- Bitcoin dominance surges previous 57.68%, with indicators pointing to potential bullish volatility.

- On-chain exercise strengthens, whereas the MVRV ratio alerts doable shopping for alternatives for buyers.

Bitcoin [BTC] has made a big breakthrough, closing its dominance degree at 57.68% for the primary time since April, 2019. Traditionally, when Bitcoin’s dominance reached such ranges, it initiated a protracted uptrend, pushing dominance to 71%.

With this latest breakout and Bitcoin at the moment buying and selling at $59,179, up 0.73% within the final 24 hours at press time, many are speculating whether or not it’s on the verge of one other huge rally.

RSI and Bollinger bands counsel a possible upside

Bitcoin’s RSI is at the moment at 51, reflecting a impartial market with no indicators of maximum shopping for or promoting stress. In the meantime, the Bollinger Bands present BTC close to the higher band, which regularly alerts potential upward worth volatility.

If BTC can break above the $59,000 threshold with robust quantity, it could point out additional worth progress, serving to preserve or develop its market dominance.

Supply: TradingView

Change reserves level to long-term holders

Bitcoin’s trade reserves are at 2.585 million BTC, with solely a minor 0.04% enhance over the past 24 hours. Whereas this implies short-term promoting stress, the general development has proven a decline in reserves all through the week.

This means that buyers could also be transferring Bitcoin off exchanges into chilly storage, a powerful sign of long-term confidence.

Supply: CryptoQuant

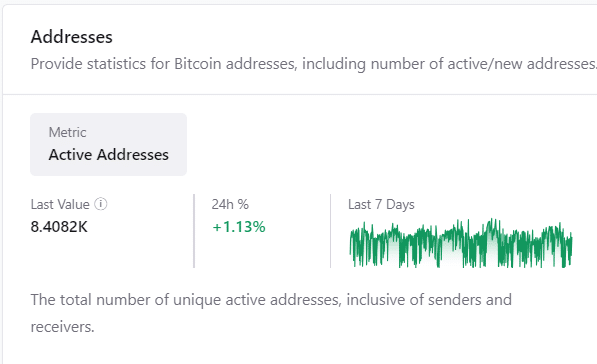

Lively addresses and transactions present robust community exercise

Bitcoin’s community continues to point out sturdy exercise, with over 8.4 million lively addresses, reflecting a 1.13% enhance up to now day. The transaction rely additionally rose to 515,260 within the final 24 hours, a 0.83% uptick, in keeping with CryptoQuant information.

Supply: CryptoQuant

This regular progress in on-chain exercise helps Bitcoin’s dominance surge, highlighting robust community fundamentals.

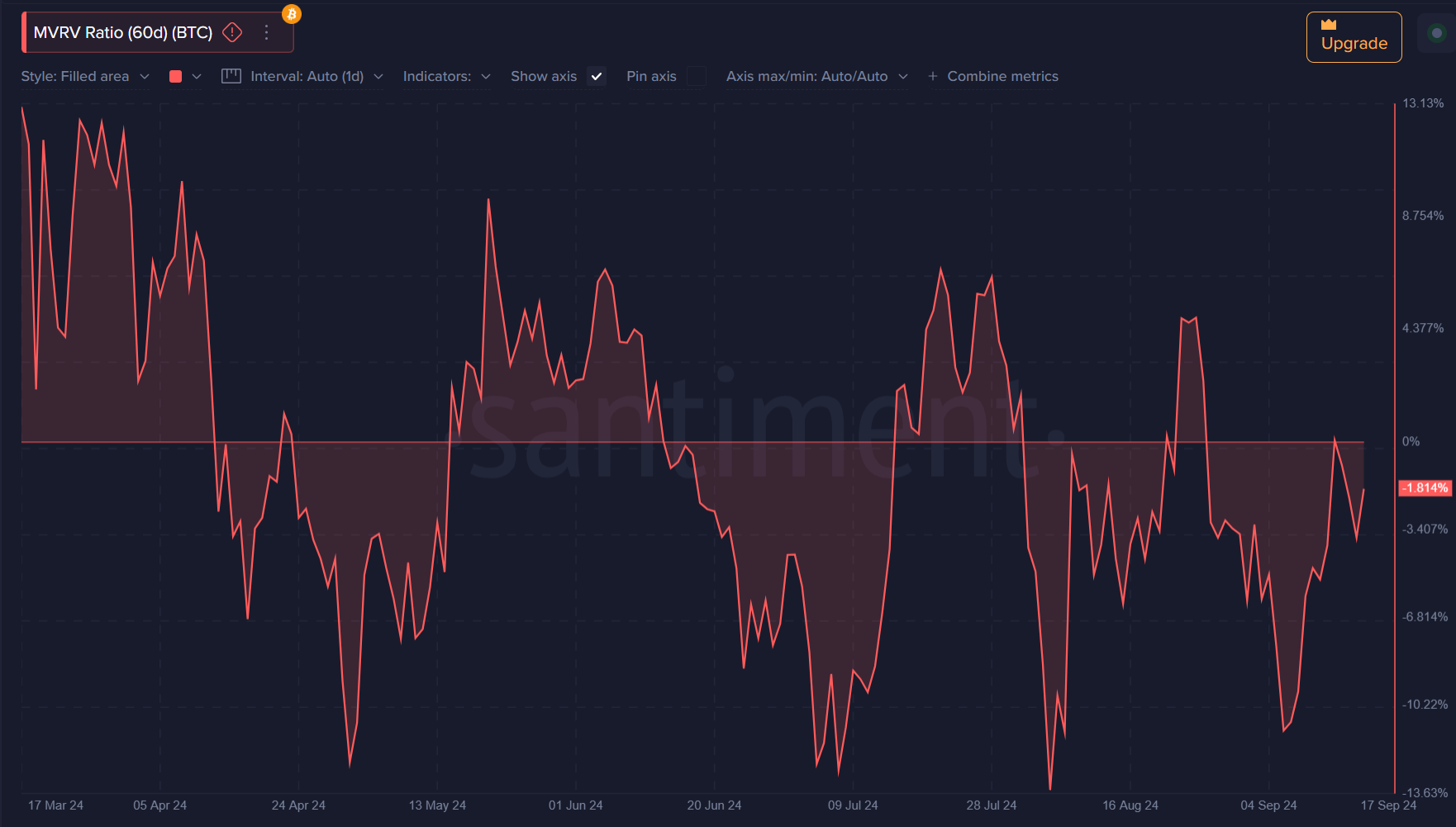

MVRV ratio hints at a shopping for alternative

The 60-day MVRV ratio at the moment stands at -1.81%, indicating that, on common, buyers are holding Bitcoin at a small loss.

Traditionally, unfavorable MVRV values have signaled undervaluation, suggesting that Bitcoin may very well be poised for an upward correction, making this a possible shopping for alternative.

Supply: Santiment

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Can Bitcoin Lead the Market Into One other Bull Run?

With dominance above 57.68%, robust on-chain fundamentals, and technical indicators aligning, Bitcoin could also be gearing up for one more main rally.

Nonetheless, key ranges like $59,000 and ongoing community exercise will probably be essential in confirming whether or not Bitcoin can prolong its dominance and reignite a broader bull market.