- Regardless of the huge value surge, BTC withdrawals from exchanges had been comparatively low.

- Exercise on the Bitcoin ecosystem continued to say no.

Bitcoin [BTC] has seen an surprising surge in value over the previous few days, which has impressed hope amongst merchants and holders. Because of the surge in optimism, addresses have been holding on to your BTC.

Withdrawals decline

A minor withdrawal of Bitcoin occurred yesterday, with 10,000 BTC leaving trade wallets. The full worth of the withdrawn Bitcoin is estimated to be round $630 million.

This sturdy demand for Bitcoin suggests a possible resurgence of curiosity within the cryptocurrency market.

Analysts be aware that the extent of constant demand for Bitcoin hasn’t been this excessive since late 2020, marking a big shift in investor sentiment.

Supply: X

At press time, BTC was buying and selling at $67,049.74 and its value had declined by 0.74% within the final 24 hours. Most holders of BTC had been worthwhile, as BTC was simply $6,000 {dollars} away from its all-time excessive.

The rate at which BTC was buying and selling at had declined. This meant that the frequency at which BTC was buying and selling at had declined.

Despite the fact that this may be perceived as a adverse signal for BTC, a declining velocity additionally meant that quite a lot of addresses had been holding onto their Bitcoin and had been refusing to promote.

Moreover, the full variety of holders of BTC has additionally surged, indicating that a lot of addresses have gathered vital quantities of BTC.

Coupled with the rising variety of holders, there was an reverse sample seen in miner holdings. AMBCrypto’s evaluation of Santiment’s information revealed that the provision held by miners had considerably fallen.

This might show to be constructive for BTC in the long term. If miners fail to generate excessive quantities of charges, it turns into tough for them to stay worthwhile.

To maintain their enterprise sustainable, they often resort to promoting their holdings, which finally ends up including promoting stress to BTC.

A decrease provide of BTC held by miners signifies that these sections of holders would have much less of an impression on the worth of BTC going ahead.

Supply: Santiment

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Exercise on the decline

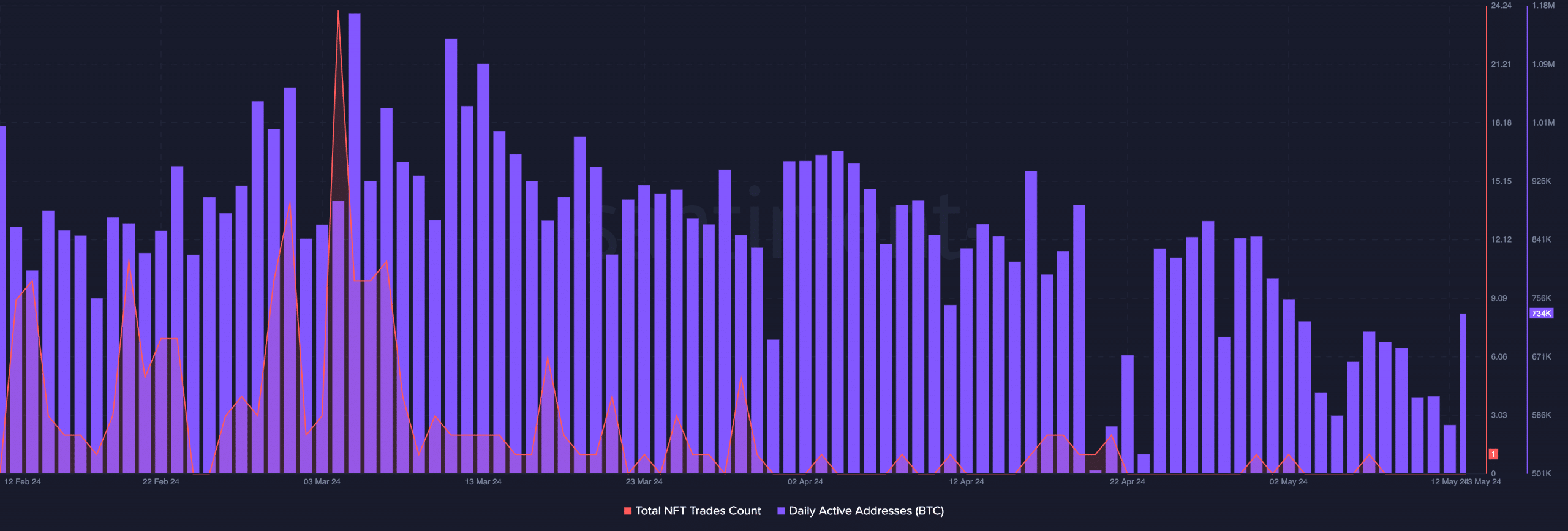

One of many the explanation why miners fail to generate charges is because of inactivity on the community. Over the previous few weeks, the variety of each day energetic addresses on the Bitcoin community had fallen.

Coupled with that, the variety of NFTs being traded on the community additionally declined. This steered a waning curiosity in Bitcoin’s ecosystem.

Supply: Santiment