- Bitcoin’s latest positive aspects have been met with skepticism as trade inflows surge, suggesting profit-taking.

- Traditionally, Bitcoin’s efficiency in September has been poor, inflicting market jitters.

Bitcoin [BTC] worth was buying and selling at $56,864 at press time after a 3.6% acquire in 24 hours. The positive aspects adopted a 31% improve in buying and selling volumes, per CoinMarketCap.

The renewed optimism comes regardless of September being one of many worst months for Bitcoin. Nevertheless, regardless of the upsurge, a number of alerts are but to show bullish, creating issues that BTC may not be out of the woods but.

September bears hang-out merchants

The overall market sentiment remains to be bearish, with the Bitcoin Concern and Greed Index at 33, suggesting that merchants had been bracing for a possible repeat of earlier worth dips in September.

In truth, a latest report by U.S. fund supervisor NYDIG famous that the market could possibly be,

“Stuck in a seasonal slog for the next month.”

The report additionally acknowledged,

“On average, Bitcoin has fallen 5.9% in September and the median return is -6.0%. That’s not much solace given that September is just starting.”

The sentiment will probably change in direction of the top of the month. Based on Rekt Capital, Bitcoin could possibly be headed for 3 straight months of optimistic upside within the final quarter of the 12 months.

As previous worth declines in September hang-out merchants, Bitcoin’s upside potential stays capped.

Trade inflows attain 7-day excessive

One other key sign exhibiting {that a} bearish development is in play is trade inflows.

Information from CryptoQuant exhibits that on ninth September, Bitcoin inflows to identify exchanges reached 18,193, a large leap from the two,535 BTC posted the day gone by. This was additionally the largest degree of inflows in seven days.

Supply: CryptoQuant

The surge in inflows coincided with a restoration in BTC costs, suggesting profit-taking. It alerts that merchants are anticipating a bearish development forward as they select to trim losses.

Such promoting exercise signifies that merchants don’t anticipate a significant breakthrough in worth, and Bitcoin’s uptrend would possibly proceed to face resistance.

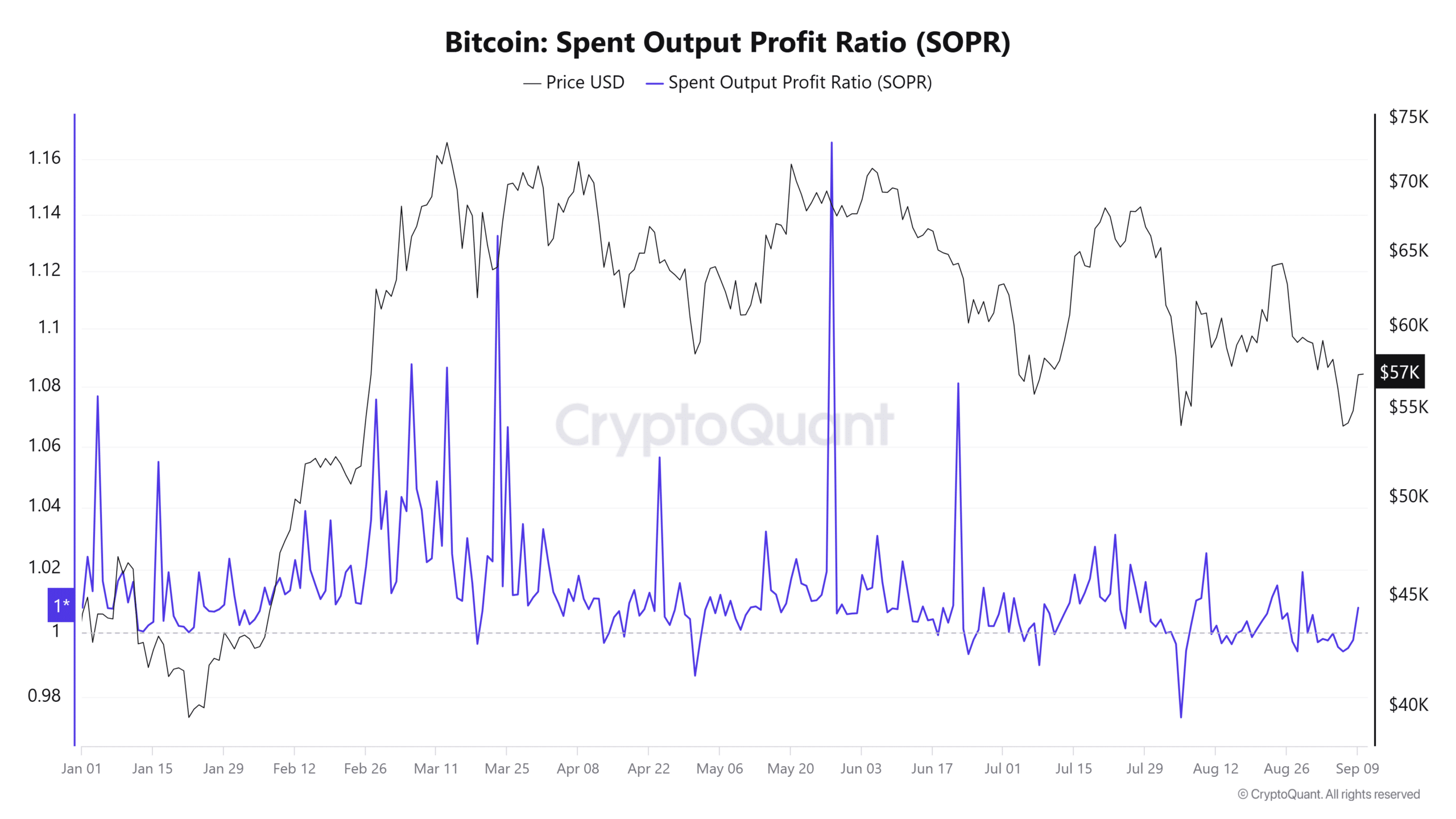

The profit-taking conduct is additional seen within the Spent Output Revenue Ratio (SOPR) ratio on CryptoQuant which has shifted above 1 suggesting that merchants are promoting to appreciate positive aspects.

This may put a brake on Bitcoin’s positive aspects.

Supply: CryptoQuant

Consumers maintain again

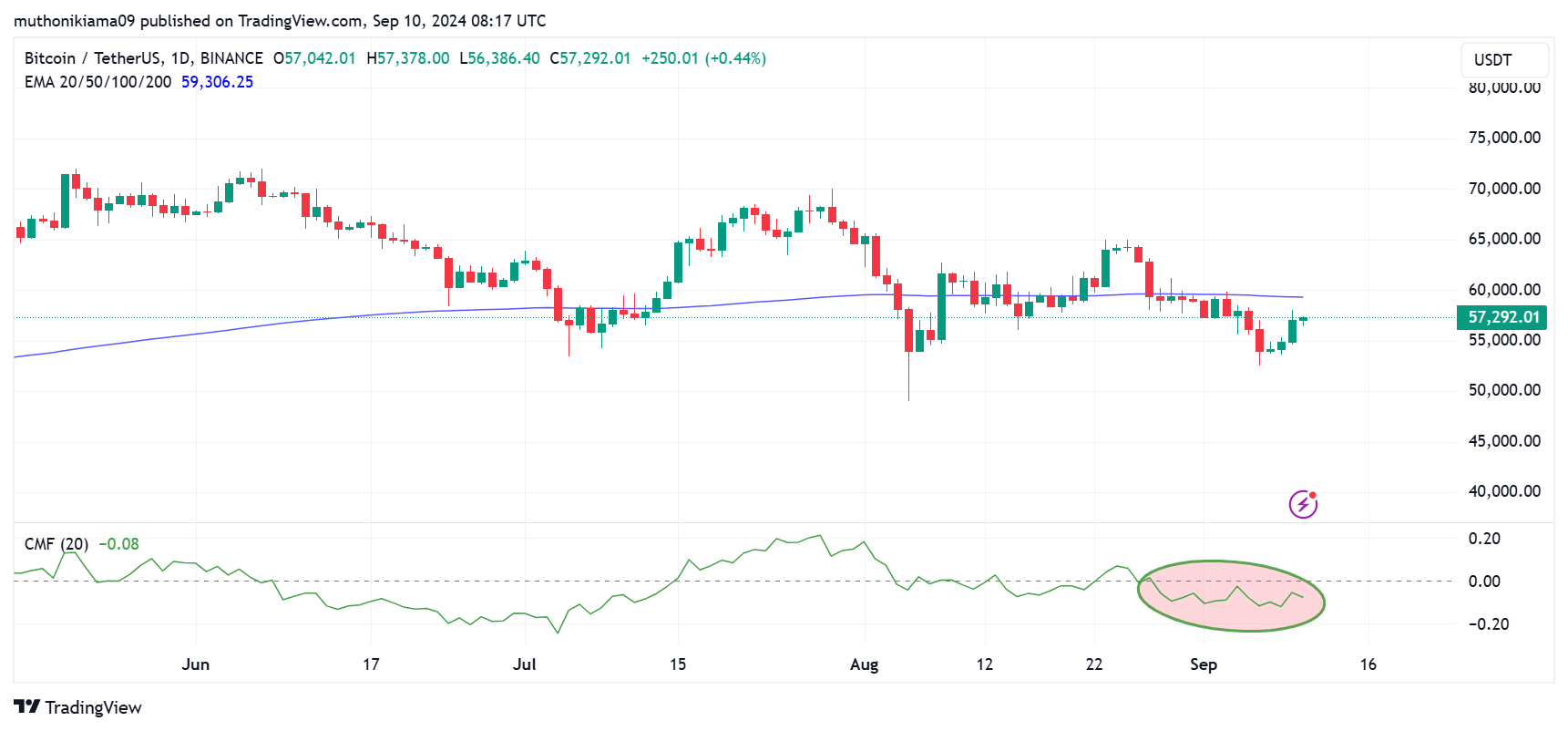

In a typical crypto bear market, shopping for exercise stays comparatively low. This development has appeared on the Bitcoin day by day chart.

The Chaikin Cash Move has been unfavorable for the reason that twenty seventh of August. Regardless of some bouts of shopping for exercise, this indicator has not flipped optimistic for 2 weeks.

This exhibits that Bitcoin has skilled extra promoting than shopping for inside this era.

Supply: TradingView

Furthermore, BTC has traded under the 200-day Exponential Shifting Common for 2 weeks now. This exhibits that the overall market sentiment is unfavorable.

The lack of BTC to reclaim the 200-day EMA additionally signifies a insecurity amongst merchants in a near-term worth restoration.

Upcoming CPI knowledge

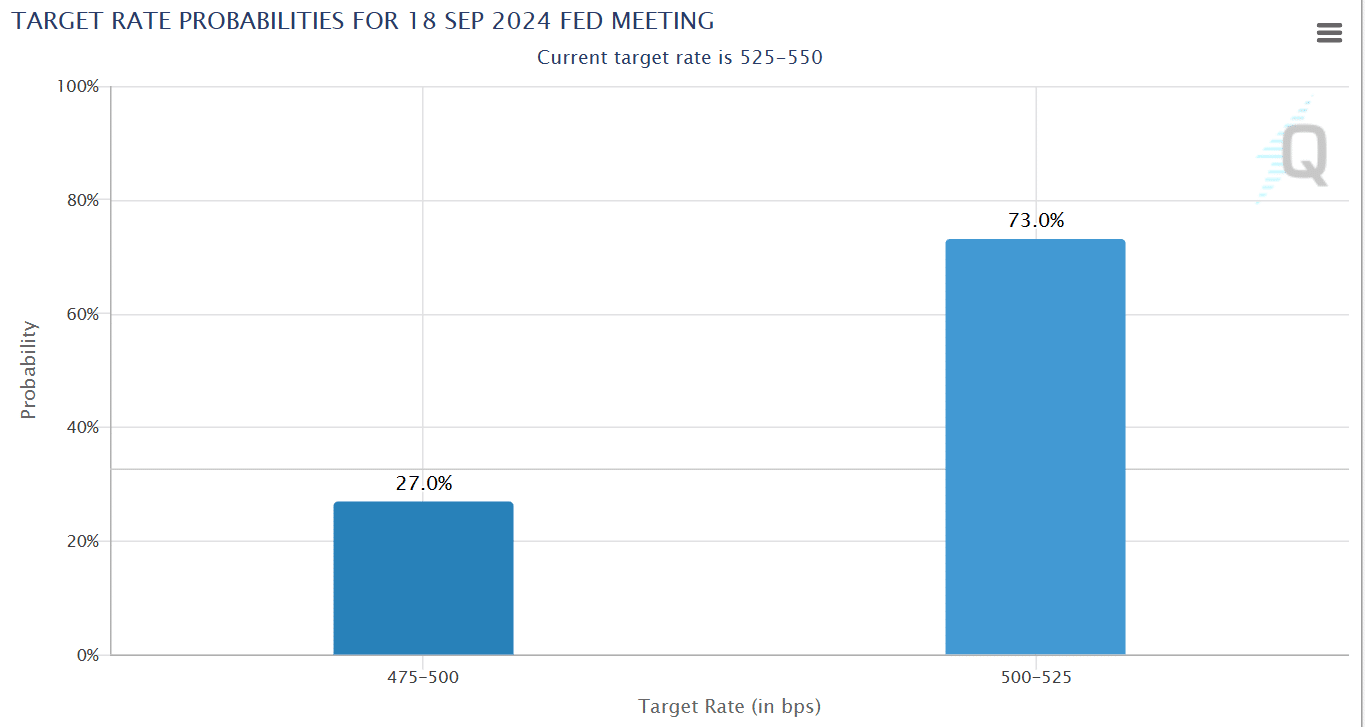

Crypto merchants are additionally turning their consideration in direction of the US Client Value Index (CPI) knowledge that will likely be launched on Wednesday.

Based on Marketwatch, buyers count on the August CPI print to come back in at 2.6%, a drop from the earlier month’s 2.9%.

Optimistic inflation knowledge will strengthen the case for the Federal Reserve easing rates of interest subsequent week.

Per the CME FedWatch Device, 73% of buyers worth in a 25 foundation factors price reduce, whereas 27% of buyers anticipate a good steeper reduce of fifty foundation factors.

Supply: CME FedWatch Device

Final week, U.S. Treasury Secretary Janet Yellen, heightened expectations of price cuts after saying the economic system was wholesome and headed right into a restoration.

The Fed easing charges for the primary time since 2020 will enhance urge for food for threat property reminiscent of crypto, which could decrease the chances of a crypto bear market.

A optimistic signal emerges

Whereas bearish alerts are dominating, a optimistic signal emerged when spot Bitcoin exchange-traded funds (ETFs) flipped optimistic for the primary time since late August.

On the ninth of September, inflows to identify Bitcoin ETFs got here in at $28M per SoSoValue knowledge.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Nevertheless, the 2 largest Bitcoin ETFs by internet property noticed unfavorable outflows. The BlackRock iShares Bitcoin Belief (IBIT) and the Grayscale Bitcoin Belief (GBTC) noticed $9M and $22M in outflows, respectively.

If the Bitcoin ETF knowledge is available in optimistic for the remainder of the week, it is going to renew optimism amongst crypto merchants and alleviate fears of a bear market.