- The Bitcoin Funding Charges turned unfavorable at press time — the signal of a possible reversal.

- Bitcoin is about to make new highs if it breaks by way of the $65K mark.

Bitcoin’s [BTC] Funding Price turned unfavorable, signaling a shift in market sentiment. Merchants have gotten cautious, with the lengthy/quick ratio dipping to 1.61 at press time.

Futures present stronger promoting strain, as CVD Futures stand at -1.91 billion. Traditionally, when Funding Charges flip unfavorable, it has typically indicated market bottoms.

Bitcoin Funding Price drops hints

Since 2018, when the 30-day common Funding Charges turned unfavorable, Bitcoin noticed a median 90-day return of 79%, in accordance with K33 Analysis.

Destructive Funding Charges can typically result in quick squeezes, pushing the worth increased as bearish positions gas a rebound.

Supply: Glassnode

Taking a look at Bitcoin’s value motion, significantly the BTC/USDT pair, it seems that the market is displaying indicators of change.

Bitcoin was buying and selling close to a crucial resistance stage of $58,000 at press time. If the king coin breaks and sustains above this stage, it may push the worth increased towards $65,000.

Traditionally, unfavorable Funding Charges sign an upcoming surge, and the latest sturdy candles recommend the transfer might occur quickly.

If Bitcoin fails to interrupt the $58,000 stage, the worth may revisit decrease key ranges, doubtlessly reaching liquidity across the $50,000 psychological stage.

Supply: TradingView

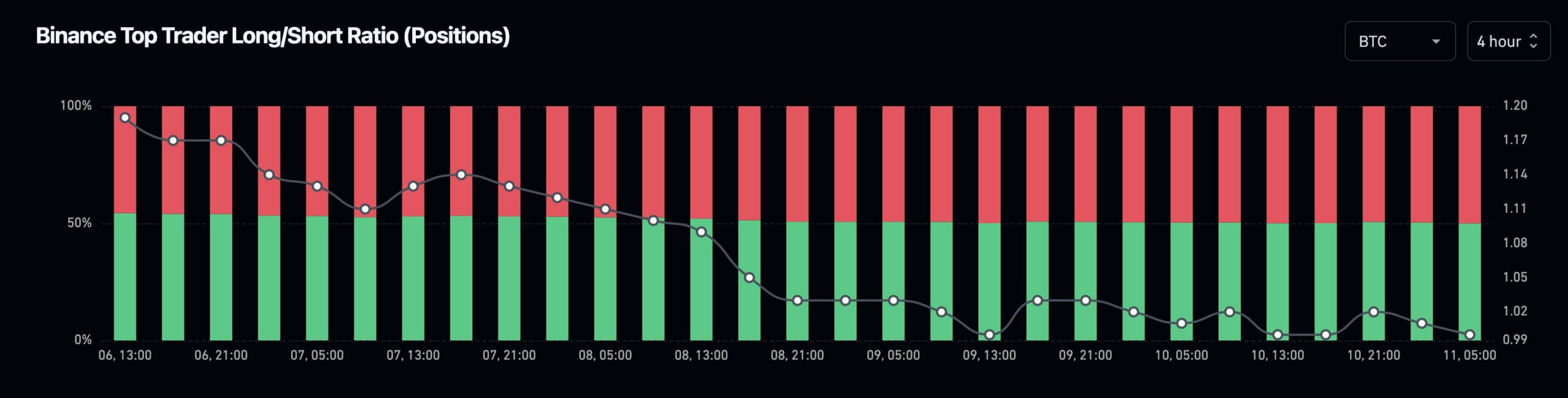

Exchanges’ high merchants flip lengthy

Additional evaluation revealed that high merchants on exchanges like Binance [BNB] have switched to lengthy positions, signaling confidence in the next BTC value.

These high merchants, typically thought of sensible cash, are shopping for Bitcoin whereas the market stays fearful. The shift in lengthy trades helps the concept that Bitcoin is about for a value surge, with knowledge indicating a bullish outlook.

Supply: X

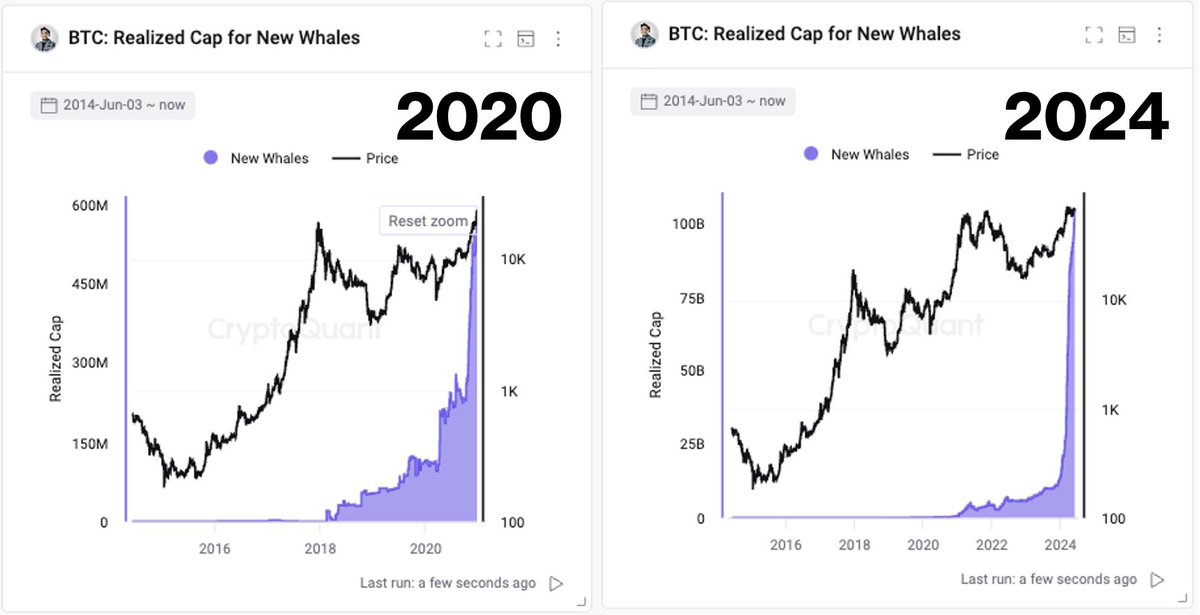

Whales purchase aggressively

New Bitcoin whales have been additionally making aggressive strikes, additional affirming the bullish sentiment.

New whales in 2024 have multiplied their holdings by 150 occasions in comparison with these from 2020, a time when Bitcoin skilled a significant bull run.

This enhance in whale exercise signaled stronger adoption of Bitcoin on this cycle in comparison with earlier ones.

Supply: CryptoQuant

The inflow of recent whale investments recommended that the unfavorable Funding Charges might set off a rally towards a brand new all-time excessive, presumably by the tip of this 12 months or early subsequent 12 months, because it did firstly of 2024.

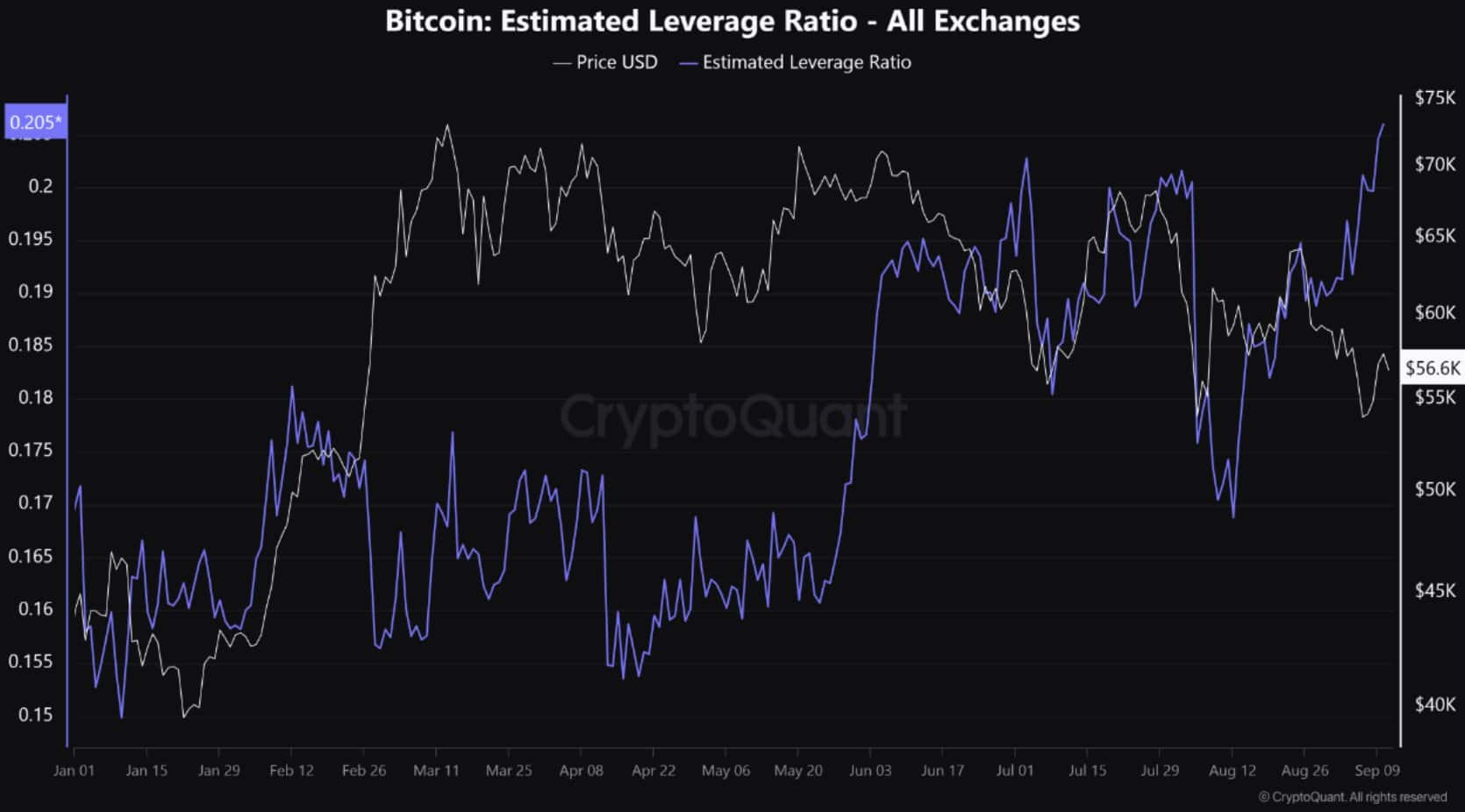

Estimated leverage ratio

Lastly, Bitcoin’s Estimated Leverage Ratio has reached a brand new year-to-date excessive. This enhance in leverage within the derivatives market indicated that buyers have gotten extra energetic.

The rising engagement in derivatives is prone to increase Bitcoin’s value motion over the long run.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

As extra merchants use leverage, the probabilities of vital value actions enhance, pushing Bitcoin’s value increased within the close to future.

With the present market circumstances and key indicators aligning, Bitcoin appears poised for increased features.

Supply: CryptoQuant