Picture supply: Getty Photographs

One of many extra disappointing underperformers on the inventory market in recent times has been Diageo (LSE: DGE). The FTSE 100 spirits large is down 11% 12 months to this point and 37% for the reason that begin of 2022.

This inventory’s already a fairly large holding in my portfolio, however now I’m questioning whether or not to make the most of the dip and make it even bigger. Listed here are my ideas.

Shopper slowdown

On 30 July, the agency reported its preliminary outcomes for FY24 ended 30 June. Total income fell 1.4% 12 months on 12 months to $20.3bn, lacking estimates for $21.2bn. Volumes declined by 2.1%, with demand weak within the US and dreadful demand within the Latin America and Caribbean area (a 21.1% quantity decline).

That large hunch was resulting from customers shifting to cheaper native spirits. This was most pronounced in Brazil and Mexico, the place demand for Scotch and tequila was notably weak. Diageo’s premium manufacturers in these respective classes embrace Johnnie Walker and Don Julio.

On the underside line, natural working revenue fell 5% to $5.9bn. Earnings per share of $1.73 dipping from $1.97 in FY 23.

Trying ahead, administration isn’t providing an improved outlook for FY25, which it says will proceed to be “difficult“.

Modest restoration anticipated

The US accounts for nearly 40% of Diageo’s gross sales. Final 12 months, the US spirits market declined for the primary time in almost 30 years, based on trade researcher IWSR.

The principle danger is an extra deterioration in that key market. With a US recession already a priority, it might’t be dominated out.

In keeping with the identical analysis from IWSR although, international beverage alcohol’s anticipated to start its restoration in 2025. Nonetheless, development’s anticipated rise “at a compound annual development charge of +1% between 2023 and 2028“.

It additionally added that the “premiumisation universe for spirits is narrowing”. That’s not nice for Diageo’s personal premiumisation story.

On the plus aspect, what forecast development there’s will largely come from India, China and the US. Diageo has a presence in all three markets, whereas international tequila development ought to stay robust. In addition to Don Julio, Diageo owns the Casamigos tequila model.

In the meantime, Guinness has grown globally by double digits for seven consecutive quarters. Not unhealthy for a 265-year-old model!

Discount basement?

On some key metrics, the inventory seems to supply nice worth. It’s buying and selling on a price-to-sales (P/S) a number of of three.5 whereas the ahead price-to-earnings (P/E) ratio is round 18. Each are at multi-year lows.

Regardless of the difficult surroundings, the corporate nonetheless generates significant free money circulate and returns it to shareholders via dividends. Final 12 months, free money circulate elevated by $400m to $2.6bn whereas the dividend was raised by 5%.

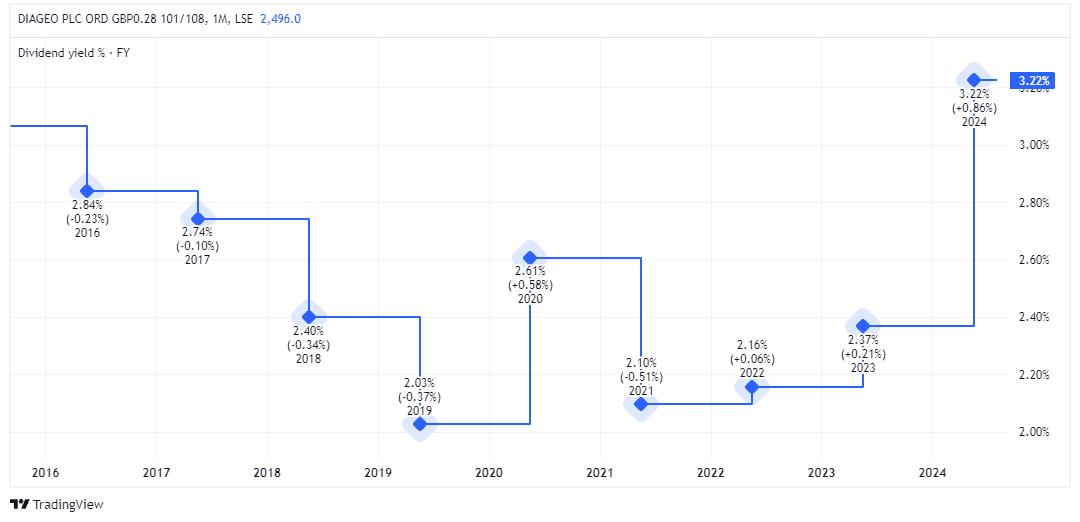

The yield’s climbed to three.2%, which is 50% extra revenue than buyers have been getting simply two years in the past. Diageo stays a blue-blooded Dividend Aristocrat.

I notice that dealer Citi not too long ago reiterated its Purchase advice on the inventory, saying that it’s “time to revisit what remains an attractive compounding mid-term growth story”.

Solely time will inform if the inventory’s in discount basement territory at present. However I see good worth right here and I’m tempted to purchase extra Diageo shares in September.