- Bitcoin stabilizes above $64,000, with metrics suggesting potential bullish momentum and ETF demand driving help.

- Analysts predict doable breakout targets between $88,000 and $100,000 if key resistance ranges are reclaimed.

Bitcoin [BTC] has lately proven indicators of stabilization above the $64,000 mark, though it initially surged to $66,000 within the early hours of the thirtieth of September.

Since then, a correction has introduced the asset all the way down to $64,633, marking a slight 1.4% decline.

Regardless of this short-term dip, a broader view reveals Bitcoin’s progress, with the asset up by 10.2% over the previous two weeks.

Nevertheless, the query stays: when will Bitcoin begin the bull run that many specialists predict may push its value into six figures?

To supply readability for traders, CryptoQuant, an on-chain knowledge supplier, has shared important metrics for monitoring Bitcoin’s bullish momentum.

The platform revealed a collection of posts on X (previously Twitter) aimed toward serving to traders perceive the place Bitcoin is likely to be headed.

They famous that Bitcoin’s sturdy momentum over the previous three weeks—rising over 23% from $52,500 to above $65,000—has been partly fueled by elevated demand for spot Bitcoin Alternate-Traded Funds (ETFs).

Notably, mixed inflows from BlackRock, Constancy, and Ark totaled $324 million on the twenty sixth of September, signaling heightened curiosity from U.S. traders.

Supply: CryptoQuant

THIS is vital for bullish momentum

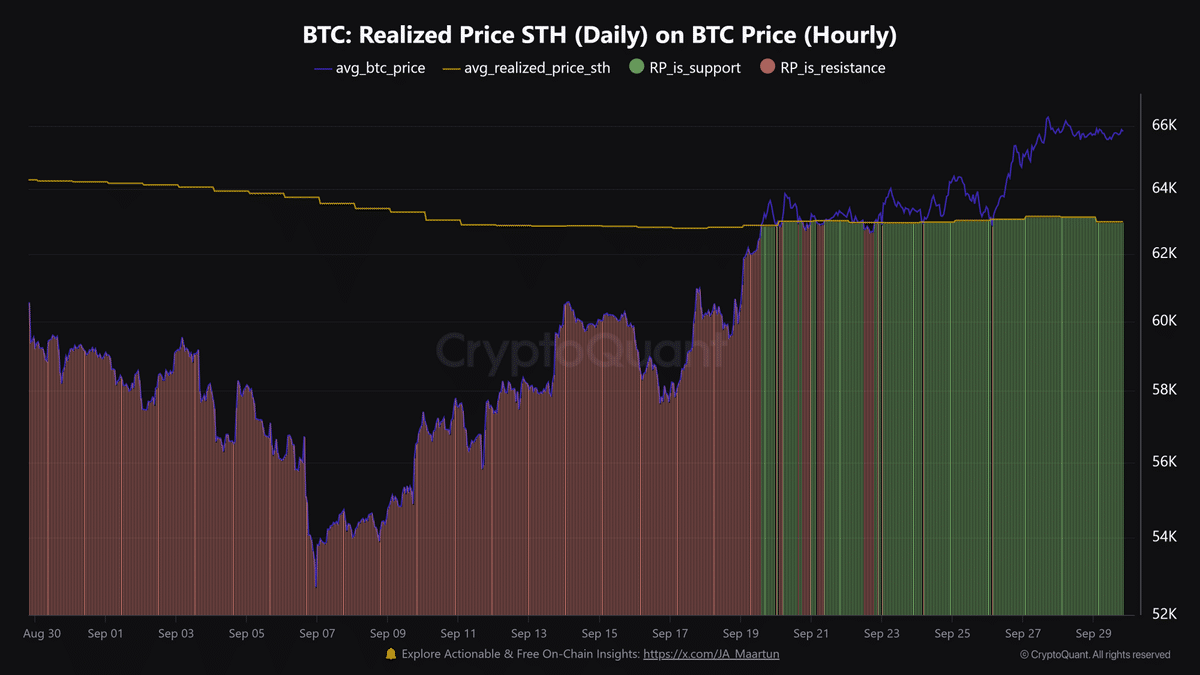

In keeping with CryptoQuant, one of many key drivers for Bitcoin’s latest rally is the resurgence of short-term holders again into revenue territory.

These holders, outlined as traders who’ve moved their Bitcoin inside the final 155 days, have a mean buy value of round $63,000.

As Bitcoin’s value hovers above this stage, it may act as a powerful help stage, reinforcing bullish sentiment.

Supply: CryptoQuant

The futures market additionally presents important insights into Bitcoin’s value traits. CryptoQuant revealed that Bitcoin’s Open Curiosity was $19.1 billion at press time.

Traditionally, surges previous $18.0 billion have led to cost corrections.

Supply: CryptoQuant

This marks the seventh time such a threshold has been crossed since March 2024, prompting warning round the opportunity of a short-term dip.

Regardless of this, the general development of accelerating futures exercise displays rising investor confidence.

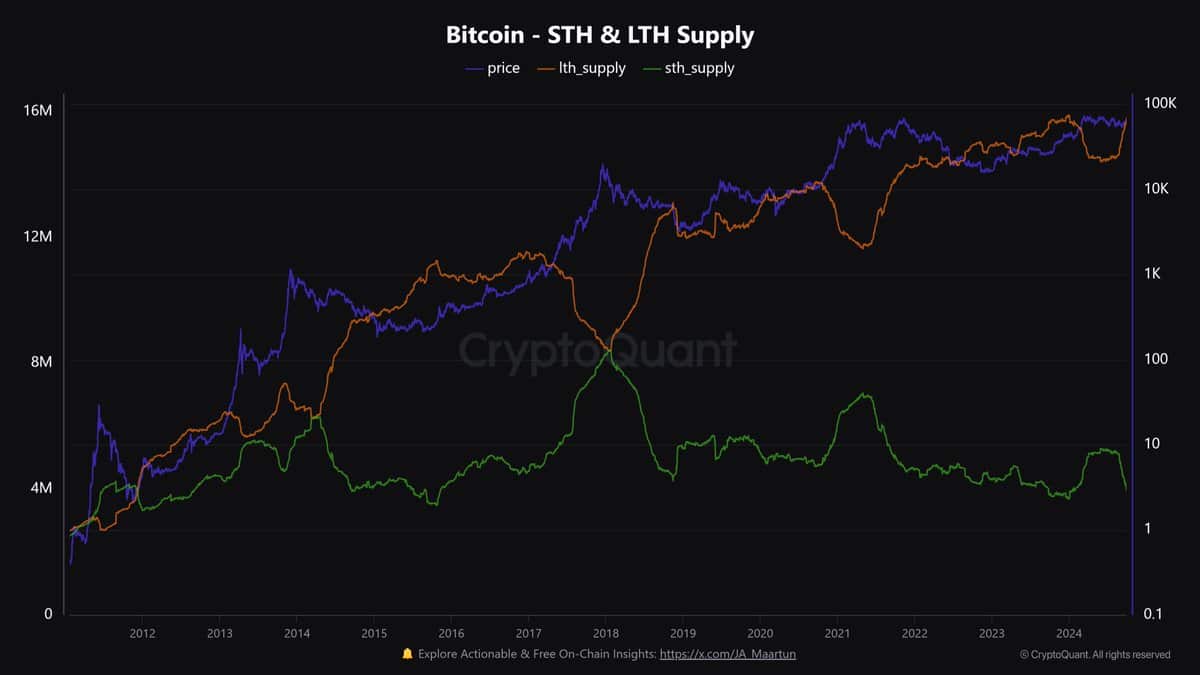

One other notable growth is the transformation of spot Bitcoin ETF holdings into long-term holder provide.

As cash surpass the 155-day holding interval, they’re more and more categorized as a part of the long-term provide.

Supply: CryptoQuant

Whereas this shift would possibly counsel a bullish outlook, CryptoQuant warns that such actions are sometimes noticed within the later levels of a bull market, indicating potential market maturity or a transition part in Bitcoin’s trajectory.

Analysts weigh in on Bitcoin’s potential rally

Past the elemental metrics, a number of analysts have shared their views on the place Bitcoin may head subsequent.

Javon Marks, a distinguished crypto analyst, steered that Bitcoin was nearing a important resistance stage outlined by a “descending broadening wedge” sample.

Supply: Javon Marks/X

In keeping with Marks, a bullish breakout previous this resistance may propel Bitcoin to a goal vary of $99,000 to $100,000, a rise of over 51% from its present value.

His outlook emphasised that Bitcoin could also be gearing up for a big transfer within the coming weeks.

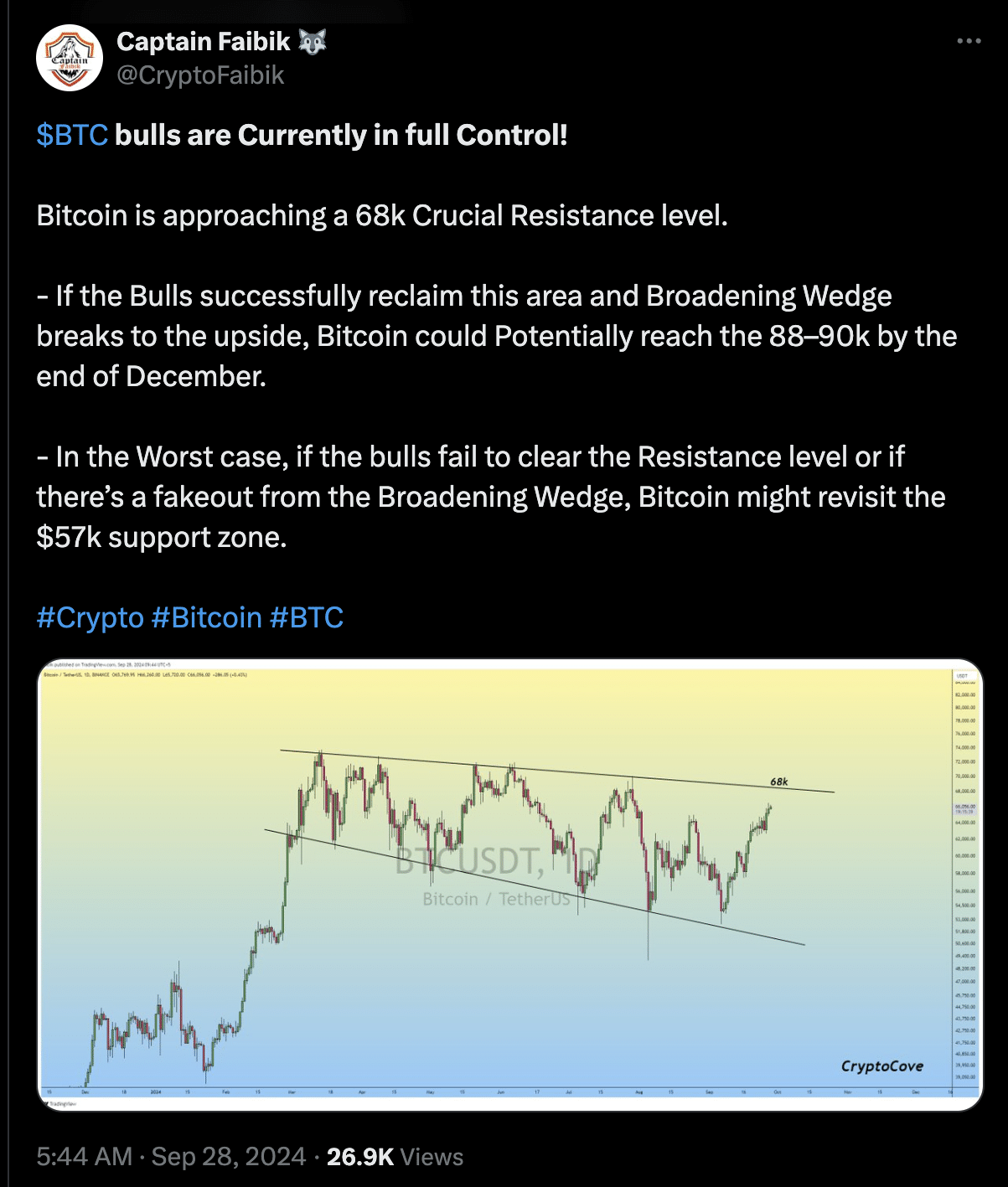

Equally, one other analyst, Captain Faibik, famous that Bitcoin bulls at present maintain a powerful place available in the market.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

With Bitcoin approaching a vital resistance stage of $68,000, Faibik speculated {that a} profitable breakout from the broadening wedge may see the cryptocurrency attain $88,000 to $90,000 by the tip of December.

Nevertheless, he additionally cautions that failure to interrupt by way of this resistance, or a possible fake-out, may see Bitcoin retest help zones round $57,000.

Supply: Captain Faibik on X