Picture supply: The Motley Idiot

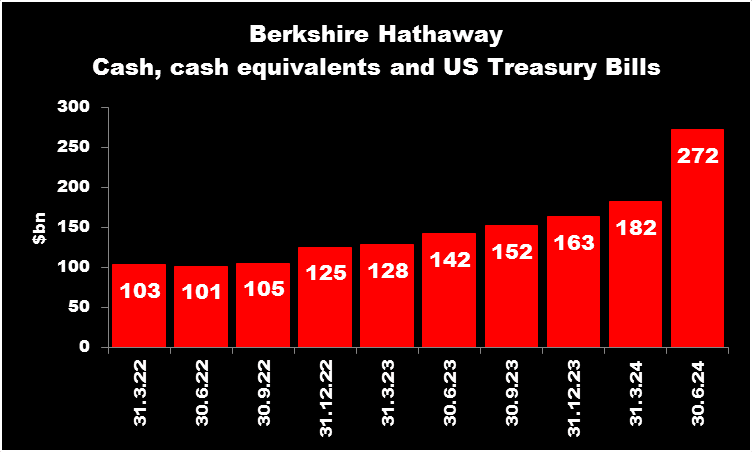

Warren Buffett, as chairman and CEO of Berkshire Hathaway, is presiding over a money stability of $272bn. Because the chart beneath exhibits, the corporate’s money, money equivalents, and US Treasury payments — that are a proxy for money — have been steadily rising because the finish of 2022.

Not that it seems to be affecting its market cap. This week (28 August), it grew to become the primary non-tech enterprise to report a inventory market valuation of $1trn.

From 1965 to 2023, its share value elevated by 19.8%. This compares to a median annual return of 10.2% from the S&P 500 (with dividends reinvested).

And though a few of this may be attributed to Berkshire’s funding in Apple, a lot of it has come from stakes in corporations exterior the expertise sector, like American Categorical and The Coca-Cola Firm.

Nonetheless, when most likely the world’s most well-known investor begins substituting money for shares, I believe it’s time to contemplate the implications.

What may this imply?

A lot of the money generated throughout the second quarter of 2024 got here from the sale of round half of Berkshire’s stake in Apple.

When requested on the annual shareholders’ assembly concerning the disposal, Buffett implied it was for tax causes. The billionaire expects the speed on capital good points to extend because the US tries to deliver its finances deficit beneath management.

Perhaps this implies there’s nothing to fret about?

I’m not so certain.

Buffett as soon as instructed traders to be fearful when others are grasping. And plenty of imagine that US equities are at the moment overvalued.

Any signal of a crash is more likely to have an effect on everybody’s portfolio, together with mine, which predominantly holds FTSE 100 shares. Because the saying goes, when America sneezes the remainder of the world catches a chilly.

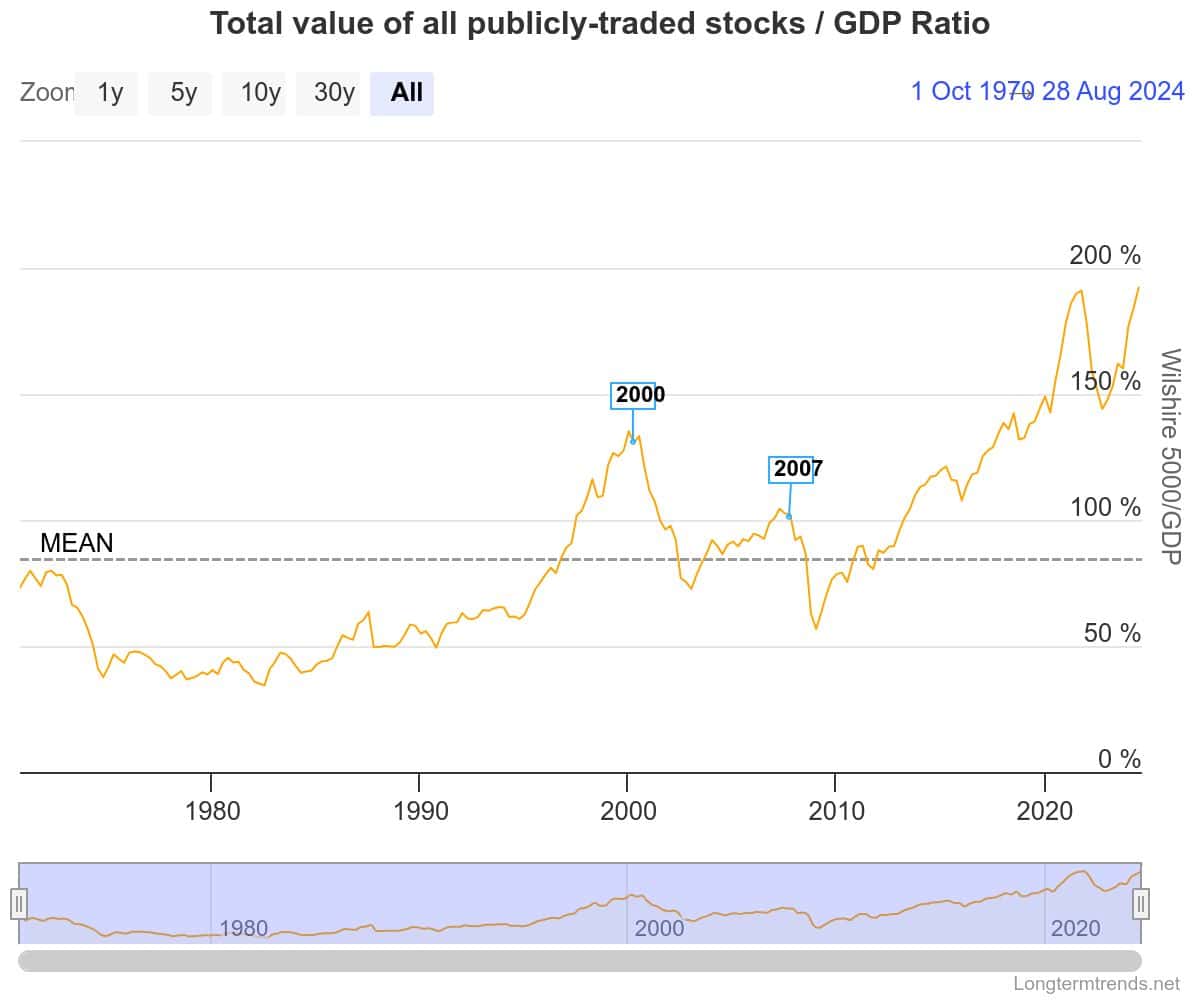

A bit like a market-wide price-to-earnings ratio, the chart beneath compares the mixed worth of the nation’s 5,000 largest listed corporations with its gross home product.

And looking out again 54 years, valuations have by no means been larger. Related peaks in 2000 and 2007 had been adopted by important market corrections.

My very own view

However regardless of this, I’m not going to alter my technique.

I shall maintain investing for the long run. I do know there will likely be some unhealthy instances forward. However I can’t predict when these will occur.

As an alternative, I’m going to proceed to spend money on high quality corporations which have the perfect likelihood of constantly rising their earnings.

That’s why I just lately purchased some Barclays (LSE:BARC) shares.

I’m impressed by the financial institution’s chief govt who recognises that its efficiency lags behind that of its friends. For instance, its statutory return on tangible fairness for the six months to 30 June 2024, was 11.1%. That is inferior to that of Lloyds Banking Group (13.5%) and NatWest Group (16.4%).

C.S. Venkatakrishnan has launched into creating a less complicated enterprise mannequin with an emphasis on its higher-margin markets.

Analysts are forecasting earnings per share (EPS) of 30.5p (2024), 39.6p (2025), and 48.4p (2026). If these estimates show correct, by 2026, the financial institution may have elevated its EPS by 75%, in comparison with 2023. These figures indicate a ahead (2026) price-to-earnings ratio of simply 4.7.

Nonetheless, banking shares will be unstable. Unhealthy loans are all the time a threat and margins will likely be squeezed as rates of interest (as anticipated) begin to fall.

Regardless of this, for its long-term potential, I believe Barclays will likely be addition to my portfolio.