- Buying and selling quantity of BTC ETFs hits $5.7 billion.

- BTC and ETH recovers from market downturn.

Over the past 30 days, Cryptocurrency markets have skilled excessive volatility. The final two days have seen crypto markets crash and get better, with BTC hitting under $49k as altcoins additionally declined concurrently.

Nevertheless, whereas the crypto markets crashed, the BTC spot ETF buying and selling quantity doubled.

BTC ETF buying and selling quantity hits $5.7 billion

Supply: Coinglass

Amidst the market crash, buying and selling quantity for Bitcoin ETFs has surged to over $5.7 billion. Based on the report, the current surge arose after 48 hours of heightened crypto market volatility.

Knowledge from Coinglass confirmed that ETF outflows have decreased and remained regular for the final 48 hours, hitting a average degree of $84.1 million.

Equally, Coinglass confirmed that the online property stay at $48 billion. The information exhibits a constructive market response to ETFs as crypto tokens proceed to indicate uncertainty.

BTC and ETH ETFs rebound after excessive outflows

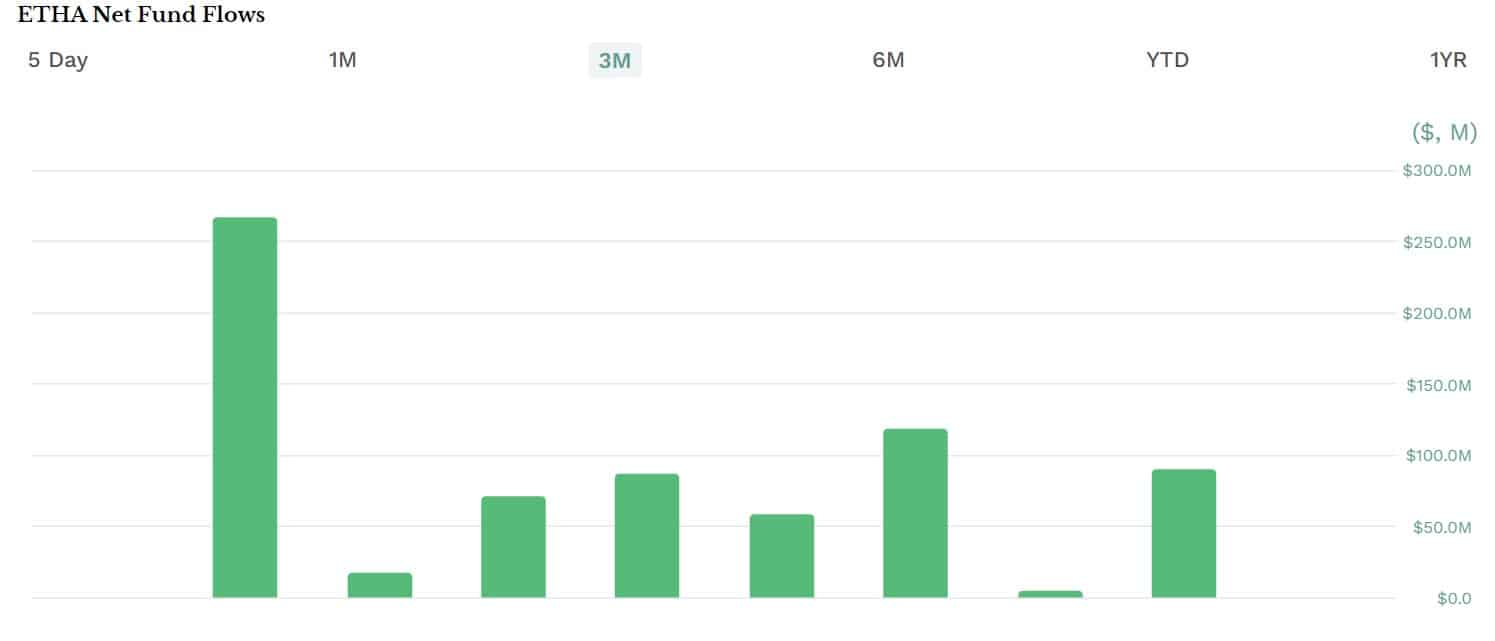

Because the launch of Ethereum ETFs final month, they’ve reported excessive outflow, which has affected ETH costs.

ETH ETFs have recorded excessive outflows for the previous few weeks, hitting over $2 billion. ETHE reached $2.1 Billion in outflows, inflicting issues over ETH ETF’s capacity to compete with Bitcoin ETFs.

Supply: ETHA

Equally, Bitcoin ETF Outflows had hit a document excessive for the previous 6 months. On fifth, because the market crashed, BTC ETFs outflow hit $168.4 million, with Grayscale BTC Belief ETFs and ARK 2iShares BTC ETFs main in outflows.

Nevertheless, within the final 24 hrs, BTC ETFs have hit a document excessive, with buying and selling quantity surpassing $1.3b within the first minutes of enterprise on sixth July.

With the surge, iShares Bitcoin Belief made the best in buying and selling exercise, surpassing $1.27 billion.

Supply: Blockworks

Impacts on BTC and ETH?

ETH and BTC’s market costs have notably recovered after hitting low months. Bitcoin hit a two-month low after falling under $50k, whereas Ethereum recorded a low of $2116.

The decline resulted from elevated gross sales of $1.2 billion in crypto liquidation following a ripple impact from the crash in world shares.

Supply: Tradingview

Regardless of the decline, BTC costs have been recorded, and knowledge exhibits that ETF holders held their positions through the market downturn. BTC is buying and selling at $56888 after a 1.97% improve in 24 hrs and a substantial restoration from a low of $49577.

Subsequently, with ETF holders holding positions, BTC ETF buying and selling quantity soared to $5.2 billion, even outpacing January buying and selling quantity after the launch.

Equally, Ethereum ETFs which have recorded large outflows previously have recorded an influx of over $49 million.

Thus, the elevated ETF buying and selling quantity and inflows have performed a significant position in driving BTC and ETH costs up after recording 2-month lows.

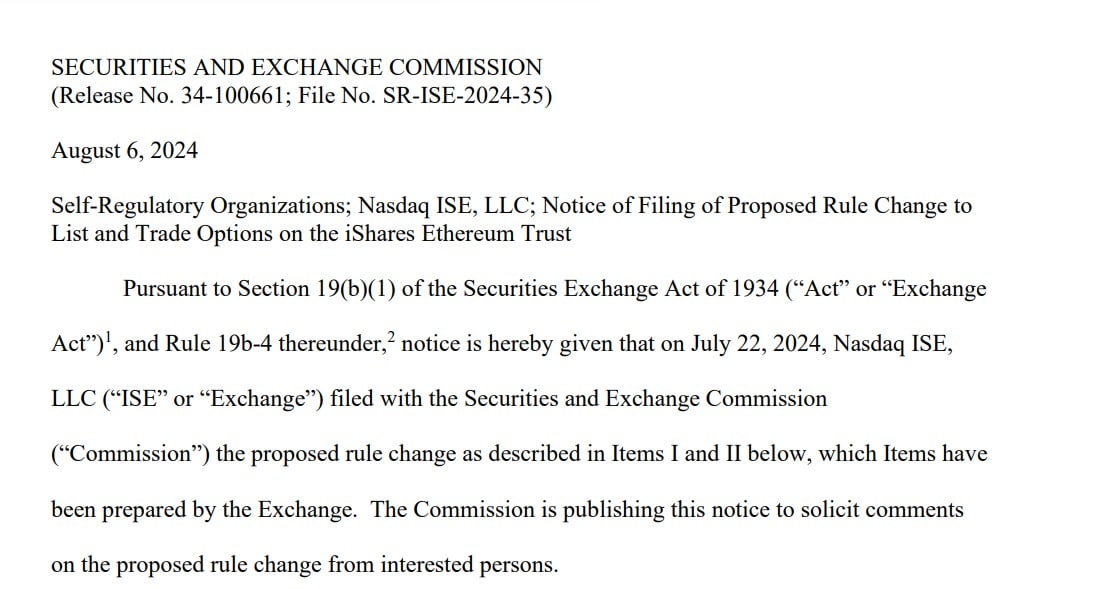

BlackRock, Nasdaq File for spot Ethereum ETF

One other increase to Ethereum ETFs amidst elevated market uncertainty is the current transfer by Blackrock and Nasdaq.

Based on stories, the 2 companies have determined so as to add choices to Ethereum ETFs to ETHA (iShares Ethereum Belief). The SEC submitting by Nasdaq and Blackrock proposed a rule change to permit choices buying and selling of the iShares Ethereum Belief (ETHA).

The submitting said that,

“The Exchange believes that offering options on the Trust will benefit investors by providing them with an additional, relatively lower-cost investing tool to gain exposure to spot ether as well as a hedging vehicle to meet their investment needs in connection with ether products and positions.”

Supply: SEC

The filling comes almost three weeks after the launch of Ethereum ETFs. Whereas Ethereum ETFs have skilled excessive uncertainty, the markets assume it’s a hit and require additions for buying and selling choices.