Picture supply: Getty Photos

Over the previous month, the Rolls-Royce (LSE:RR) share worth is principally unchanged. This has offered a while for buyers to take a breath following the 122% achieve over the previous yr. But as we begin to gear up for the ultimate quarter, many are questioning if the inventory may head greater into year-end and past. Right here’s what I discovered when taking a better look.

Decrease debt helps

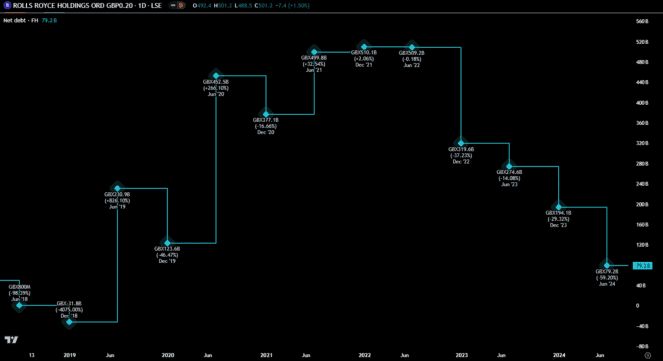

One issue that ought to assist the share worth to rise additional is the continued discount of internet debt. Through the early a part of the pandemic, the agency was compelled to tackle important debt with the intention to preserve the enterprise afloat. In any case, there was a pointy drop in demand within the civil aerospace division with the lockdowns.

By the center of 2021, the pile stood at over £5bn. This threatened to significantly harm the corporate. Though the world began to return to regular, the curiosity funds on this debt had been excessive. But as a part of the technique pivot and transformation, the administration group has been centered on decreasing its liabilities.

Web debt for H1 2024 returned to the extent seen earlier than the pandemic, as proven beneath.

Primarily based on that trajectory, I imagine this could proceed. And it ought to help the inventory in two foremost methods. One is that curiosity prices will fall, releasing up money stream for different enterprise wants. The opposite is that a part of how we worth a inventory relies on the web asset worth. Lowering debt (a legal responsibility) in the end helps to extend the worth of the corporate general.

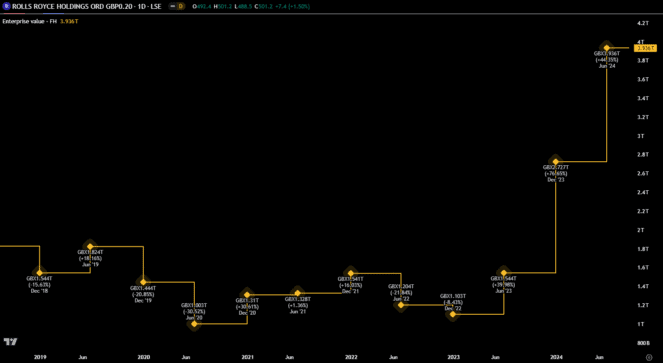

Rising enterprise worth

A second issue that might counsel additional positive factors for the inventory is the enterprise worth. As proven beneath, the enterprise worth for Rolls-Royce has been taking pictures up over the previous yr. This determine is an alternate approach of measuring the value of an organization, as an alternative of simply trying on the market cap.

In the intervening time, the enterprise worth is £43.44bn, with the market cap at £42.63bn. Though they’re other ways of valuing an organization, the 2 figures needs to be comparable to one another. Due to this fact, if the enterprise worth retains climbing, I’d anticipate the market cap (and the share worth) to do the identical.

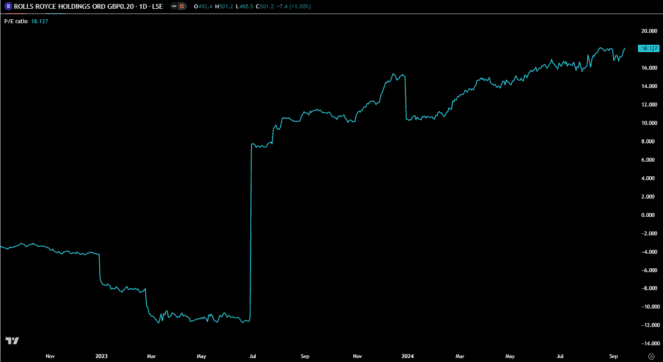

Relative worth climbing

One concern some may need is that because the enterprise flipped to being worthwhile, the inventory is now not undervalued. In truth, the price-to-earnings (P/E) ratio is now above 18 and has been climbing because the agency posted its revenue in 2023. The chart monitoring the ratio is proven beneath.

When contemplating if the inventory can preserve rising, the P/E ratio does turn into extra legitimate. I take advantage of a ratio of 10 as a benchmark of honest worth. That 18 isn’t ridiculously excessive, nevertheless it definitely provides me the impression that the share worth is slightly excessive. Due to this fact, we may see the inventory proceed to tread water till incomes per share rise to make the ratio extra balanced.

Finally, I do assume the inventory can proceed to push greater within the coming yr, however at a way more affordable tempo. As such, I’m not in an enormous rush to purchase the inventory proper now.