- Bitcoin mining issue reaches ATH.

- Bitcoin whales purchased over 84,000 BTC in July.

Bitcoin [BTC] has been failing to make new highs however crypto traders are nonetheless bullish on BTC long-term.

VanEck CEO has predicted Bitcoin will attain half the market cap of gold, exceeding the $350,000 value level. Individually, Morgan Stanley advisors will pitch BTC ETFs by BlackRock and Constancy beginning seventh August.

These, mixed with Trump’s Bitcoin debt concept, alerts a strong future for crypto. Nonetheless, the asset could possibly be about to face a possible downtrend.

Bitcoin mining issue hits new excessive

It was reported that Bitcoin mining issue and US cash provide have hit new all-time highs necessitating extra computational energy, probably affecting profitability.

That is probably due to the elevated actions on the Bitcoin blockchain. With $900 trillion of worldwide wealth and BTC’s market cap at $1.25 trillion, it is a important allocation.

Supply: BitcoinMagazine PRO

A latest $3 trillion loss in shares as a consequence of recession fears highlights Bitcoin’s resilience. Whereas conventional belongings plummet, BTC stays a focus.

Many traders underestimate cryptocurrency’s potential, making now an opportune time to think about BTC in a diversified portfolio for the long-term positive aspects.

Bitcoin whales anticipate rally as BTC funding will increase

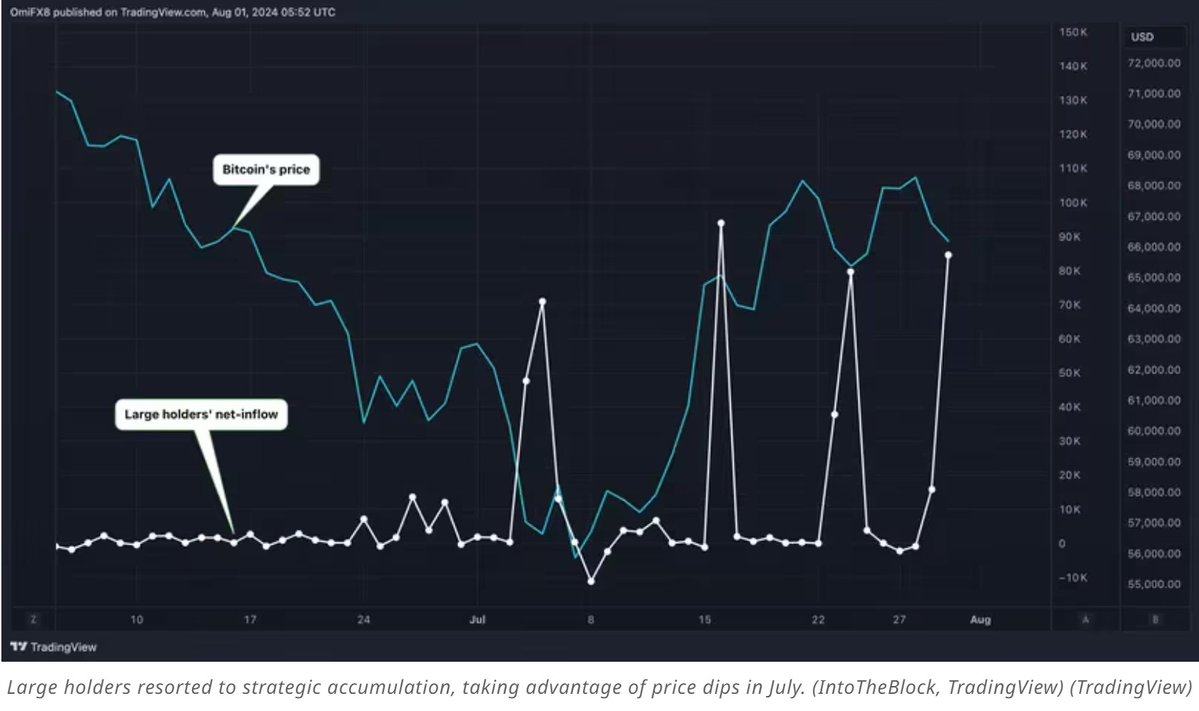

In July, Bitcoin whales purchased over 84,000 BTC, the most important buy since October 2014, amounting to $5.4 billion.

Whereas many traders had been offloading their holdings, these massive holders, proudly owning a minimum of 0.1% of complete Bitcoin’s provide, had been accumulating in keeping with IntoTheBlock.

This important improve highlights the strategic strikes of whales throughout market fluctuations, reinforcing their affect and confidence in Bitcoin’s long-term potential.

Supply: TradingView

BTC potential downtrend

A take a look at Bitcoin’s MACD exhibits a decrease excessive in 2024 in comparison with 2021, trending decrease and pushing down swiftly whereas value is buying and selling increased however in a possible reversal zone.

This divergence suggests a possible bearish development is about to start with a affirmation from value motion that’s making successive equal highs.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Bitcoin’s new ATH in 2024 could have resulted from financial inflation somewhat than true worth development.

The MACD’s bearish development is a sign for the short-term merchants that BTC could quickly change path concentrating on the crucial help vary of $28k – $37k.

Supply: TradingView