Picture supply: Getty Photographs

I’m constructing an inventory of the perfect FTSE 100 shares to purchase in 2025. Listed below are two I wouldn’t contact with a bargepole.

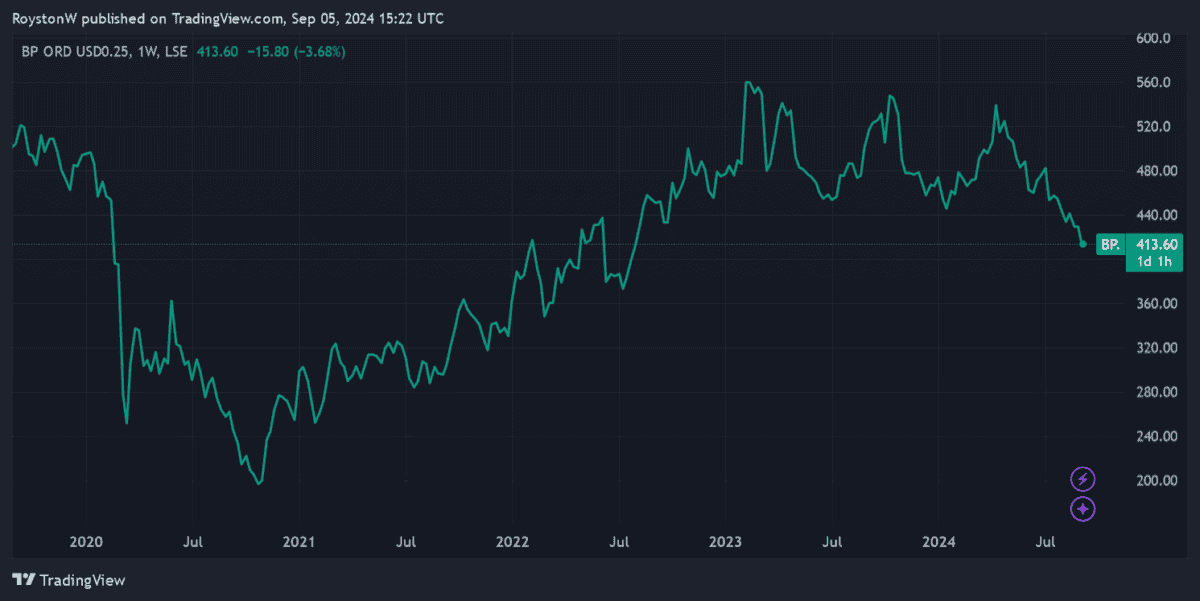

BP

It doesn’t matter how properly {that a} commodity-producing enterprise is run. They don’t have any management over the market forces, and if the worth of the product they concentrate on sinks, so will their earnings.

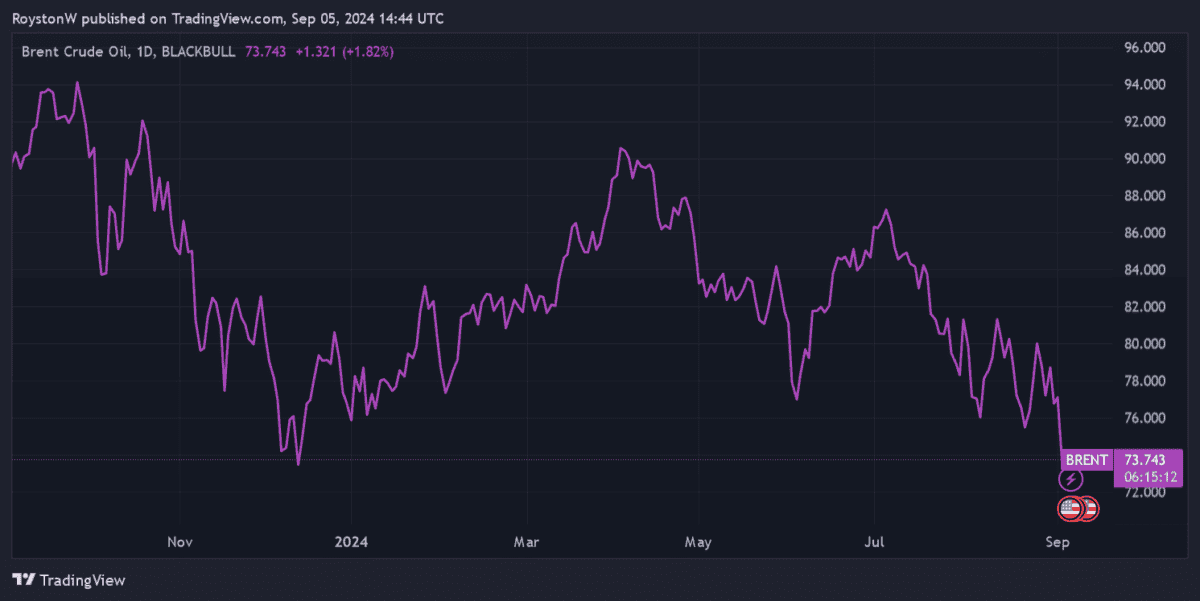

That is what makes BP (LSE:BP.) such a dangerous choose, for my part. With OPEC+ nations ignoring calls to chop manufacturing, and provide from exterior the cartel additionally tipped to rise, the market may very well be awash with extra oil that depresses costs.

The specter of a US recession and continued financial downturn in China provides additional peril for oil shares. And business analysts have disconcertingly stepped up slicing their oil worth forecasts for 2025 in response. The consultants at Citi, as an illustration, even recommend they might plunge to $50 per barrel subsequent 12 months.

After all, these gloomy forecasts aren’t assured. Power costs may the truth is spring increased relying on, for instance, OPEC+ manufacturing selections and better-than-expected financial development.

However the dangers to the draw back make BP a share I plan to keep away from. Additional progress within the renewable vitality sector may additionally weigh on fossil gas producers like this each in 2025 and past.

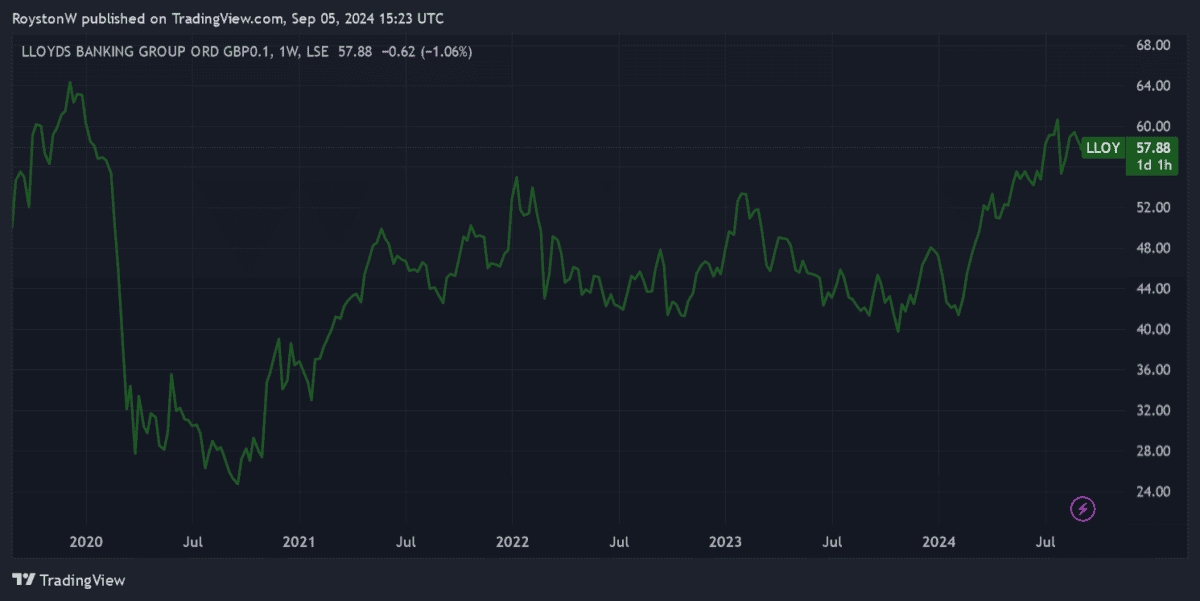

Lloyds Banking Group

Lloyds Banking Group (LSE:LLOY) is one other well-liked Footsie share I’m steering properly away from. In truth, I believe the opportunity of a share worth drop right here could be increased than with BP within the brief time period.

One in every of my chief issues is that web curiosity margins (NIMs) may stoop over the subsequent 12 months. Because the Financial institution of England (BoE) gears as much as minimize rates of interest, the earnings retail banks make on their lending actions could also be about to slip.

At Lloyds, the NIM dropped to 2.94% within the first half of 2024, from 3.18% a 12 months earlier, as the good thing about tighter BoE coverage earlier on unwound. This in flip pulled pre-tax revenue 14% decrease.

Conventional banks like this are additionally watching their margins erode as challenger banks develop their companies and ramp up product funding.

Lastly, The FTSE 100 financial institution may face billions of kilos value of fines associated to product mis-selling. The Monetary Conduct Authority’s (FCA) investigating claims of overcharging for automobile loans, for which Lloyds has already put aside £450m. Some analysts consider the ultimate price may find yourself someplace close to £4bn.

On the plus aspect, Lloyds’ earnings may impress if the UK financial restoration continues, driving its share worth increased. However that is certainly not a certainty if inflationary pressures stay and the cooling US economic system causes a broader international slowdown.

On steadiness, the dangers of proudly owning Lloyds shares are additionally too excessive for my liking.