- BTC has declined by round 1% at press time.

- Quick-holders stay in revenue regardless of the decline within the final 24 hours.

Bitcoin [BTC] has just lately lifted the temper of the crypto market, breaking via the $60,000 value barrier and shifting nearer to a different key resistance stage. This surge has enabled some whales to safe important earnings and liquidated quite a few quick positions.

Bitcoin whales take revenue

An evaluation of Bitcoin’s day by day chart reveals that it broke its short-term resistance on seventeenth September. This resistance, fashioned by its short-term shifting common (yellow line), was overcome when BTC gained over 3%, reaching round $60,300.

Bitcoin skilled consecutive uptrends following this breakout, closing the final buying and selling session at roughly $63,362.

Supply: TradngView

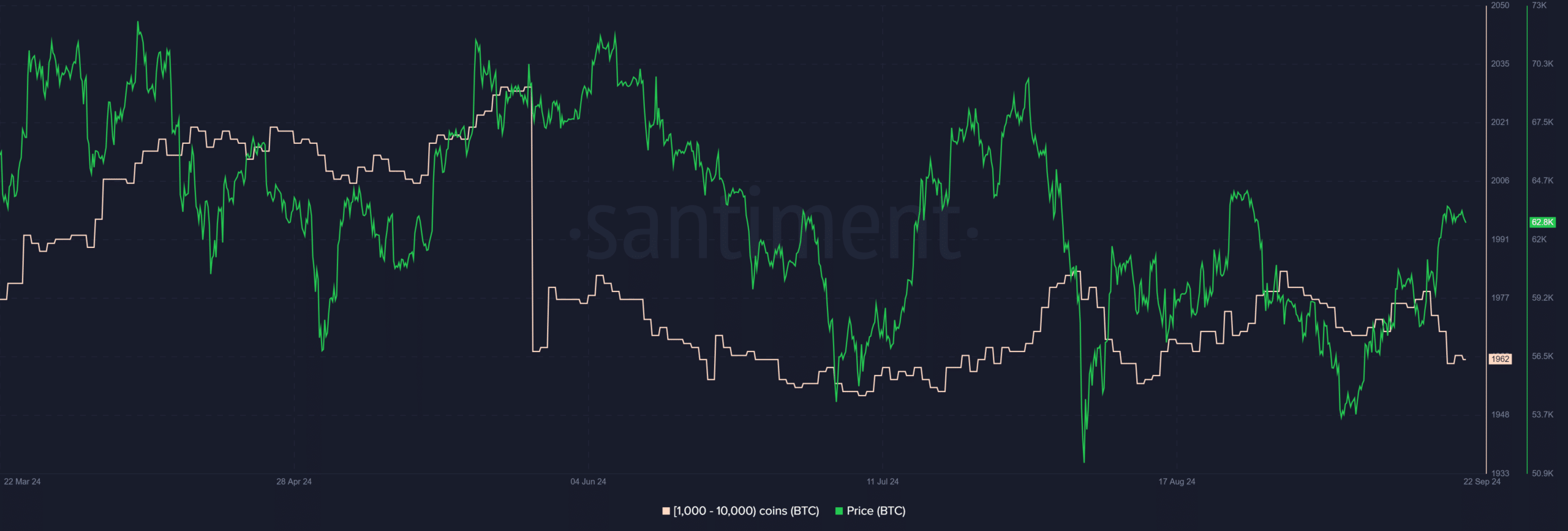

Information from Santiment signifies that this value enhance prompted some BTC whales to understand earnings. Previously 96 hours, these giant holders bought over 30,000 BTC, price round $1.86 billion.

Regardless of this important sell-off, Bitcoin stays bullish, as evidenced by its Relative Power Index (RSI), which has stayed above 60.

Supply: Santiment

Bitcoin MVRV reveals a 5% revenue

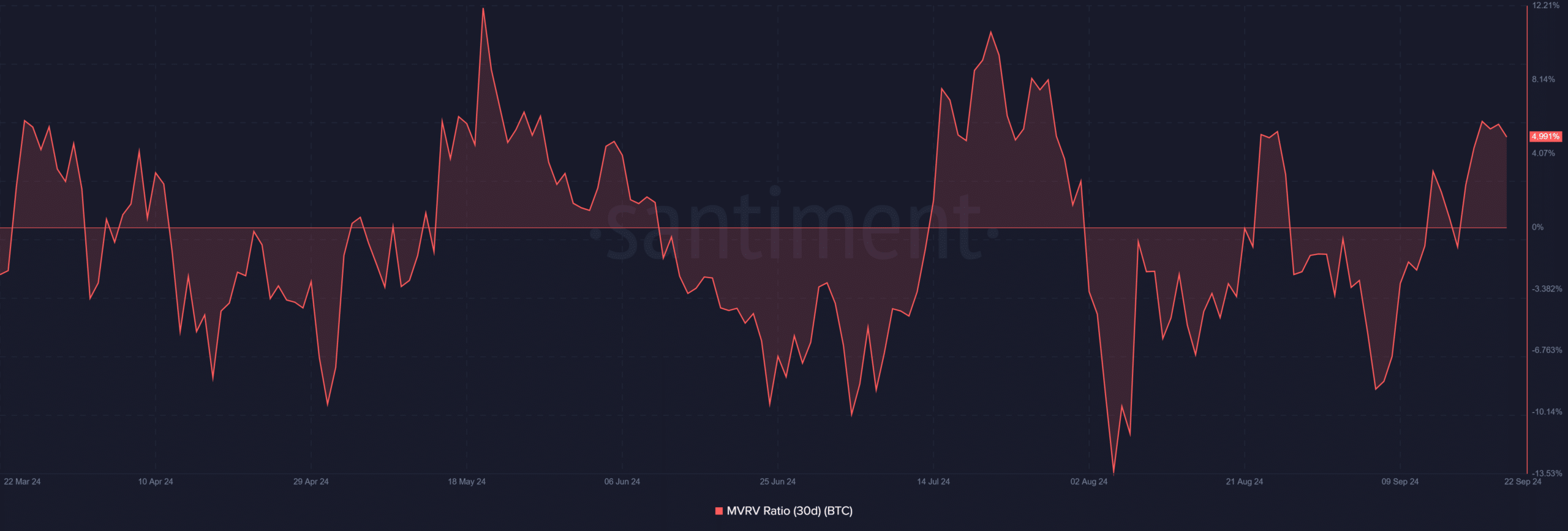

Quick-term Bitcoin holders have moved into revenue as a result of latest value appreciation. Evaluation of the 30-day Market Worth to Realized Worth (MVRV) ratio from Santiment confirmed it crossed above zero on seventeenth September and is presently nearing 5%.

Because of this holders inside this timeframe are averaging practically a 5% revenue, aligning with the earnings realized by whales in latest days.

Supply: Santiment

Quick positions face elevated liquidations

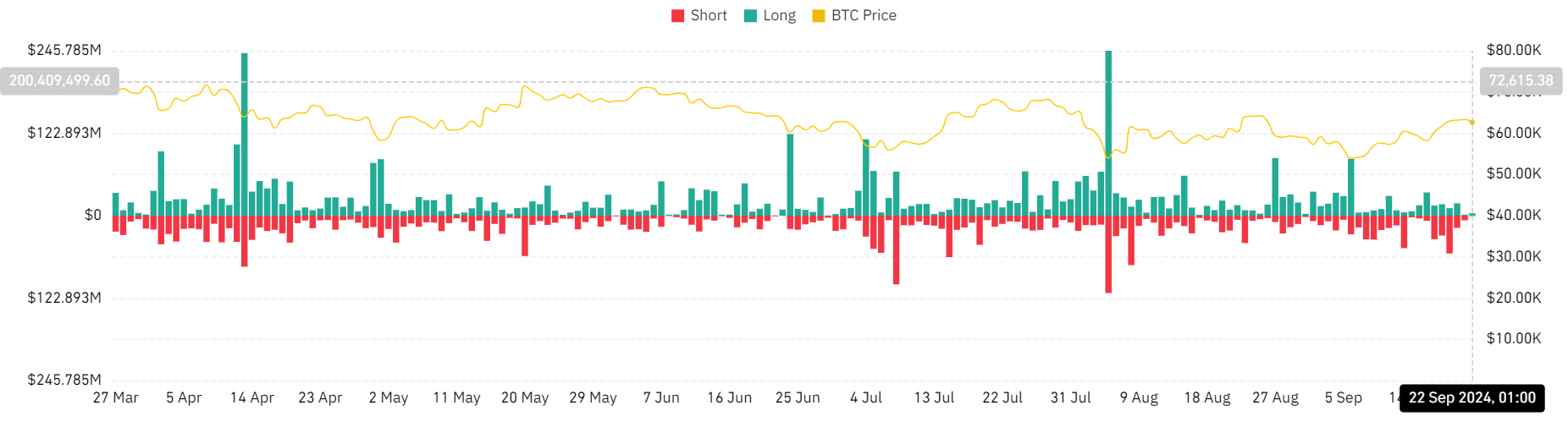

Since Bitcoin’s uptrend started, there was a big enhance within the liquidation of quick positions. Evaluation from Coinglass reveals that over $146 million price of quick positions had been liquidated between seventeenth and twenty first September.

In distinction, lengthy positions noticed liquidations of round $63 million throughout the identical interval.

Supply: Coinglass

Learn Bitcoin (BTC) Value Prediction 2024-25

Moreover, the BTC funding fee has remained constructive over the previous few weeks, indicating that extra patrons are getting into the market in comparison with sellers—a constructive signal for Bitcoin.

This development might assist Bitcoin soak up promoting stress from whales taking earnings.