- Bitcoin plunges under $53K, sparking a broad crypto market downturn.

- Crypto market turmoil extends to shares, with notable reactions from former President Trump.

After approaching the $70K mark, Bitcoin [BTC] has just lately plunged under $53K. Based on CoinMarketCap, BTC was buying and selling at $52,591, reflecting a drastic 13.42% drop in simply 24 hours.

This sharp decline triggered a widespread crypto massacre, with many altcoins experiencing important losses.

Crypto massacre

Ethereum [ETH] fell by over 20%, and Solana [SOL] dropped greater than 16%, amongst different substantial declines throughout the market.

Regardless of the current dip in Bitcoin’s worth, the crypto group has remained resilient. Jameson Lopp, Co-founder and Chief Safety Officer at CasaHODL, highlighted this sentiment by stating,

“If you’re sad from looking at charts, just switch to the Bitcoin dominance chart.”

Echoing this attitude, Samson Mow, CEO of JAN3, an organization centered on Bitcoin adoption, underscored the constructive outlook for the main cryptocurrency, and acknowledged,

“If you’re worried about the collapse of the financial system, you want #Bitcoin. If you’re worried about war, you want #Bitcoin. If you’re worried about the future in any way, you want #Bitcoin.”

He additional emphasised the chance for traders not presently shopping for BTC, and added,

“If you don’t want #Bitcoin, then you either don’t understand Bitcoin or what is about to happen.”

Bitcoin falls additional

Regardless of the constructive sentiment surrounding Bitcoin, the cryptocurrency on the time of writing fell additional under $49K. Commenting on this, Jason A. Williams, co-founder of Morgan Creek {Digital}, stated,

“If you get more excited to buy Bitcoin the further it goes down, like and retweet this post.”

Additional fueling criticism, Frank Chaparro, Host of The Scoop podcast and Director of Particular Tasks, added,

“Bitcoin can go to $20k before I feel anything.”

Notably, the turbulence didn’t simply impression the crypto market; it additionally prolonged to the inventory market, which confronted a big downturn.

However, what shocked the group was former President Donald Trump‘s current assertion on Fact Social, the place he commented,

Supply: Fact Social

On-chain metrics paint a unique image

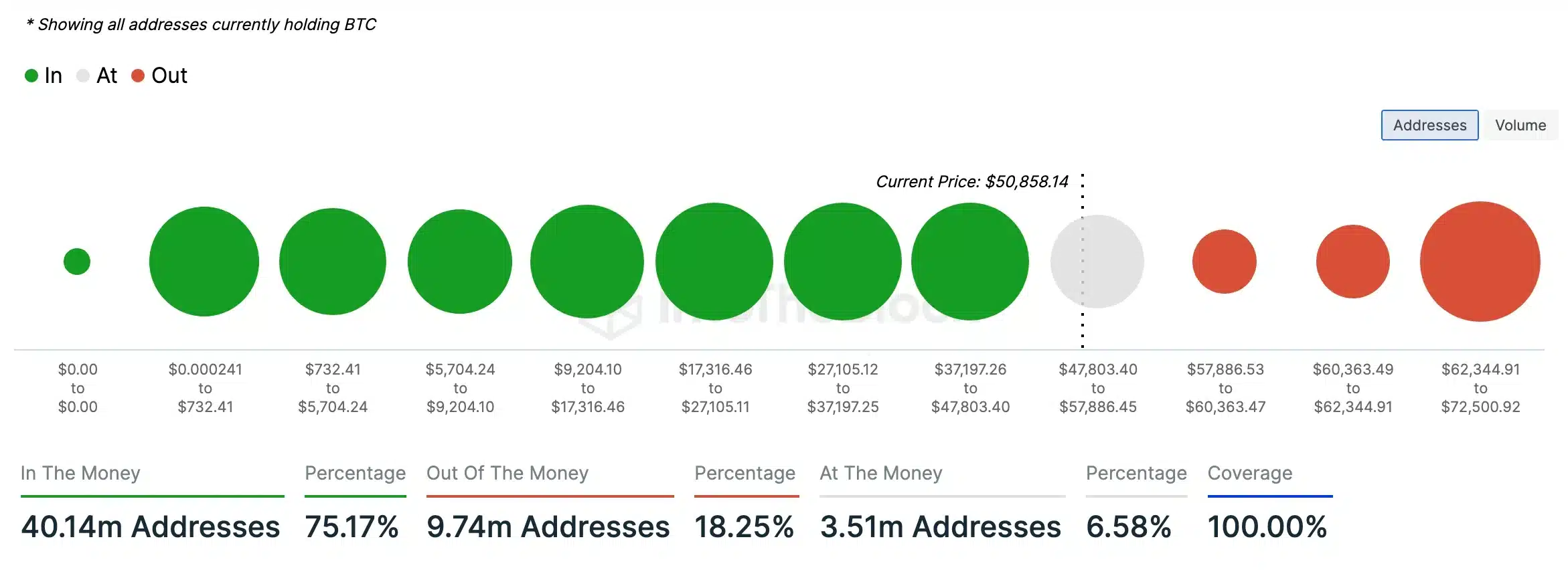

To know the true essence of market dynamic, AMBCrypto analyzed the IntoTheBlock knowledge and revealed {that a} important majority (75.17%) of BTC holders held tokens valued larger than their buy value at press time, indicating that they have been “in the money.”

In distinction, a smaller section (18.25%) held BTC tokens that have been value lower than their buy value, inserting them “out of the money.” This instructed a bullish sentiment or potential upcoming value surge for Bitcoin.

Supply: IntoTheBlock

That being stated, eToro market analyst Josh Gilbert talking with a publication put it greatest when he stated,

“When you invest in crypto assets, you’re stepping into the ring of volatility. This is a small jab for crypto, not even a black eye. We’ve got more rounds left of this bull market before the bell rings.”