- Bitcoin noticed additional promote strain on Friday as financial knowledge hammered down on market sentiment

- BTC would possibly regain some momentum as the worth dips into a possible purchase zone

Bitcoin bears dominated on Friday, sending the market crashing by virtually 6%. The highest cryptocurrency has been on a downtrend for some time now, with a number of financial experiences affecting its efficiency over the previous few weeks.

Bitcoin’s bearish outburst on Friday was in response to weak unemployment knowledge. The numbers got here in increased than anticipated, with the general unemployment charge in the US rising to 4.3%. Consequently, the information triggered recession fears, resulting in a bearish investor sentiment for BTC and the remainder of the market.

Is Bitcoin able to push again up?

Bitcoin has to this point dropped roughly 13% from its highest worth on Monday, courtesy of this latest bearish extension. Consequently, it entered an essential potential purchase zone, one which we highlighted beforehand.

Our evaluation positioned the following potential purchase zone between $61,870 and $59,917. This was primarily based on Fibonacci retracement from its July lows to its highest latest ranges.

Supply: TradingView

On the time of writing, BTC was valued at $61,727, indicating a surge in shopping for strain at latest discounted ranges. This was throughout the aforementioned Fibonacci retracement zone too.

This may also be interpreted as a sign that the promote strain has slowed down. Therefore, the query – Will or not it’s sufficient to maintain a sizeable uptrend now?

Bitcoin whales on the transfer

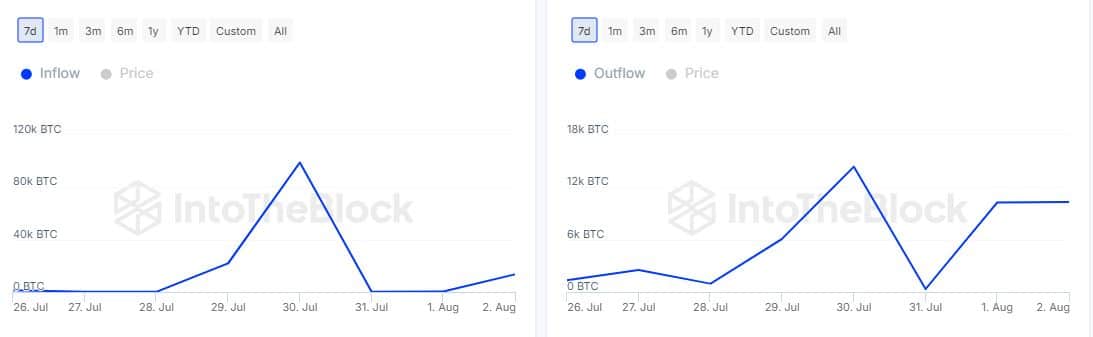

BTC’s possession stats revealed that whales have been actively shifting funds out and in of their wallets. Whale inflows peaked at 99,000 BTC on 30 July. Inflows additionally confirmed optimistic development from 391.8 BTC on 1 August to 13,490 BTC throughout yesterday’s session.

This can be an indication that whales amassed a big quantity of Bitcoin throughout the board.

Supply: IntoTheBlock

Quite the opposite, whale outflows peaked at 14,370 BTC on 30 July, earlier than dropping to 340 BTC the following day. Outflows peaked at 10,330 BTC extra lately on 2 August. The overall quantity of inflows in whale addresses had been increased than outflows – Signaling that whales have been accumulating.

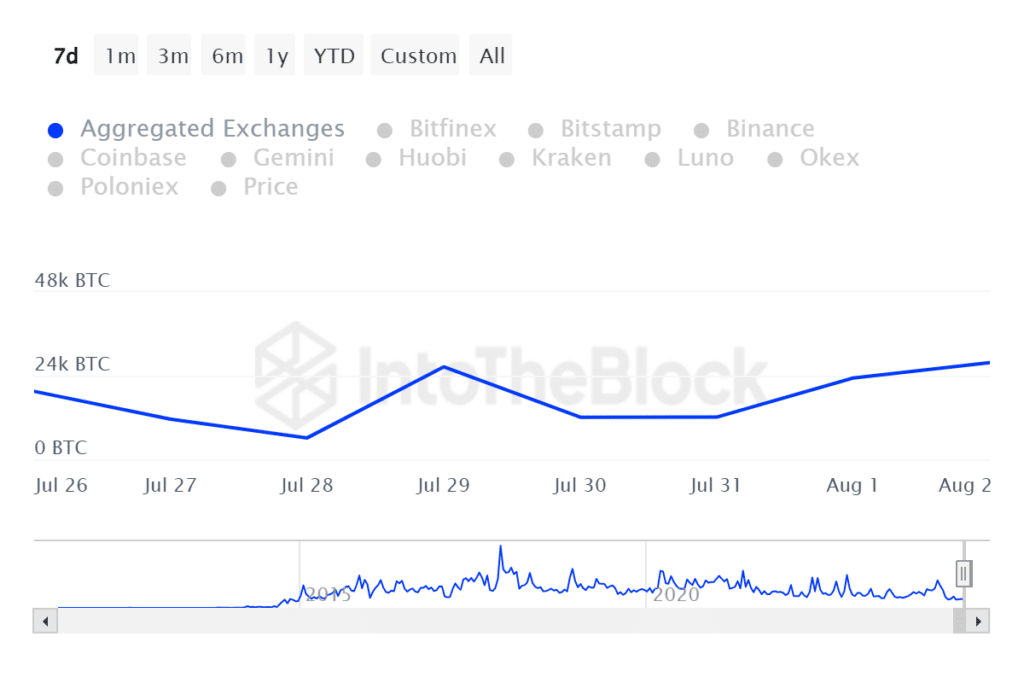

We additionally explored the quantity of Bitcoin flowing out and in of exchanges to find out the extent of purchase or promote strain.

The info revealed that Bitcoin’s aggregated trade outflows peaked at 27,730 BTC throughout yesterday’s buying and selling session.

Supply: IntoTheBlock

Compared, Bitcoin had 16,850 BTC in outflows throughout the identical buying and selling session. This implies there was a web outflow of 10,880 BTC. This equates to over $671 million price of shopping for strain.

Ergo, the quantity of BTC flowing out of exchanges throughout Friday’s buying and selling session appeared to verify that merchants, together with whales, have been accumulating. This might set the tempo for some restoration into the brand new week, until promote strain intensifies.