Picture supply: Getty Pictures

Shopping for undervalued progress shares can produce strong long-term beneficial properties. Since I’ve many years left in my investing journey, I’m blissful to have publicity to extra risky investments in my portfolio to attempt to beat the market.

With indicators that macroeconomic circumstances may enhance, I’m hopeful that one FTSE 100 progress inventory I personal is perhaps gearing up for a share worth rally.

Scottish Mortgage Funding Belief (LSE:SMT) is the inventory I’m speaking about. Right here’s why I’m bullish on the fund’s progress prospects at present.

A reduction that may not final

Baillie Gifford‘s £13.7bn managed fund invests in a high-conviction portfolio of progress shares world wide.

It’s a one-stop store for diversification throughout main inventory market names. These embody semiconductor giants Nvidia and ASML and e-commerce titans equivalent to Amazon and its Latin American rival MercadoLibre. It additionally invests in unlisted shares like Elon Musk’s enterprise SpaceX.

Assessing the online asset worth (NAV) of a closed-ended fund’s investments is one option to calculate how low-cost its share worth is. It’s not dissimilar to measuring a conventional firm by its e book worth.

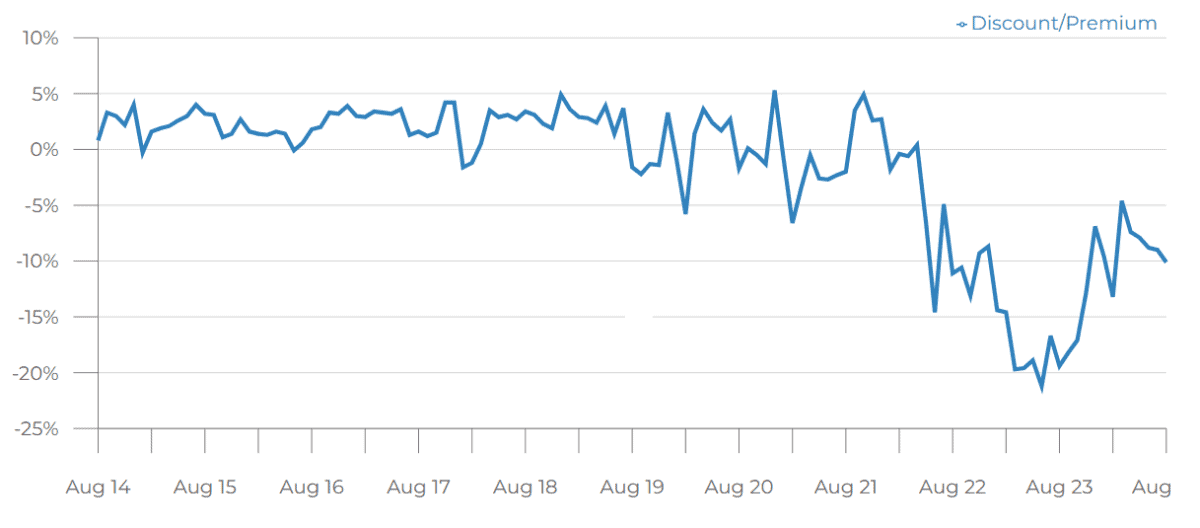

At the moment, the Scottish Mortgage share worth (a bit of above £8 at present) stands at a steep 10% low cost to its NAV. For a lot of the previous decade, it’s traded at a slight premium.

Nonetheless, the post-pandemic hole between the share worth and underlying worth of the belief’s investments has narrowed since mid-2023. It appears like time is perhaps of the essence for traders who wish to purchase low-cost Scottish Mortgage shares.

Share worth progress

Rate of interest cuts are excessive on the agenda for main central banks throughout the globe. Standard investing knowledge suggests this might enhance the efficiency of progress shares like these in Scottish Mortgage’s portfolio.

That’s as a result of the attraction of fixed-income investments like bonds falls, encouraging traders to hunt out higher-risk alternatives for progress.

As well as, the administration workforce has proven dedication to revive the share worth again to its pandemic glory days when it briefly modified fingers above £15.

A two-year share buyback programme for at the least £1bn value of shares is the most important that’s ever been carried out by a UK funding belief. I view this as a shareholder-friendly transfer and an vital step to sort out the present low cost.

Volatility’s a priority for potential traders. Scottish Mortgage isn’t a ‘steady as she goes’ funding. The opportunity of massive share worth slumps is an intrinsic threat of chasing greater progress.

I even have considerations concerning the fund’s non-public fairness publicity. This was a think about a boardroom bust-up that hit the headlines final yr. Finally, it led to the departure of Professor Amar Bhidé who slammed the door on the way in which out in his public feedback.

Unlisted shares are tough to worth. It’s worrying when these closest to the motion specific doubts concerning the belief’s technique.

I’m an optimistic shareholder

Regardless of the dangers, I consider the Scottish Mortgage share worth is primed for progress on account of a shifting financial local weather and the NAV low cost.

I’m not a fan of each inventory within the portfolio, however I like nearly all of the fund’s investments. That’s ok for me. I’ll proceed to carry my shares for the long run.