- Are Bitcoin whales actually accumulating? We discover on-chain information to seek out some solutions.

- Bitcoin longs might be vulnerable to liquidations if the bears assume dominance.

Bitcoin [BTC] bounced again by over 3% through the buying and selling session on the 2nd of September. A part of this efficiency was pleasure triggered by studies that whales have been accumulating BTC.

Nevertheless, its incapacity to take care of robust momentum calls into query these studies.

In line with Lookonchain, whales have additionally been shifting Bitcoin onto exchanges regardless of wholesome outflows. This may occasionally counsel that whales have been making an attempt to set off extra volatility available in the market.

Regardless of these studies, AMBCrypto additionally noticed unfavourable netflows from Bitcoin ETFs, which didn’t precisely encourage confidence.

These findings warranted an evaluation of Bitcoin addresses to determine the extent of accumulation.

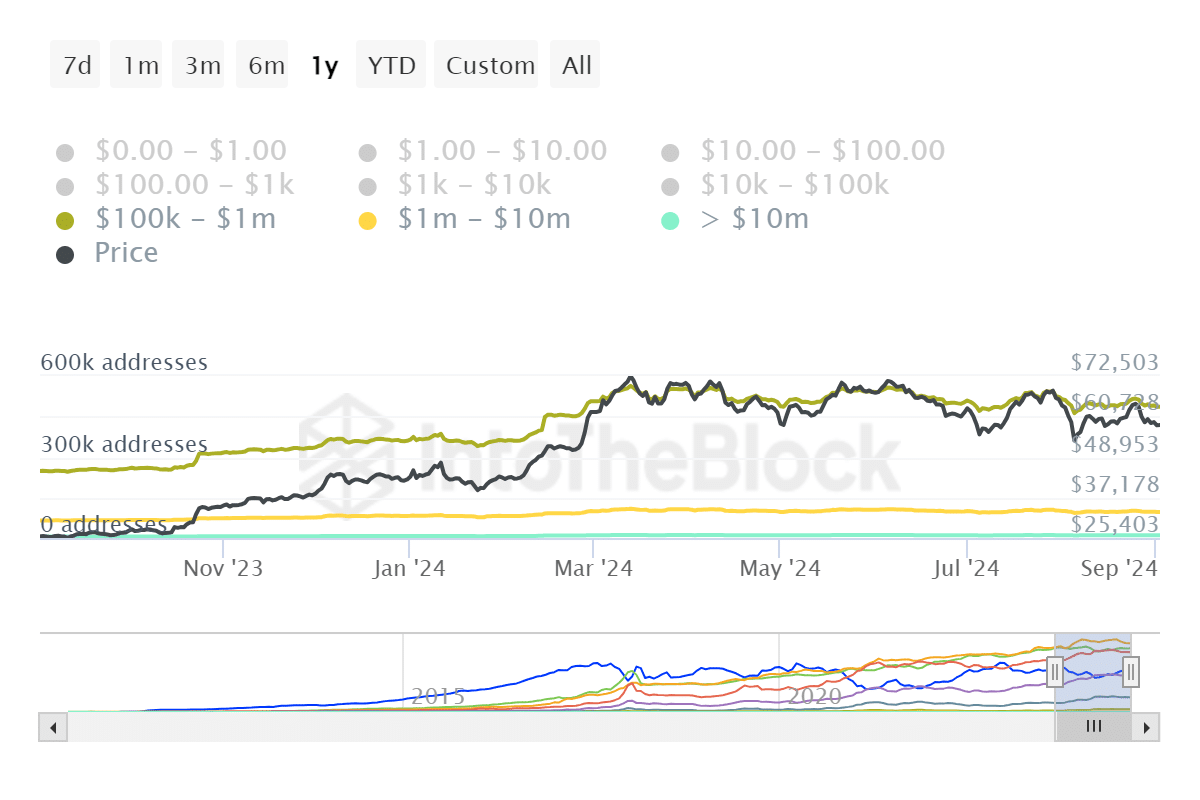

IntoTheBlock information revealed that addresses holding between $100,000 and $1 million value of BTC dropped from simply over 516,000 addresses on the twenty fifth of August to over 486,500 addresses by the 2nd of September.

Supply: IntoTheBlock

Addresses within the $1 million to $10 million value of BTC vary additionally dropped from 100,540 addresses to 96,150 addresses throughout the identical interval.

Addresses holding greater than $10 million value of Bitcoin dropped from 100,440 addresses to 100,000 addresses.

A Bitcoin worth inducement set-up?

The info confirmed {that a} vital variety of whales contributed to promote stress. So, the hype might have been a traditional inducement try, the place the market will get overvalued and supplies exit liquidity for the sellers.

This could clarify Bitcoin’s restricted upside and its wrestle to maintain restoration above $60,000.

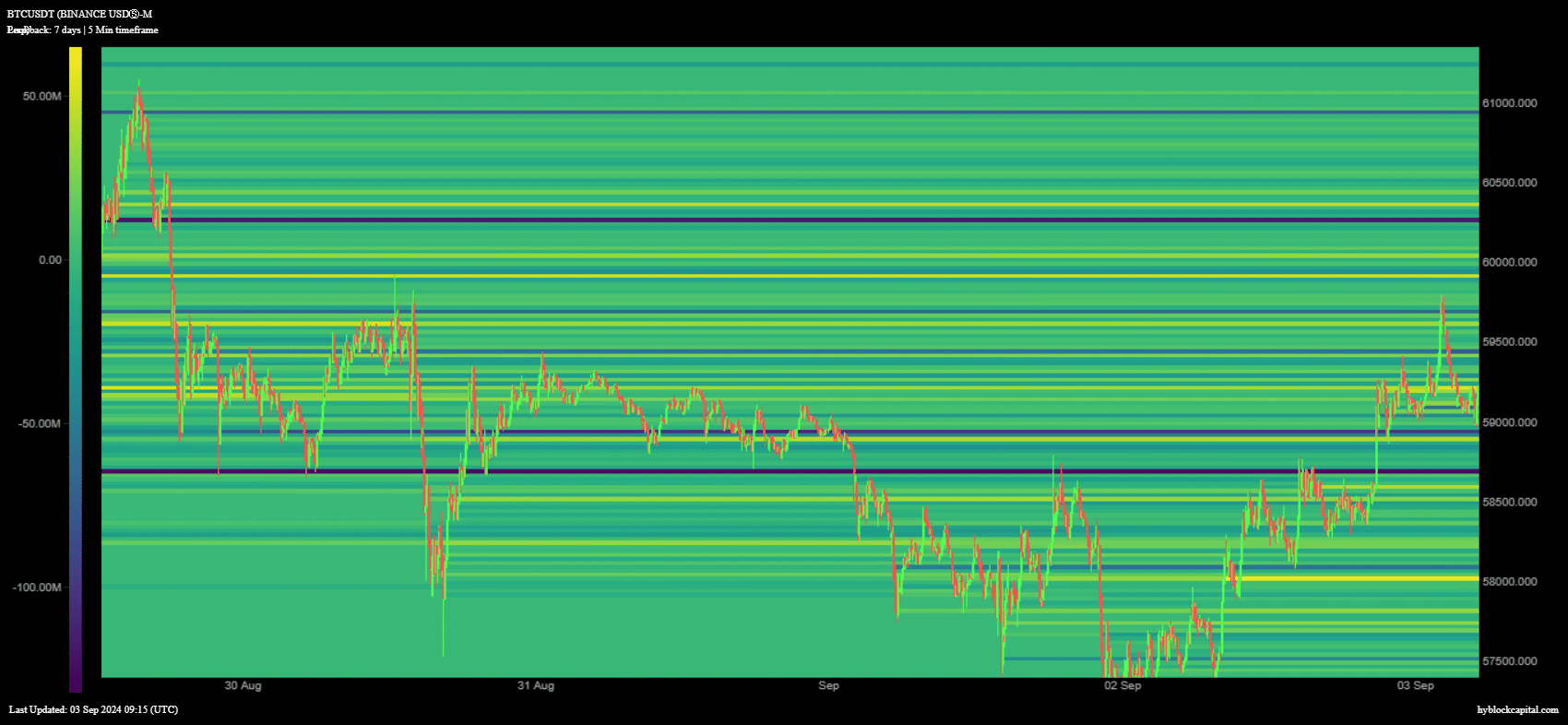

Inducement ranges are often characterised by a surge in urge for food for leveraged positions. We noticed a pile up of 25.582 million internet longs close to the underside on the 2nd of August.

The determine was larger at 52.82 million internet longs on the $58,000 worth stage.

Supply: Hyblock Capital

The surge in lengthy positions indicated rising expectations of extra upside. This additionally coincided with the resurgence of urge for food for leverage.

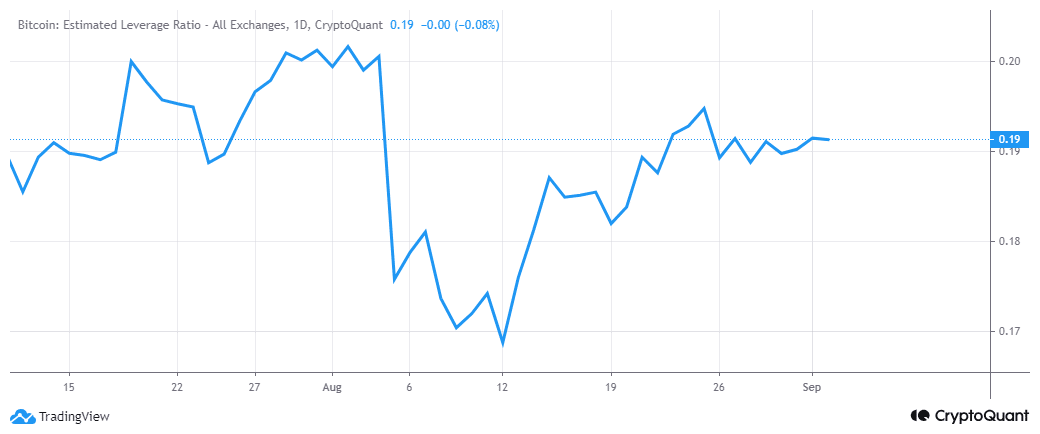

Bitcoin’s estimated leverage ratio bottomed out on the twelfth of August, adopted by a pivot.

This signaled that the market has been embracing extra leverage and will probably be constructing in direction of heavy liquidations in case of one other crash.

Supply: CryptoQuant

Bitcoin exchanged palms at $58,861 at press time, after a 0.47% low cost within the final 24 hours.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

This signaled that the market has been struggling to take care of the momentum, and it aligned with the promote stress coming from whales as noticed earlier. It additionally highlighted the opportunity of liquidations if the worth dips decrease.

The following 24 hours will probably be crucial for Bitcoin because the market awaits the subsequent FED determination relating to rates of interest. This may occasionally end in a unstable second half of the week.