- Why Bitcoin may very well be flashing indicators of a volatility resurgence and a possible breakout.

- BTC whale exercise on the rise as trade flows are anticipated to surge within the coming days.

Bitcoin [BTC] has been buying and selling inside a slender vary underpinned by low volatility within the final 15 days.

It has demonstrated resistance close to the $61,000 degree throughout that point, leading to pullbacks each time it pushed close to or above that zone.

The king coin has as soon as once more managed to rally above the $61,000 value degree within the final 24 hours. This time, although, there are some noteworthy observations which can trace at rising bullish momentum.

For starters, BTC’s RSI has been struggling to push above its 50% degree ever because the crash that occurred earlier this month.

Nevertheless, the latest mid-week bullish push propelled it above the RSI mid-level, and its upside within the final 24 hours demonstrated resilience above that degree.

Supply: TradingView

The RSI’s conduct signifies that Bitcoin is experiencing a gradual resurgence of bullish momentum, which can assist its value motion within the short-term.

This might spill into the weekend, probably permitting BTC to push outdoors the sideways vary.

Bitcoin indicators at pivotal second

Bitcoin could profit from a liquidity inflow to gas a strong upside. Coincidentally, The NASDAQ simply shaped a bearish divergence sample, which implies a resurgence of promote strain might see liquidity circulation from shares to Bitcoin.

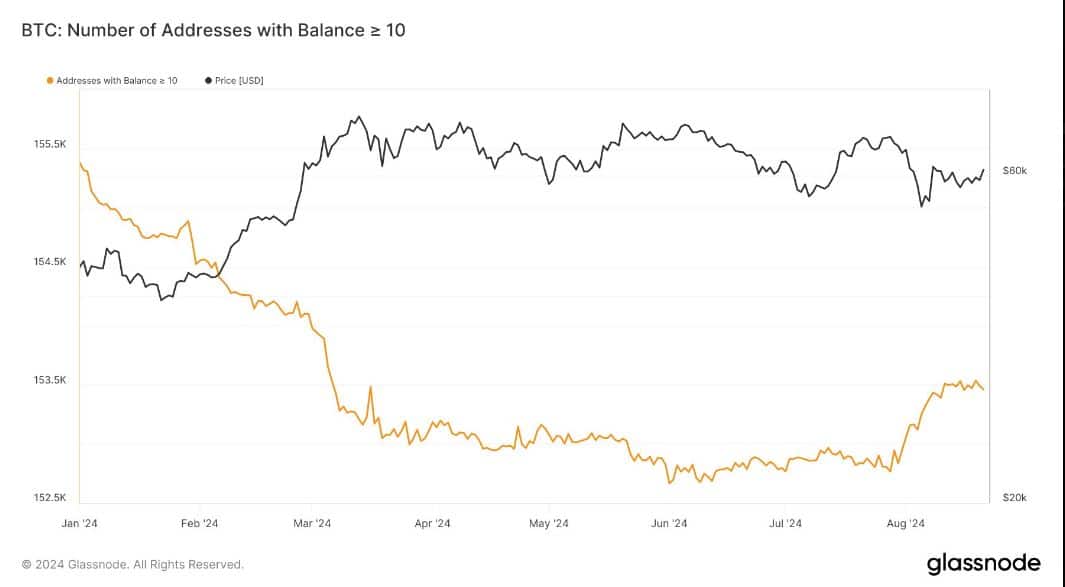

In the meantime, Bitcoin whale exercise has been on the rise. Addresses holding at the very least 10 BTC have been rising in the previous few days.

Supply: Glassnode

Rising whale exercise instructed that Bitcoin was getting nearer to exiting the present low volatility vary. Bitcoin trade flows additionally revealed one other vital statement value noting.

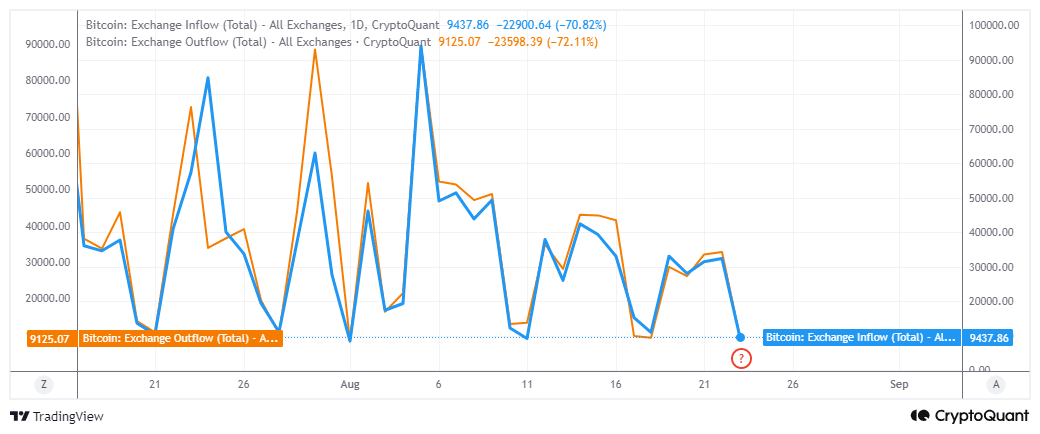

Its trade flows have been fairly cyclical over the previous few months, with peaks and troughs.

Whereas the trade circulation peaks have been totally different for essentially the most half, the underside vary has been comparatively constant. Alternate flows fell to the identical low vary within the final 24 hours.

Observe that trade outflows have been barely increased than inflows at press time.

Supply: CryptoQuant

The above chart indicators that trade flows are about to pivot to the upside. This implies the market is about to expertise increased trade flows within the subsequent few days.

As a consequence, Bitcoin value volatility could also be in favor of an uptick within the subsequent few days.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The statement that whale exercise is making a comeback might sign a better chance of Bitcoin bulls taking on within the coming week.

A stronger transfer is to be anticipated if the U.S. Federal Reserve pronounces rate of interest cuts.