Picture supply: Getty Photos

Throughout my time investing within the inventory market, I’ve experimented with many alternative methods. A few of these embrace dividend investing, penny inventory investing and dollar-cost averaging.

Extra not too long ago nonetheless, I’ve been launched to an strategy generally known as ‘quality’ investing. Proof suggests this technique has the potential to ship glorious long-term returns. I simply want I’d recognized about this technique 10 years in the past!

High quality investing in a nutshell

The genius of high quality investing is outmatched solely by its profound simplicity. All it requires is investing in high-quality companies with cheap valuations. It’s the kind of technique that might make billionaire investor Warren Buffett proud.

The trick is figuring out the precise shares, which is the place it will get a bit extra advanced. A strong stability sheet and excessive development potential are apparent however different traits to search for embrace:

- Aggressive benefit (a large ‘moat’)

- Managers who’re invested

- Sensible capital allocation

Key metrics to verify are return on capital employed (ROCE) and gross margins. ROCE ought to be larger than 15% and margins above 40%.

Figuring out shares

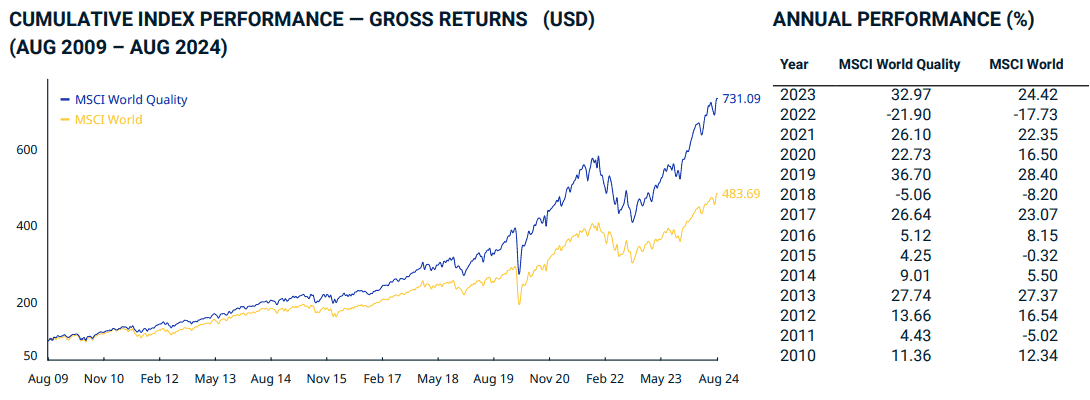

The MSCI World High quality Index is particularly designed to offer traders publicity to high-quality development shares. Within the 10 years between 2013 and 2023, it outperformed the usual MSCI World Index eight occasions.

The index leans closely in the direction of US tech shares similar to Nvidia, Apple, and Meta but additionally contains some finance and well being shares together with Eli Lilly and Visa.

When it comes to UK shares, I believe AstraZeneca (LSE: AZN) matches the invoice properly. Whereas there’s definitely competitors within the biomedical trade, it’s a pacesetter in its discipline and really properly established.

At 13%, its ROCE is barely under the really useful quantity however has greater than doubled since 2022. Extra spectacular is its gross margin, at 82.6%. It introduced in virtually $50bn in income in 2023, retaining a internet revenue of $6.4bn.

Concerns

As ever, there are some dangers and considerations. Firstly, the pharma large has various debt, which isn’t a typical attribute of a top quality firm. For now, its manageable however value maintaining a tally of.

Extra worrying is the ever-present patent cliff that every one pharma firms face. If a patent expires on one among AstraZeneca’s largest cash spinners, income might plummet as opponents flood the market with generics. Expiry dates differ based mostly on area and drug composition so moderately than one large drop, it might expertise sporadic losses.

Two of its largest sellers, Lynparza and Symbicort, face patent expiries this 12 months.

Just lately, the shares have fallen fairly sharply, which may very well be a results of shareholder jitters forward of these patent expiries. Nonetheless, this additionally presents a lovely shopping for alternative.

Wanting long-term, the shares are up 165% prior to now 10 years, representing an annualised return of 10.2% a 12 months.

Last ideas

High quality investing is a low-risk, long-term technique aimed toward constructing wealth for the long run. As such, newbie traders may really feel underwhelmed by the gradual progress it delivers. Nonetheless, it’s one of the vital dependable and confirmed strategies practised by a few of the world’s most well-known traders.

Nonetheless, I benefit from the pleasure of figuring out dangerous small-cap shares with excessive development potential. However with a greater understanding of this technique, I plan to allocate a bigger share of my portfolio to high-quality shares.