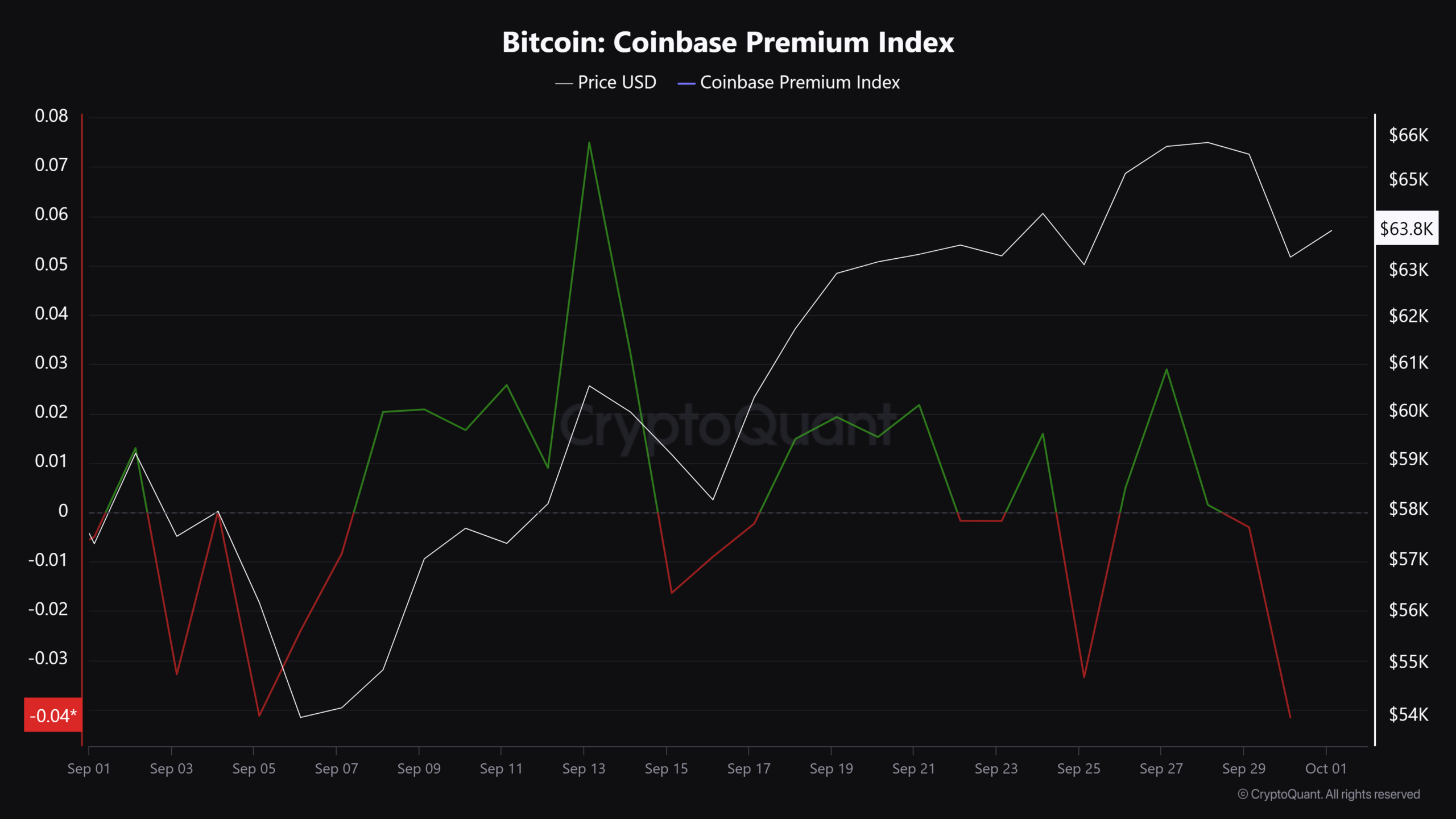

This has triggered a sentiment shift into the brand new week forward of essential US labor updates. Notably, US demand for BTC dropped from final Friday’s optimistic studying to a detrimental on 1st November, per the Coinbase Premium Index.

Supply: CryptoQuant

In comparison with almost $500 million every day inflows in US spot BTC ETFs final Friday, the merchandise netted solely $61.3 million on Monday, 30 September.

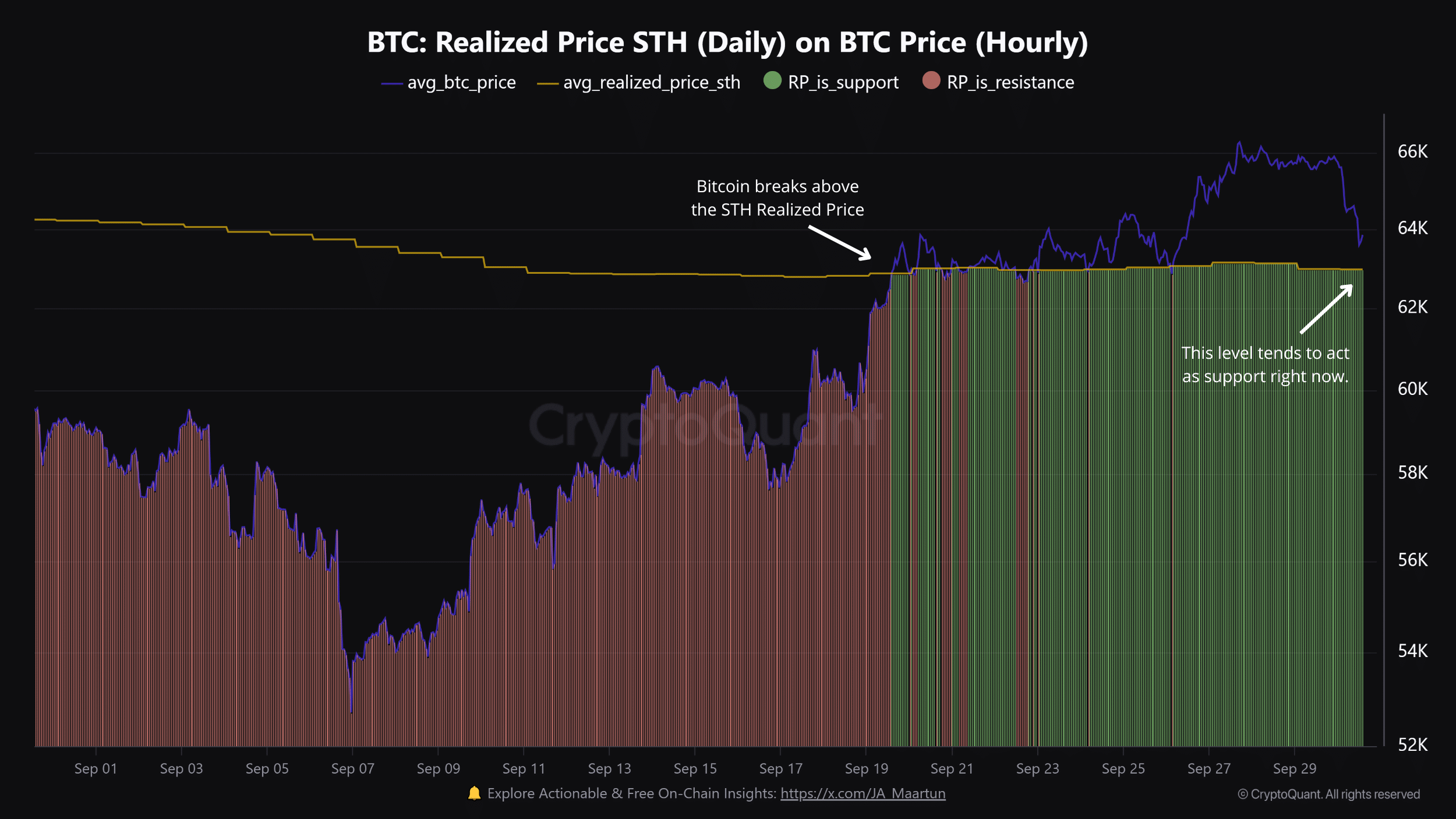

That being mentioned, the $63K stage could possibly be essential help within the brief time period. As famous by CryptoQuant, the extent was the short-term holders’ (STH) realized value and has acted as help since mid-September.

Supply: CryptoQuant

At press time, BTC was valued at $63.9K forward of essential US labor updates.

One other potential optimistic catalyst was an growing sign in the direction of an finish to the Fed’s quantitative tightening (QT) as extra establishments faucet into the Fed’s Repo facility. This might inject extra Fed liquidity and increase danger property.

Nevertheless, growing geopolitical stress within the Center East might additionally problem BTC’s Uptober expectations and is price monitoring.