- Bitcoin charges hit a yearly low for the third consecutive week as market quantity elevated

- Repetition of 2019 divergence of BTC and SPX would possibly spur bullish sentiments

Bitcoin [BTC] charges have hit a yearly low for the third week operating, following the market’s current stabilization, in accordance with IntoTheBlock’s remark on X.

Following this fall in the price of transacting Bitcoin, NPS, the third-largest public pension fund globally, invested $34 million in MicroStrategy’s inventory for Bitcoin publicity.

The transfer highlights a rising development amongst establishments to diversify into Bitcoin by way of corporations with substantial Bitcoin holdings presently of low charges. That is additionally an indication of the mainstream more and more accepting this asset class as viable.

BTC and SPX 2019 divergence repeats itself

The divergence between Bitcoin and the SPX signaled a reversal, just like 2019 when Bitcoin’s worth surged after a charge minimize by the Fed. This sample is repeating in 2024 with the Fed anticipated to chop charges once more.

Bitcoin’s current decline and subsequent divergence from the SPX mirrors the 2019 development, which led to a big worth hike. Regardless of skepticism, this situation would observe a well-recognized cycle, reflecting a recurring market sample.

Supply: TradingView

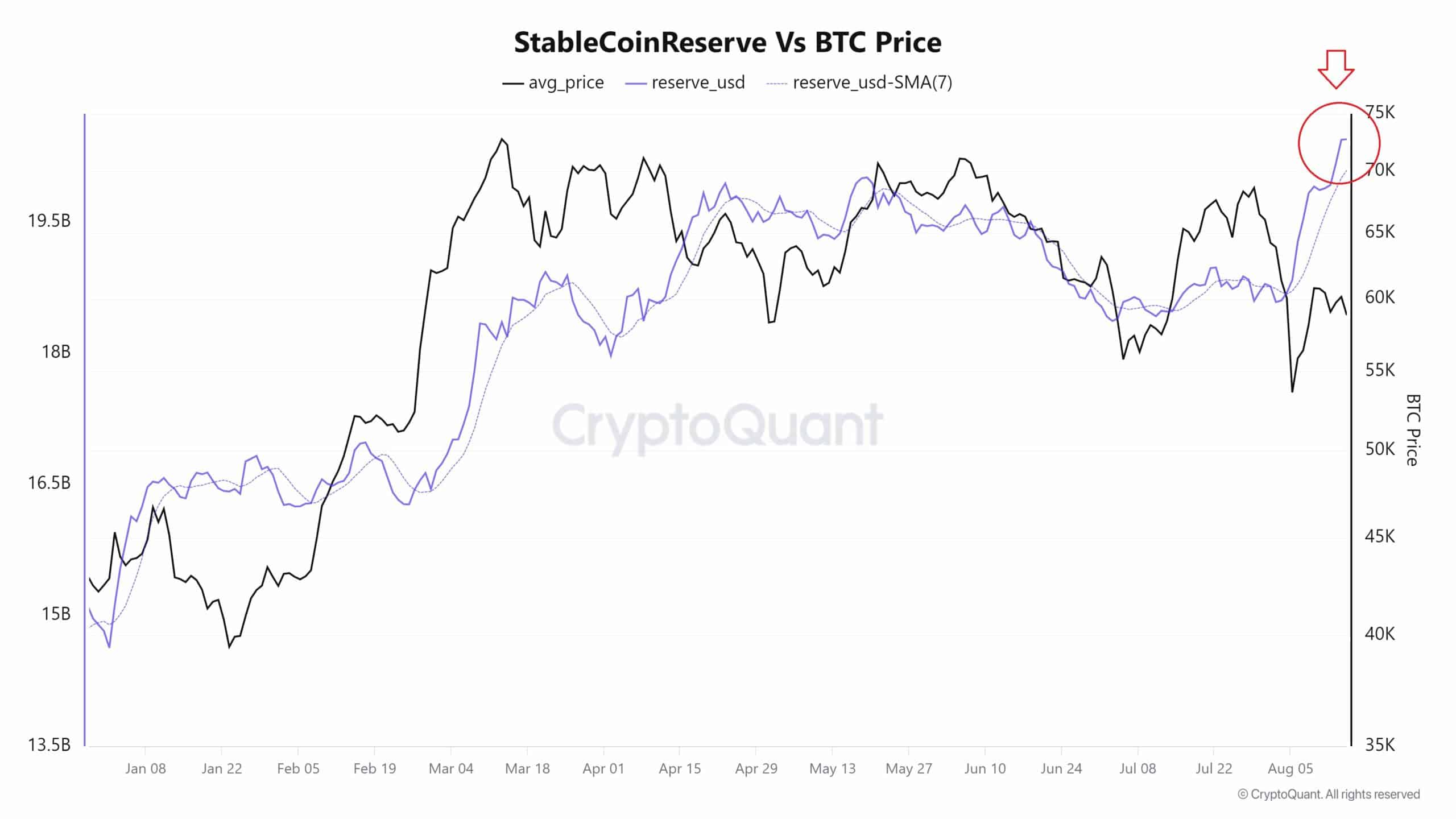

Stablecoins reserves’ affect on BTC worth

Stablecoin reserves on exchanges are at document excessive proper now, boosting Bitcoin’s shopping for energy considerably.

This surge is driving main establishments to quickly accumulate Bitcoin, as may be deduced from the broadening wedge sample on the 4-hour BTC/USDT chart.

Supply: CryptoQuant

Within the first quarter of 2024, 874 establishments held Bitcoin ETFs, with the identical growing to 1,008 by the second quarter.

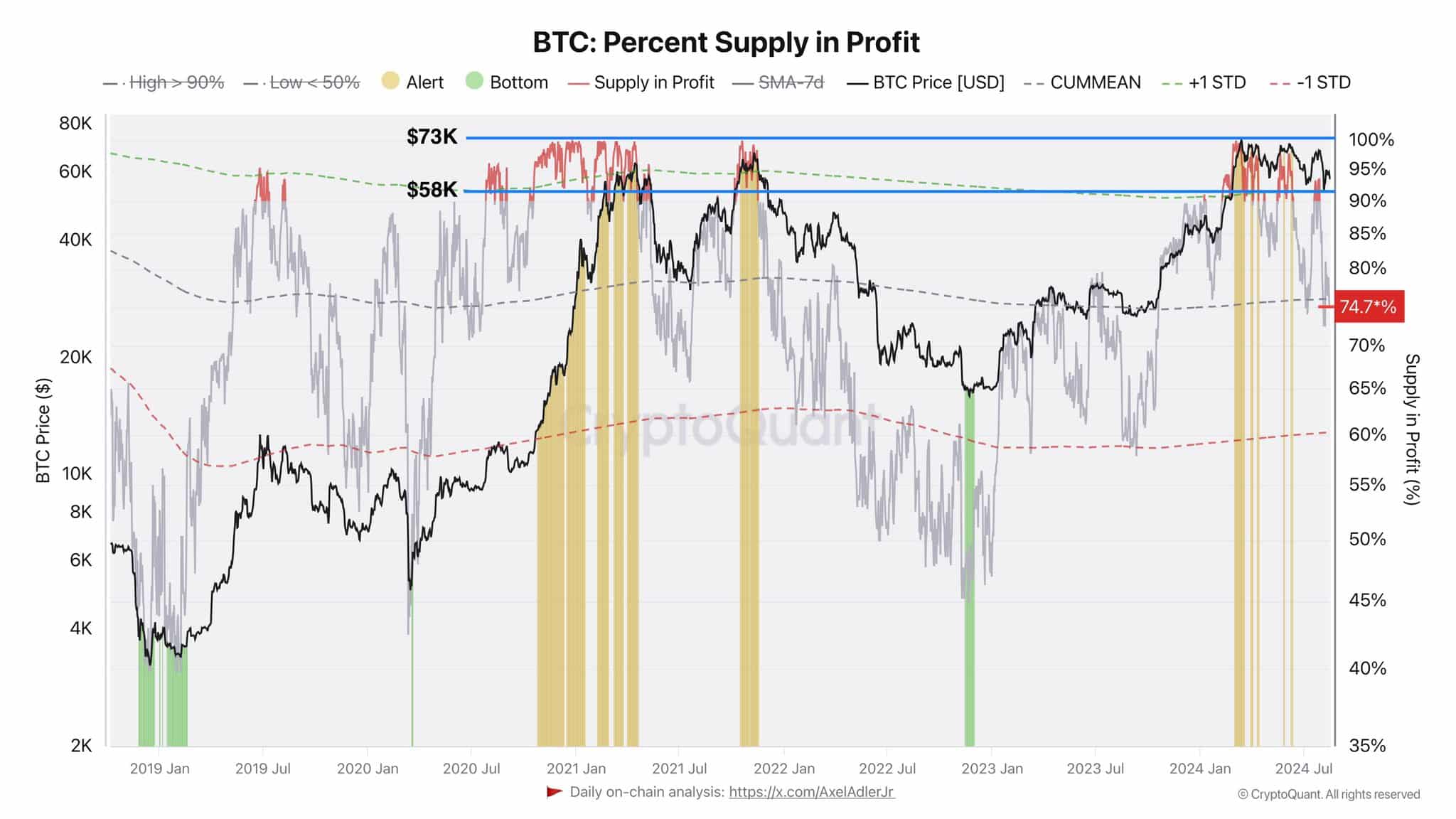

Actually, 1 / 4 of Bitcoin’s complete provide was purchased at $58K-73K, equal to about $300 billion. Traders who purchased on this vary are doubtless holding for future positive aspects, suggesting that they anticipate Bitcoin’s worth to rise additional.

Regardless of Bitcoin’s gradual worth motion and low retail curiosity, institutional shopping for is accelerating although – One other signal of the crypto’s long-term progress.

Mixed with current developments in Bitcoin’s market, a optimistic long-term worth development may be traced.

Supply: CryptoQuant

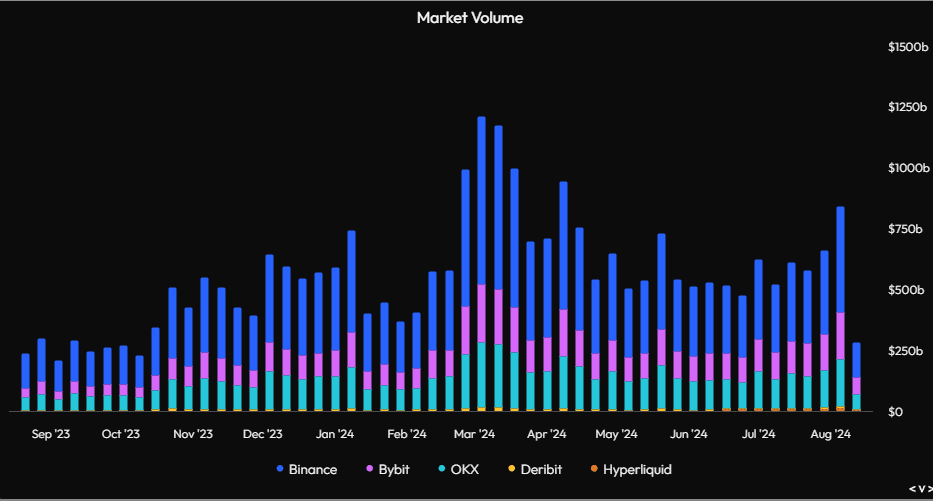

Market quantity will increase within the midst of low funding charges

Since peaking in March, market volumes have been declining for a protracted consolidation section too.

Simply final week, regardless of international market turmoil from the Japanese inventory market crash, the crypto markets noticed a big quantity hike on the charts.

Supply: Daan Crypto Trades on X

This has led to heightened volatility in Bitcoin and different cryptocurrencies.

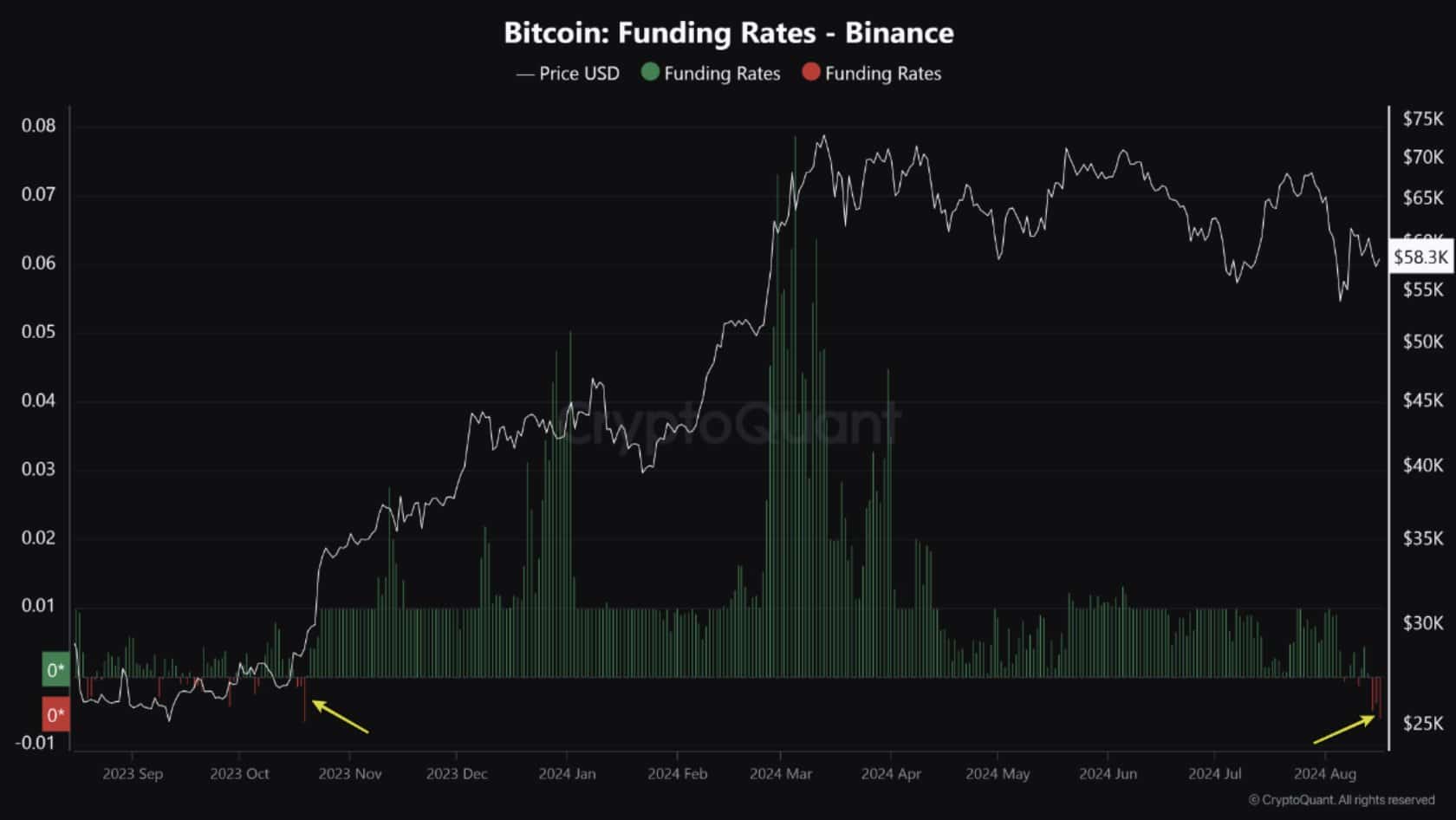

Lastly, Bitcoin funding charges on Binance have hit their lowest level of the 12 months too. The extra shorts are loaded, the upper BTC will go.

Supply: CryptoQuant

With Binance holding the biggest share of Open Curiosity, some short-term bearish sentiment could also be evident too. Nevertheless, this would current a possible shopping for alternative for long-term buyers and merchants to build up extra Bitcoin.