- BTC has dropped beneath its 200-day shifting common for the second time, the primary being July 2024.

- An analyst predicted a drop to BTC’s realized value of $31500.

Bitcoin [BTC], has skilled excessive volatility over the past months. Since hitting a neighborhood excessive of $70016 in July, it has failed to take care of an upward momentum. In reality, over the past month, it has declined by 4.63%.

Nonetheless, over the previous week, BTC has tried to reverse the pattern by rising by 4.16% weekly. Regardless of these makes an attempt, it has didn’t maintain the momentum.

As of this writing, BTC was buying and selling at $58093. This marked a 0.40% decline over the previous day.

Equally, the crypto’s buying and selling quantity dropped by 19.90% to $29.7 billion over the previous 24 hours.

This market indecision and lack of clear trajectory has left market analysts seeing an additional decline earlier than a reversal. Inasmuch, common Crypto analyst Ali Martinez a drop to its realized value citing its 200-day shifting common

Market sentiment

In line with his evaluation, when Bitcoin trades above its 200-day shifting common, it indicated robust returns. Nonetheless, when it drops beneath this degree, it units the crypto for a sustained decline.

Supply: Ali on X

Due to this fact, because it has traded beneath $64000, over the previous month, it urged a possible drop to its realized value of $31500.

In context, when BTC markets commerce beneath the 200-day common, it’s mentioned to be in a downtrend. Whereas, when it trades above the 200-day shifting common, it’s thought of bullish.

Traditionally, when BTC falls beneath its 200-day shifting common, costs are likely to drop shortly after. First, throughout the 2016-2017 bull market, BTC fell beneath the 200-day SMA for 3 consecutive months.

In the course of the 2018-2019 cycle, it fell beneath the 200-day MA in mid-2019 earlier than COVID-19 disrupted the sample. In August 2023, it fell beneath 200-day MA till October, which was accompanied by a value decline.

Just lately, on the 4th of July, BTC dropped by 2% to commerce at $57300 thus falling beneath its 200-day shifting common of $58720.

Nonetheless, when BTC breaks above this trendline costs are likely to surge. As an illustration, in October 2023, when costs broke above the 200-day MA, BTC was buying and selling at $28000.

A breakout from this trendline fueled expectations for ETFs thus paving the way in which for ATH at $73737. In July when it broke out from the trendline, its costs recovered to $70016.

What Bitcoin charts point out

Undoubtedly, as Martinez posited, a drop beneath the 200-day MA indicated a decline, per historic knowledge. However what do different indicators say?

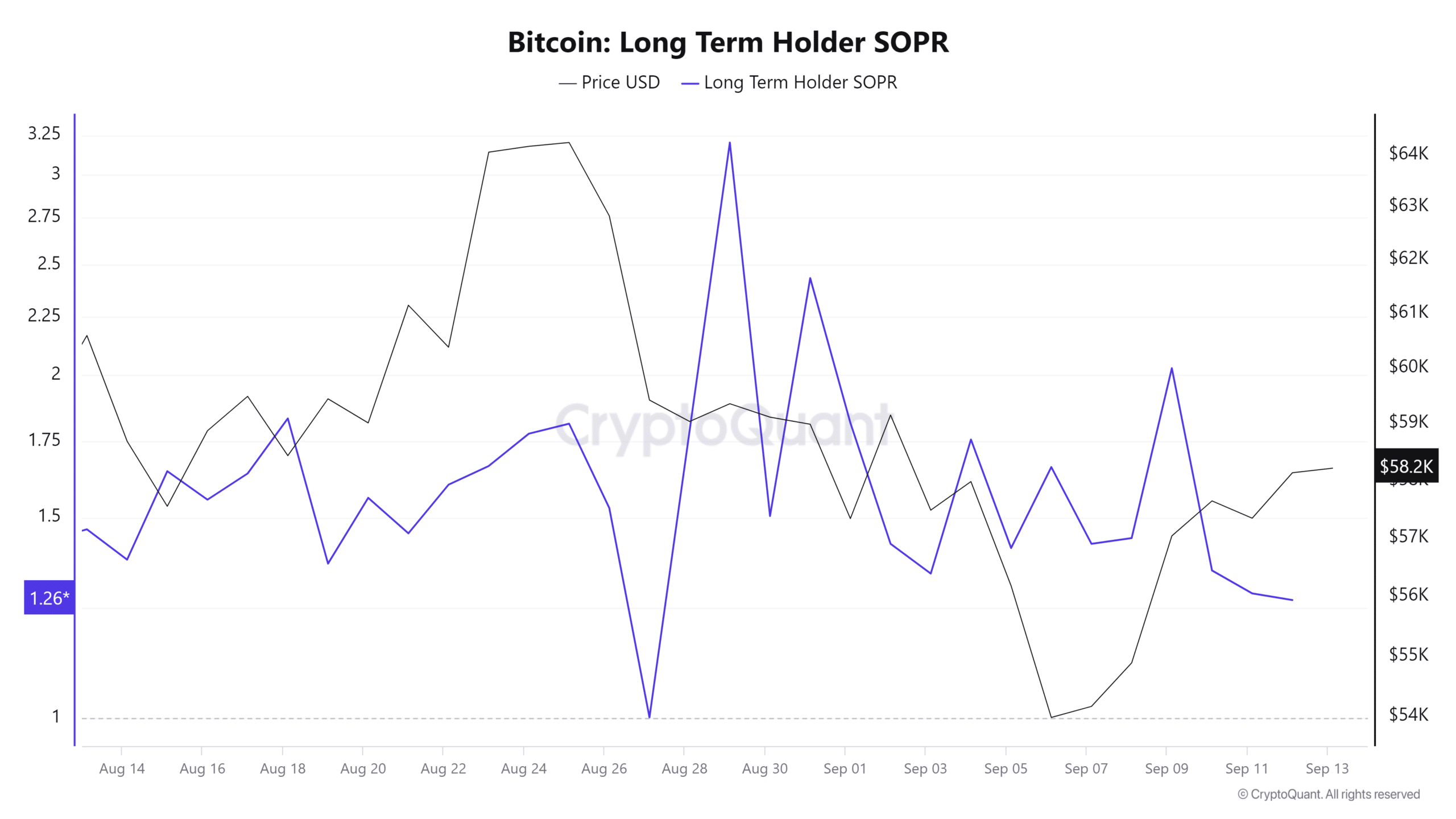

Supply: CryptoQuant

For starters, Bitcoin’s long-term holders SOPR has been on a declining channel for the reason that twenty ninth of August. The LTH SOPR has declined from 3.2 to 1.2, indicating bearish sentiment amongst long-term buyers.

This implied they now not anticipated BTC to get better, thus promoting to keep away from additional losses.

Such market habits leads to promoting strain, driving costs down.

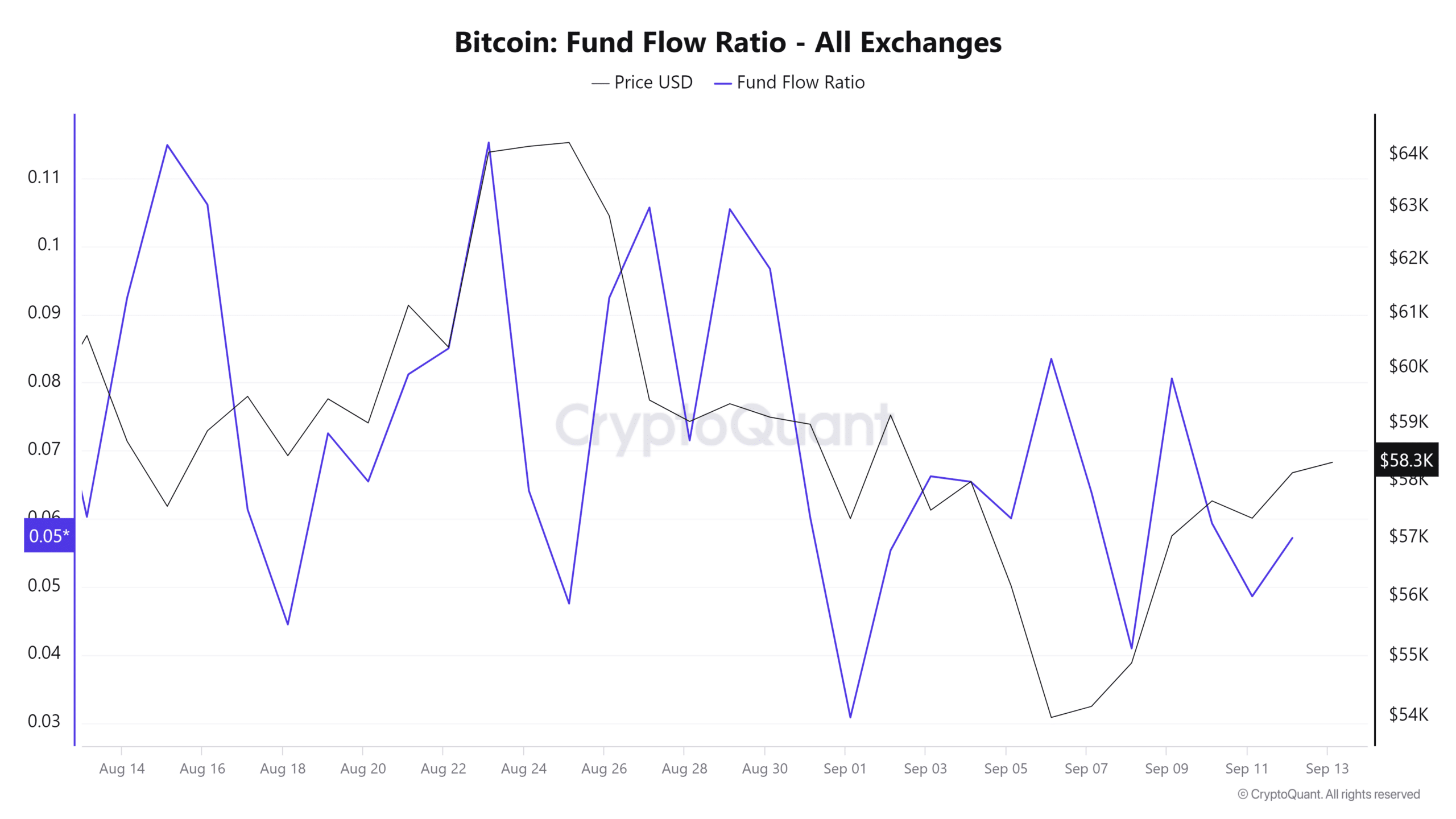

Supply: CryptoQuant

Moreover, Bitcoin’s Fund Stream Ratio has declined over the previous month, implying much less capital influx relative to total buying and selling quantity.

This urged that buyers lacked confidence and so they weren’t committing new funds. When buyers shut their positions, it leads to promoting strain, which additional pushes costs down.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Due to this fact, as Martinez posits, a drop beneath the 200-day MA implied additional decline. Based mostly on present market sentiment, BTC was positioned to say no to $54147 within the quick time period.

Nonetheless, a breakout from this trendline will push costs as much as $64727.