- BTC’s value was on the verge of dropping beneath its realized price-to-liveliness ratio.

- The coin was testing a key help stage at press time.

Bitcoin [BTC] traders have been struggling for fairly a while now because the king coin continued to lose worth. Actually, a latest evaluation factors out a growth that indicated a much bigger value drop within the coming weeks.

Let’s have a more in-depth have a look at what’s going on with Bitcoin.

Why Bitcoin may drop to $31k

As per CoinMarketCap’s information, the king coin witnessed an almost 7% value drop final week. The previous 24 hours had been additionally bearish as BTC’s value declined marginally.

On the time of writing, BTC was buying and selling at $54,306.75 with a market capitalization of over $1 trillion.

A have a look at IntoTheBlock’s information revealed that after the newest value correction, over 41 million BTC addresses had been in revenue, which accounted for 77% of the entire variety of Bitcoin addresses.

Supply: IntoTheBlock

Within the meantime, Ali, a preferred crypto analyst, posted a tweet highlighting a notable distinction. The tweet talked concerning the relation between BTC’s value and its realized price-to-liveliness ratio.

Traditionally, each time BTC’s value falls beneath the realized price-to-liveliness ratio, it has led to additional value declines.

To be exact, a slip beneath that metric pushes BTC down in direction of its realized value. Such incidents have occurred again in 2019, 2020, and 2022.

At press time, such a bearish crossover occurred. This urged merchants can anticipate a BTC drop to its realized value once more, which on the time of writing was $31.5k.

Supply: X

Odds of BTC remaining bearish

Because it appeared doubtless for BTC to drop if historical past repeats, AMBCrypto checked different datasets to search out out what they urged concerning a correction.

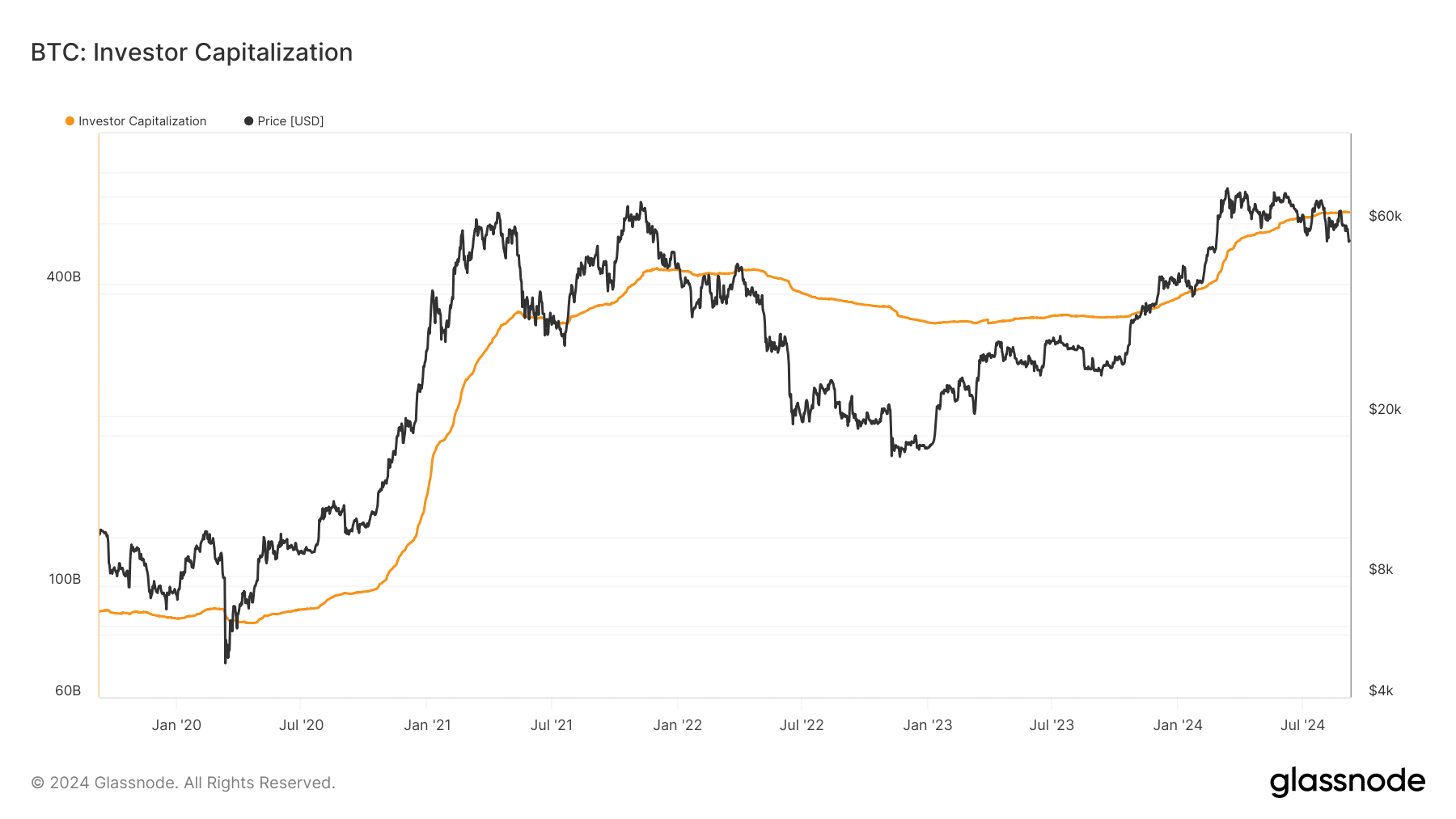

We discovered that BTC’s investor capitalization elevated considerably. Traditionally, each time BTC’s investor capitalization graph goes over its value, it’s usually adopted by value drops.

Supply: Glassnode

We then took a have a look at CryptoQuant’s information. We discovered that issues within the derivatives market had been regarding as Bitcoin’s funding price dropped. The coin’s taker purchase promote ratio turned pink, which means that promoting sentiment was dominant within the futures market.

Nonetheless, traders at giant had been shopping for BTC. This was evident from its dropping trade reserve and low internet deposit on exchanges in comparison with the final seven day common.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

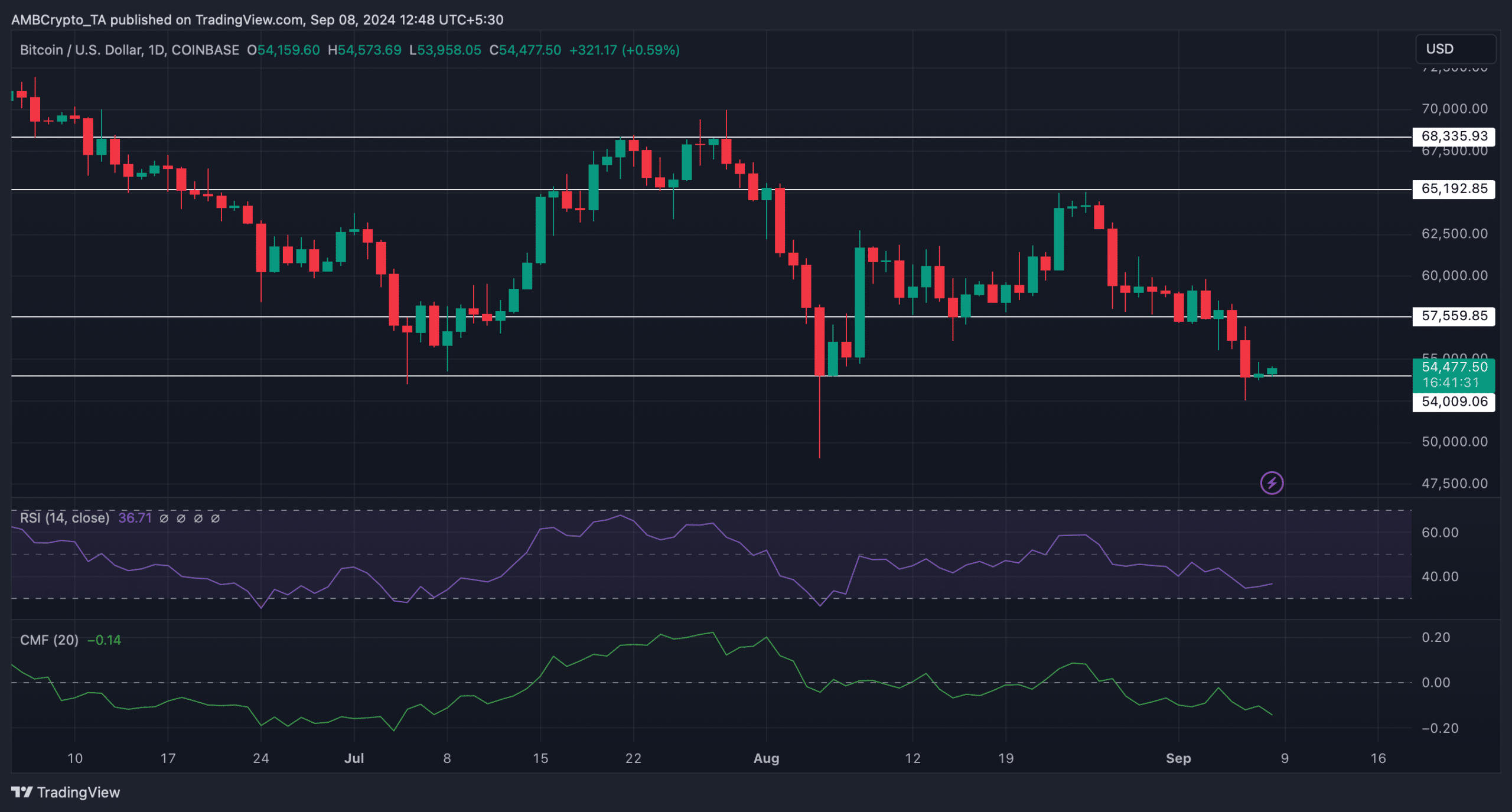

As per our evaluation, BTC was testing its essential help. A slip beneath that will recommend that the probabilities of BTC following previous developments and transferring in direction of $31k are excessive.

The Chaikin Cash Stream (CMF) registered a downtick, hinting at a failed check of BTC’s help. Nonetheless, the Relative Energy Index (RSI) remained bullish because it moved northwards.

Supply: TradingView