- Bitcoin noticed a pointy rally in early Might.

- The drop beneath the SSR oscillator bands was seen then- however will we see an prolonged rally hereon?

Bitcoin [BTC] was buying and selling at $67k at press time and threatened to interrupt out previous the vary that it consolidated inside over the previous month.

Fears round sell-offs across the halving interval have been shedding power.

Bitcoin ETFs additionally noticed inflows over the previous week, indicating a tangible enhance in demand. The push to the vary highs relieved the promoting stress of latest weeks, however can the bulls handle a breakout?

Gauging the ammo reserves of the bulls

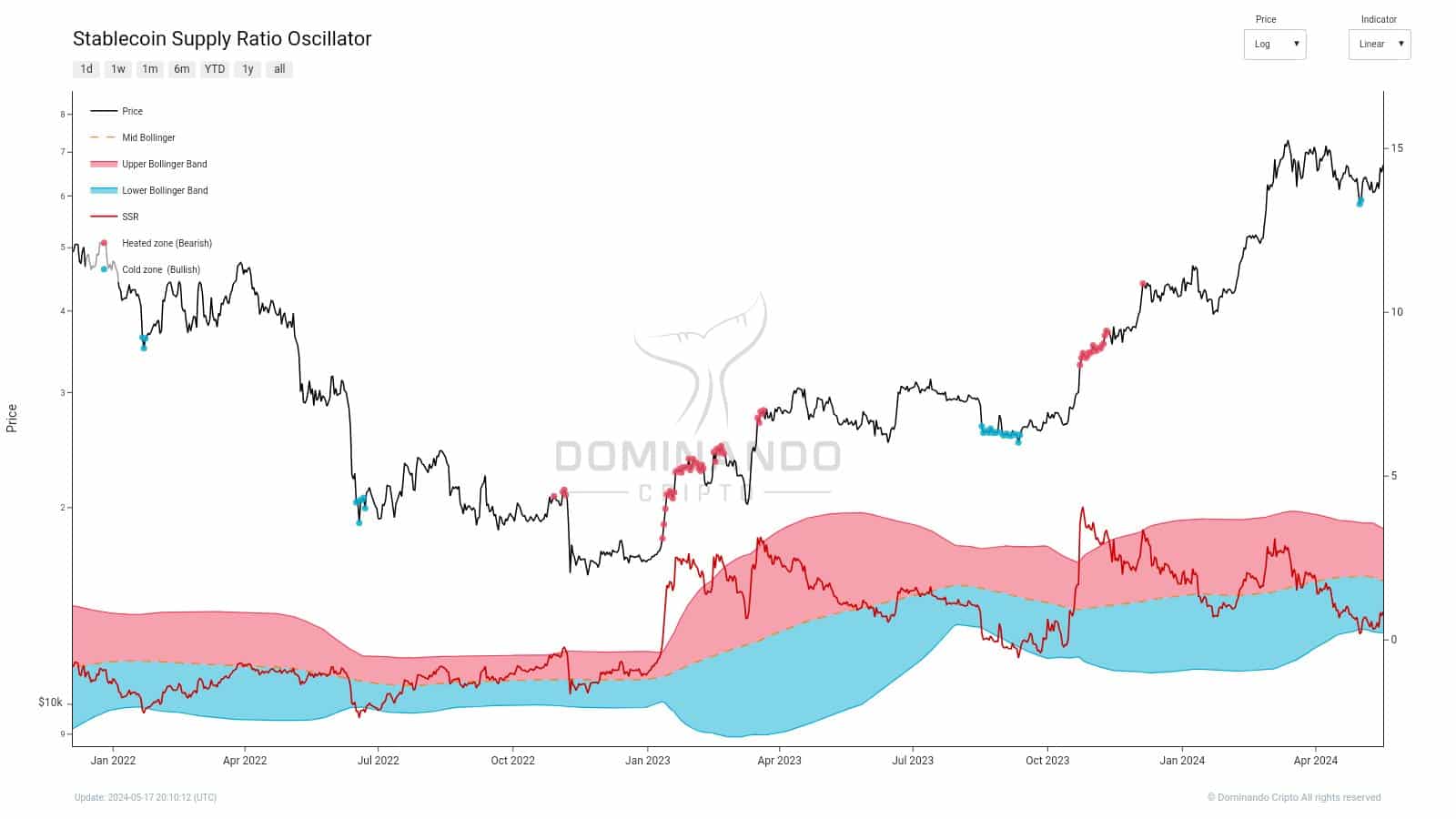

A crypto analyst highlighted in a put up on X (previously Twitter) that the stablecoin provide ratio (SSR) oscillator confirmed bullishness.

The technical indicator assesses stablecoin market sentiment relative to Bitcoin over time.

It’s calculated by taking the present SSR and its distinction with the 200-period easy shifting common. This worth is split by its customary deviation over the identical interval to reach at a set of Bollinger Bands (BB).

The present stablecoin provide is plotted over these bands to provide merchants insights into what the market sentiment is like.

When the SSR falls beneath the decrease Bollinger Band, it signifies low stablecoin dominance and potential bullish sentiment.

Supply: DominandoCripto on X

The chart above highlights how the market tends to tug again when the oscillator is overheated. Conversely, when the decrease bands are breached, it usually gives a very good long-term shopping for alternative.

Like another technical indicator, the SSR oscillator was not infallible, and every sign was not a assure of a worth transfer within the anticipated route.

We’re nonetheless inside a “buy” sign

Supply: DominandoCripto on X

The stablecoin provide ratio was beneath the 200-period SMA however above the decrease BB. It fell beneath this band in early Might, when Bitcoin costs reached $56k. Nevertheless, the value instantly rebounded increased.

The oscillator was nonetheless within the decrease BB and urged that additional positive aspects have been possible. The SSR additionally noticed a downtrend over the previous month.

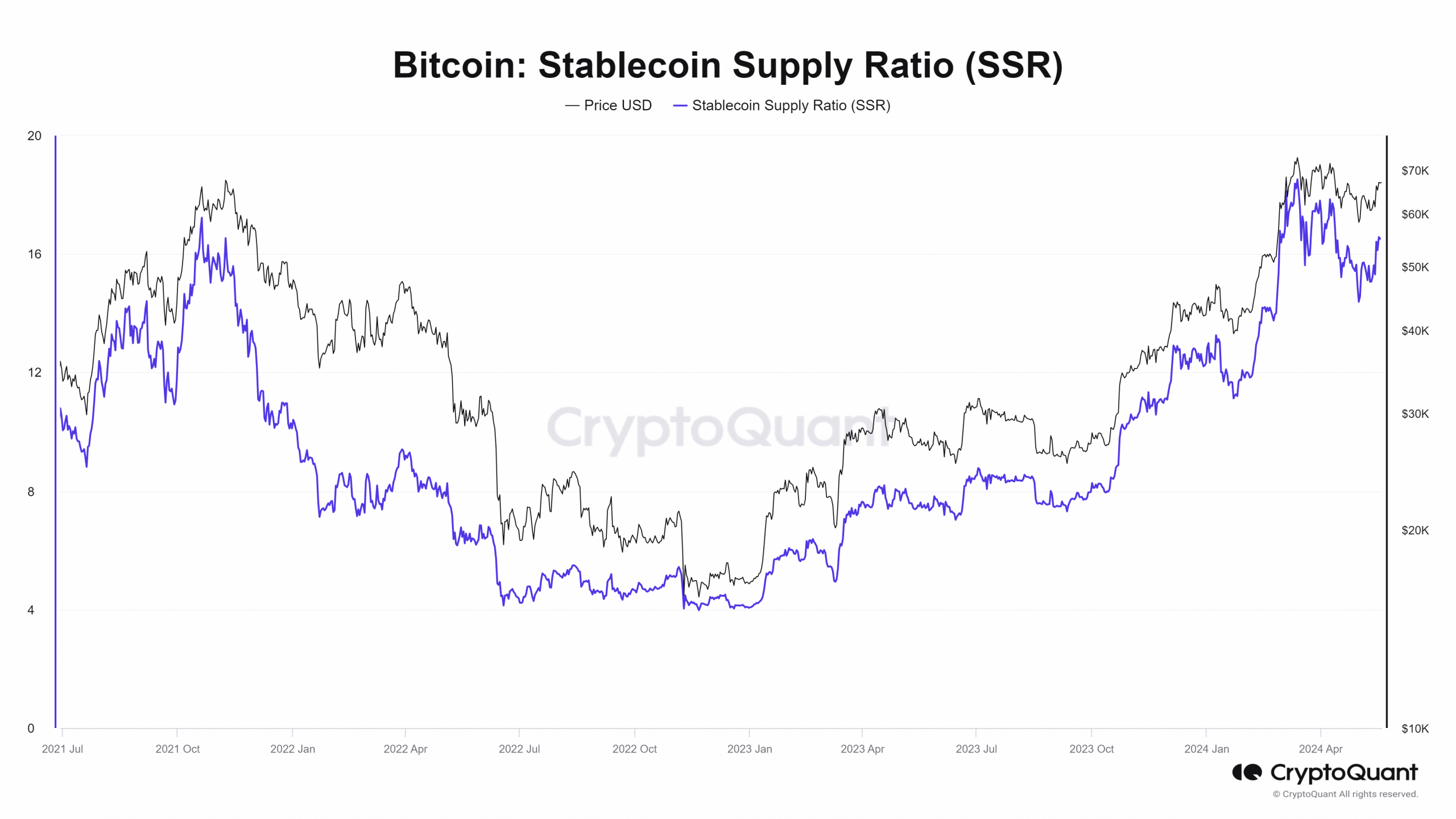

Supply: CryptoQuant

Is your portfolio inexperienced? Try the BTC Revenue Calculator

The metric has been aggressively trending increased since October 2023. Durations of stasis or pullback comparable to early January and mid-Might have been current.

A month after the January pullback, Bitcoin costs rocketed increased to breach the $46k resistance with ease. Maybe within the subsequent 2–4 weeks, we’d see a Bitcoin rally push properly past the $73k resistance.