- Giant holders gathered 84,000 Bitcoins value over $5 Billion in July.

- BTC’s 2nd highest buying and selling quantity as Bitcoin ETFs inflows surge.

Bitcoin [BTC] whales gathered 84,000 bitcoins, totaling $5 billion in July, marking the very best month-to-month enhance since 2014. Such important shopping for usually signifies a serious market shift.

This unprecedented exercise means that Bitcoin is likely to be on the verge of a considerable transfer. Traditionally, massive accumulation by whales has usually preceded main market modifications. It’s a vital time for traders to remain alert.

Supply: Ash Crypto on X

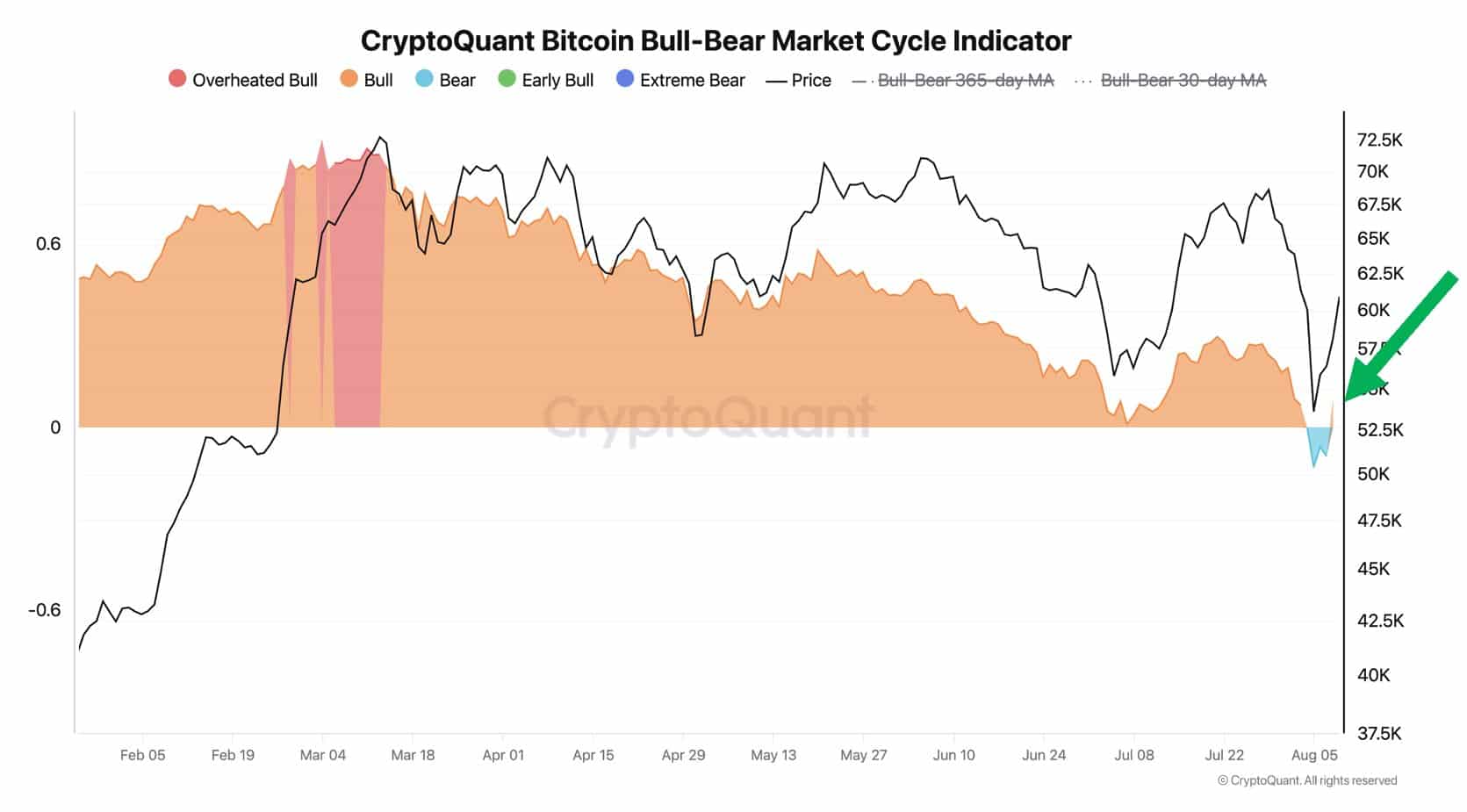

Bitcoin on-chain cyclical indicators sign a bull market

Moreover, most Bitcoin indicators together with the bull-bear market cycle indicator, that had been near signaling a downturn have now returned to displaying a bull market.

Bitcoin’s value was discounted briefly for simply three days. Given this information, the bull market appears stable. The market is ready to bounce again in two weeks.

Supply: CryptoQuant

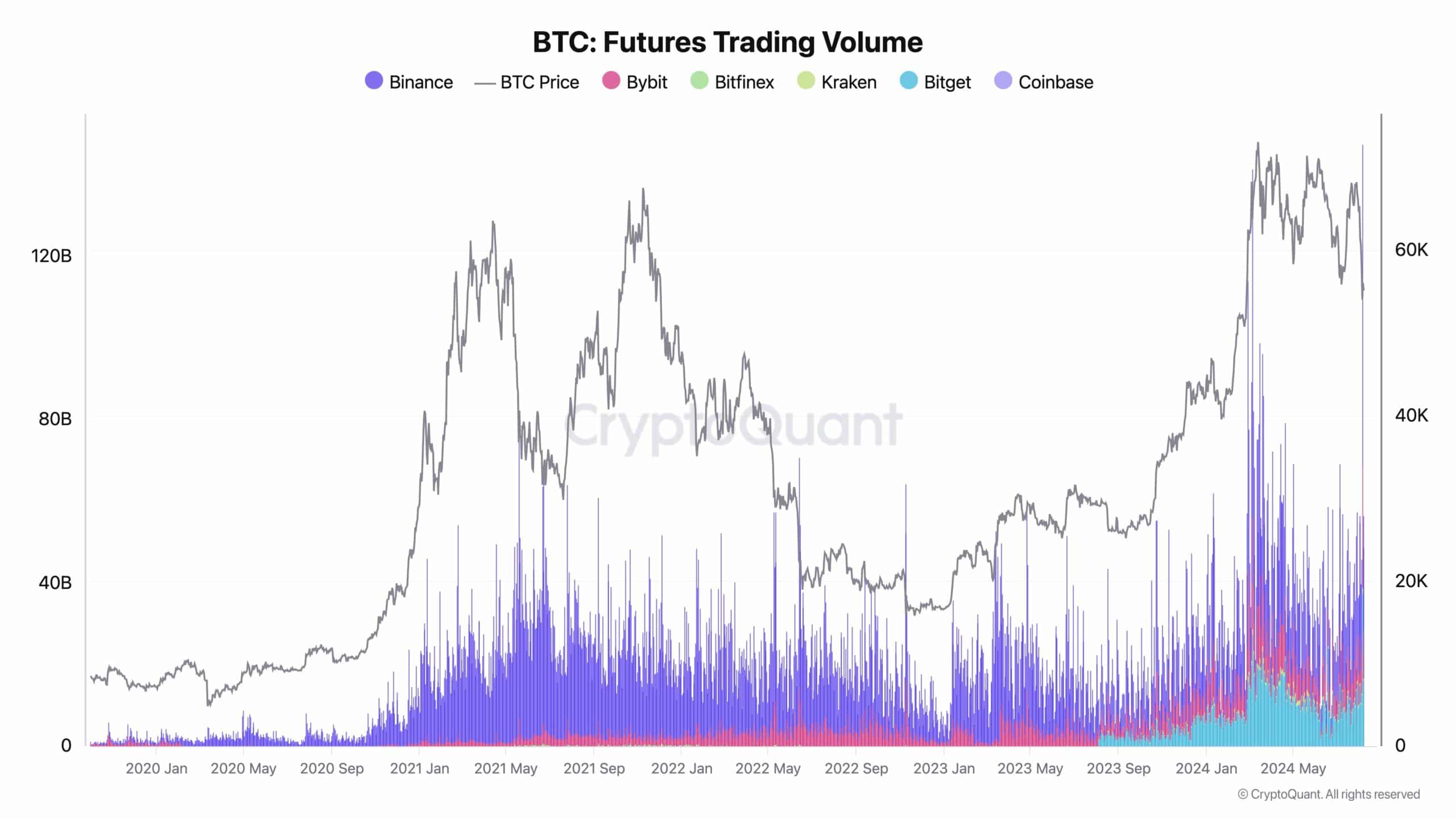

BTC futures and spot buying and selling quantity hits ATH

When Bitcoin fell to $50K, futures buying and selling quantity soared to a document $154 billion and spot buying and selling quantity reached $83 billion, the second-highest ever including extra confluence.

This dramatic drop was adopted by a robust restoration, with Bitcoin’s value rising by over 23% from its weekly low.

Supply: CryptoQuant

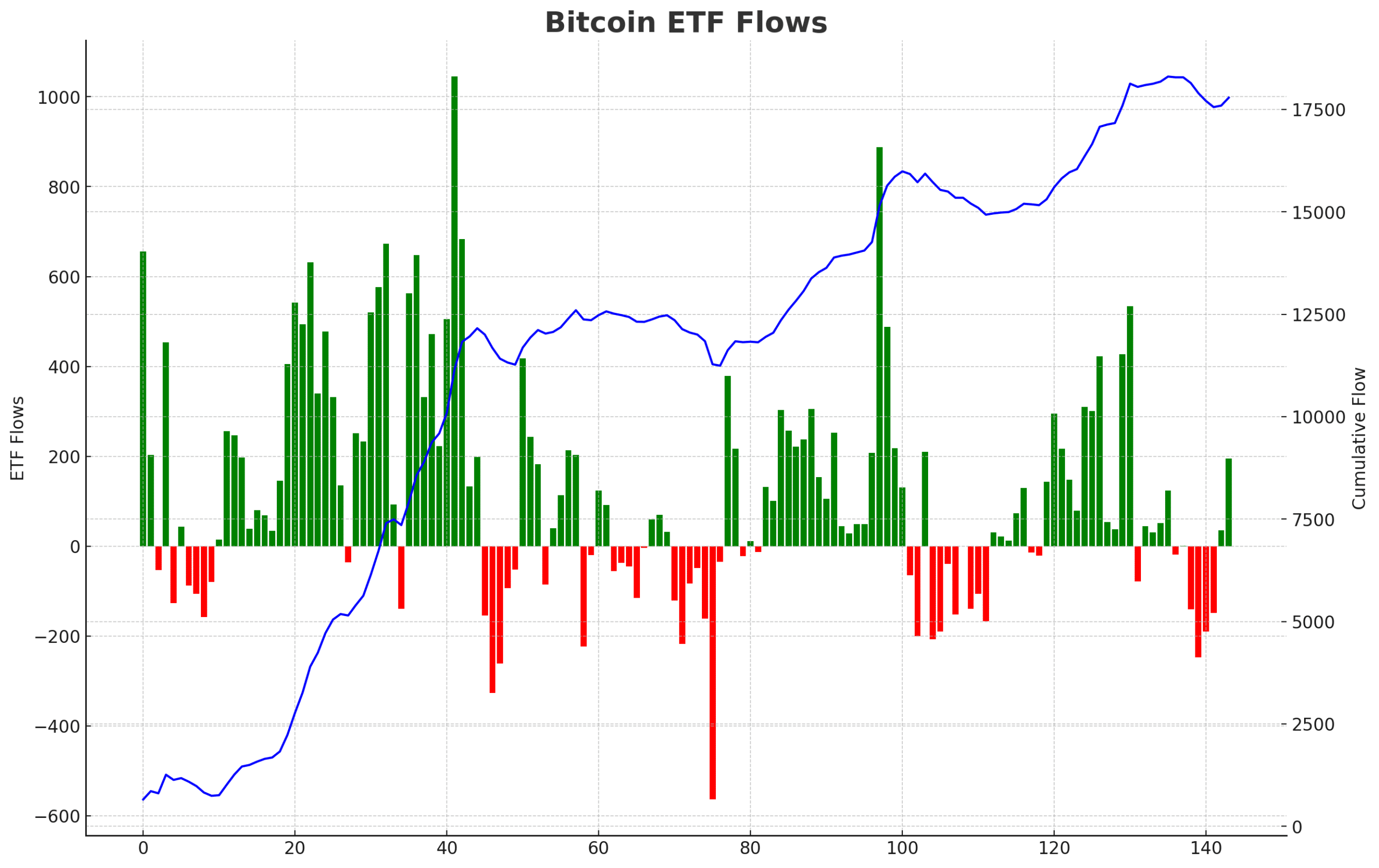

ETF inflows surge

Regardless of Bitcoin’s fluctuations, BlackRock’s Bitcoin ETF has solely skilled sooner or later of outflows since its January launch, with over $20 billion locked.

Just lately, BTC ETFs noticed $194 million in inflows after 5 days of outflows. Notably, each time BTC drops close to $50K, ETF inflows surge considerably.

This sample has repeated, with giant inflows occurring every time BTC dips to the decrease $50,000s. This development means that main traders are shopping for the dip.

Supply: Bitcoin Archive on X

Bitcoin sell-side liquidity grabbed

Bitcoin has additionally proven an attention-grabbing sample across the fifth of the month. In each July and August, it dropped sharply for 5 days initially of the month however then skilled important rallies.

Whereas this is likely to be a coincidence, it’s notable that BTC has possible absorbed sell-side liquidity, which might sign a possible rally. Analysts usually view the $70K peak as a short-term excessive.