- Bitcoin has dropped over 25% within the final 4 days.

- The liquidation quantity rose to the very best since April.

Within the final 24 hours, Bitcoin [BTC] has skilled a major decline, dropping beneath the $60,000 value vary. Given the present pattern and the market’s volatility, might we see an additional drop to the $40,000 value vary?

Bitcoin drops 9% in 24 hours

AMBCrypto’s evaluation of Bitcoin’s value pattern highlighted a major downturn over the past 24 hours, with a drop of over 9%.

Bitcoin was buying and selling at roughly $52,900, with its decline hovering between 8% and 9% inside this era.

Utilizing the value vary instrument, it was evident that for the reason that onset of the most important decline round August 2nd, Bitcoin has skilled a considerable lower in worth, amounting to over 24%.

Bitcoin to $49,000

Utilizing the Fibonacci retracement indicator to research Bitcoin’s value pattern provided helpful insights into potential future actions.

Notably, if BTC’s value managed to carry above the 23.6% retracement stage, it might ascend to check larger Fibonacci ranges.

The chart confirmed it might particularly take a look at the 38.2% stage at roughly $56,847.56 and even the 50% stage at about $59,127.13.

Conversely, if the downward pattern persists, the subsequent important help, based on the Fibonacci retracement evaluation, can be on the 0% stage, round $49,467.88.

Moreover, the Relative Power Index (RSI) evaluation confirmed it was in oversold territory. Usually, this might point out an imminent value reversal or bounce, as patrons would possibly take into account it an optimum level to enter the market.

Nevertheless, it’s essential to notice that in robust downtrends, the RSI can stay within the oversold zone for prolonged intervals.

Supply: TradingView

Moreover, the Transferring Common Convergence Divergence (MACD), one other momentum indicator, reveals bearish momentum.

This implies that the downtrend would possibly lengthen within the brief time period, particularly provided that the value is already beneath the 23.6% Fibonacci stage.

Contemplating these components—the bearish MACD, the oversold RSI, and Bitcoin’s positioning relative to key Fibonacci ranges—the short-term outlook for Bitcoin seems to be bearish.

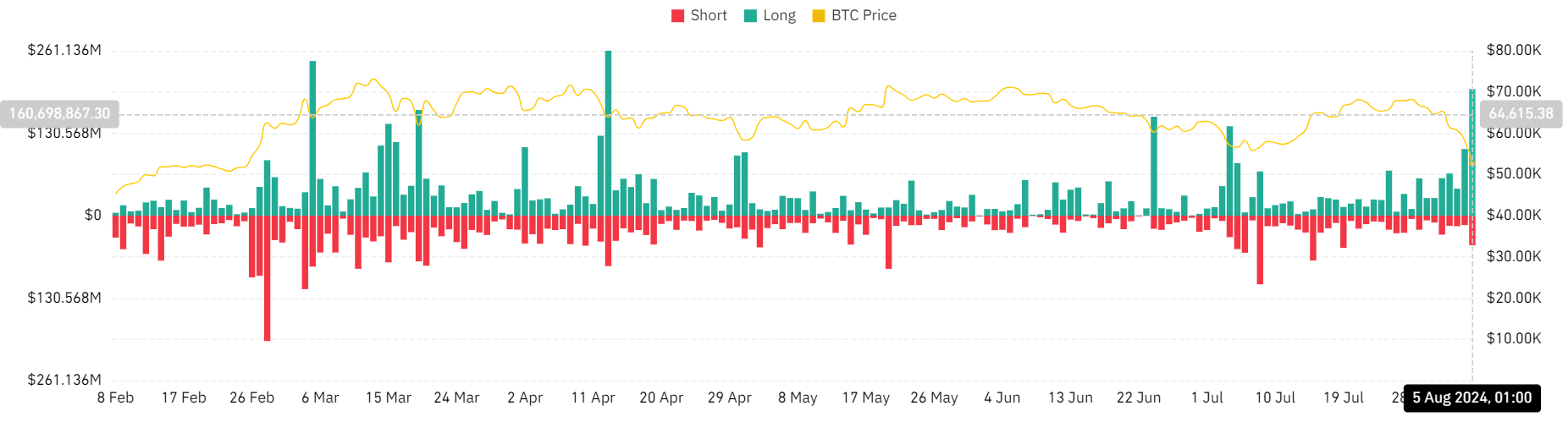

Liquidation hits highest level in months

The evaluation of Bitcoin’s liquidation quantity on Coinglass indicated a major spike, marking its highest level since April.

On the shut of buying and selling on the 4th of August, the full BTC liquidation quantity reached over $246 million.

A better examination of those figures revealed that the majority liquidations had been lengthy positions, totaling over $200 million. Compared, brief liquidations accounted for greater than $46 million.

Supply: Coinglass

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

This substantial improve in liquidation quantity, notably in lengthy positions, was a response to the sharp value motion that caught many merchants off guard.

This possible triggered stop-loss orders or liquidating leveraged positions. The prevalence of lengthy liquidations signifies that many merchants had been optimistic or bullish on BTC’s value, anticipating upward actions that didn’t materialize as anticipated.