- Bitcoin might backside quickly amid rising Bitfinex lengthy positions

- In response to the Mayer A number of, BTC’s press time worth could also be undervalued and a relative cut price

Since early August’s large sell-off, Bitcoin [BTC] hasn’t fronted a sustainable strong restoration. In truth, after the aforementioned dump, a reduction rally to $65k was sharply reversed – Illustrating the risk-off mode from traders and merchants.

Nevertheless, regardless of the newest dip to $52.5k, a neighborhood backside for BTC might be doubtless. In response to market analyst Marty Occasion, BTC might backside out amid rising Bitfinex lengthy positions. He stated,

“Bitfinex Longs continue to grow – historically, this predicts the bottom of #Bitcoin more than any other indicator.”

Supply: X

Must you seize the dip?

In response to the analyst, Bitfinex’s BTC longs have been triggered on 28 August and urged that the asset might rebound quickly.

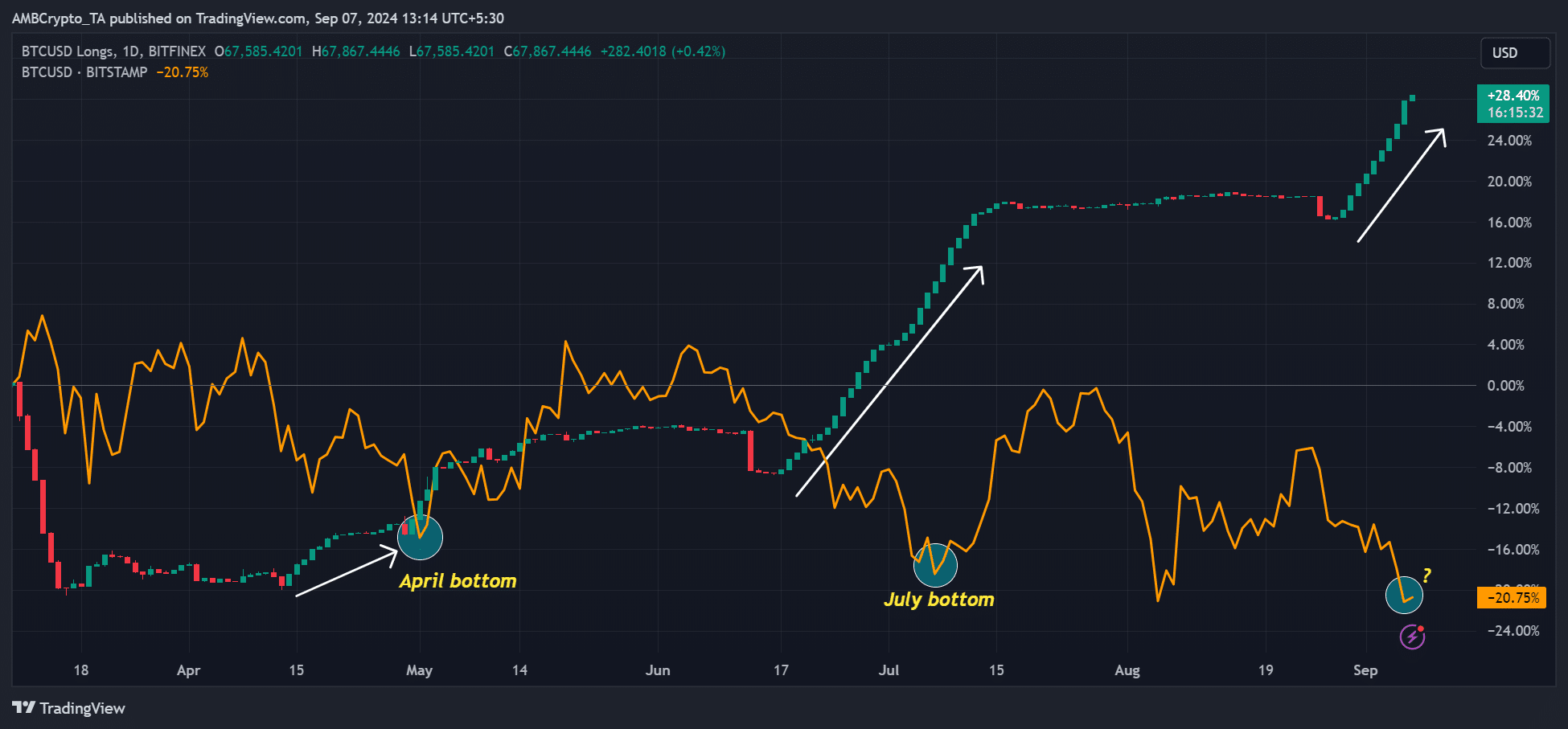

AMBCrypto’s analysis of Bitfinex’s BTC lengthy positions and worth revealed some optimistic correlations to latest bottoms too.

Supply: Bitfinex BTC longs, TradingView

As per the connected chart, BTC’s backside in April and July coincided with a pointy rise in lengthy positions on Bitfinex change. On common, BTC hit a backside after 15 days amid rising lengthy positions. Whether or not September will comply with an analogous pattern stays to be seen.

Right here, it’s price stating although that correlations don’t equal causation. And, BTC’s rebound might be triggered by different elements, together with macro or crypto-centric updates.

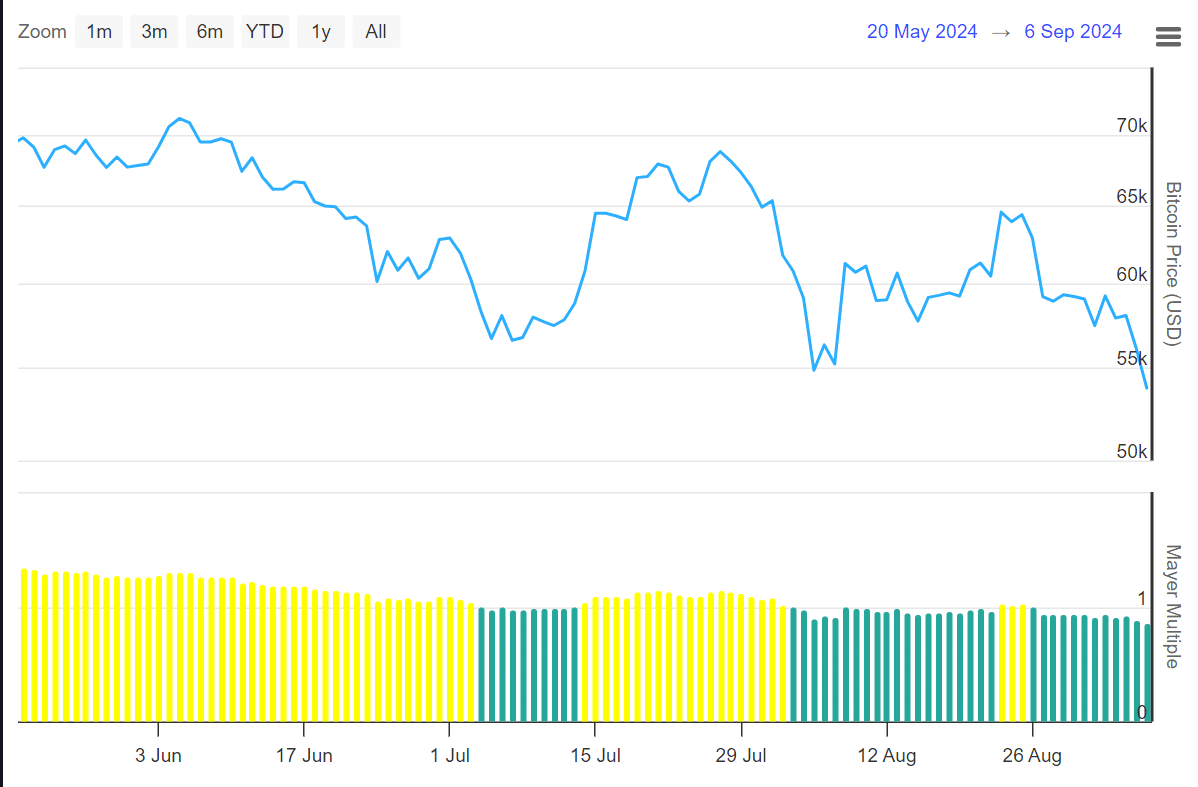

However, based on the Mayer A number of, BTC’s press time worth ranges could also be undervalued. By extension, this might current merchants a wholesome shopping for alternative.

Supply: BitBo

For these unfamiliar, the Mayer A number of gauges BTC’s worth relative to the 200-day Transferring Common. In doing so, it additionally captures its relative valuation.

Traditionally, a worth beneath 2.4 means undervalued circumstances and nice shopping for alternatives. Something above 2.4 is a warning signal of an overheated market.

In the meantime, values beneath 1 (inexperienced) coincided with native bottoms in July and early August. The identical sign was flashed in late August, much like when Bitfinex longs have been triggered. This urged that BTC could also be massively undervalued at its present costs.

The acute concern throughout markets, as illustrated by a studying of 23 on the Crypto Greed and Worry Index, is one other purchase sign to seize discounted BTC.