- Willy Woo predicted that Bitcoin might attain a minimal of $700,000 based mostly on conservative wealth allocation.

- He dismissed the $24 million mark as unrealistic, requiring whole international wealth funding into Bitcoin.

Bitcoin [BTC] has been on a bearish trip ever since its peak above $73,000 again in March.

At press time, the asset traded at a worth of $64,020—marking a 13.2% from its March all-time excessive (ATH) and roughly 4.4% prior to now week.

No matter this bearishness, Willy Woo, a distinguished analyst within the crypto house, has lately shared his insights on BTC’s potential future valuation.

Expectations and market dynamics

Woo posited that the minimal potential valuation for Bitcoin may very well be round $700,000, whereas the utmost would possibly soar as excessive as $24 million per BTC.

Nonetheless, he clarified that reaching the higher estimate would require an implausible situation the place all international wealth—amounting to roughly $500 trillion—is invested in Bitcoin.

This situation, he famous, is extremely unlikely, stating {that a} $24 million valuation per Bitcoin is “never gonna happen.”

Persevering with his evaluation, Woo touched upon reasonable expectations for institutional buyers’ involvement in Bitcoin.

He referenced Constancy’s suggestion for portfolios to incorporate 1-3% in Bitcoin, contrasting it with BlackRock’s a lot greater funding of 85% in some instances.

Woo leaned in the direction of a 3% allocation as a extra smart determine, which might nonetheless drive Bitcoin’s worth to the $700,000 mark if broadly adopted.

Additional elaborating on his predictions, Woo mentioned the adoption S-curve, noting that Bitcoin’s international adoption was 4.7% at press time.

He predicted that as adoption will increase to between 16% and 50%, Bitcoin’s worth might escalate to the degrees he outlined, pushed by growing mainstream acceptance and funding.

Bitcoin present market stance

Nonetheless, the present market tells a special story.

Latest fluctuations have seen a major variety of dealer liquidations, with Bitcoin accounting for about $72.99 million of the whole $255.67 million in liquidations within the final 24 hours, per Coinglass information.

Nearly all of these have been lengthy positions, suggesting a tumultuous interval for buyers betting on speedy positive aspects.

Supply: Coinglass

Crypto analyst RektCapital weighed in on the latest market dip, suggesting that the present retrace is likely to be shorter than earlier ones. He defined,

“The initial retrace inside the pattern took 5 weeks to bottom. The one after that took 4 weeks. This current one could take only 2–3 weeks to bottom.”

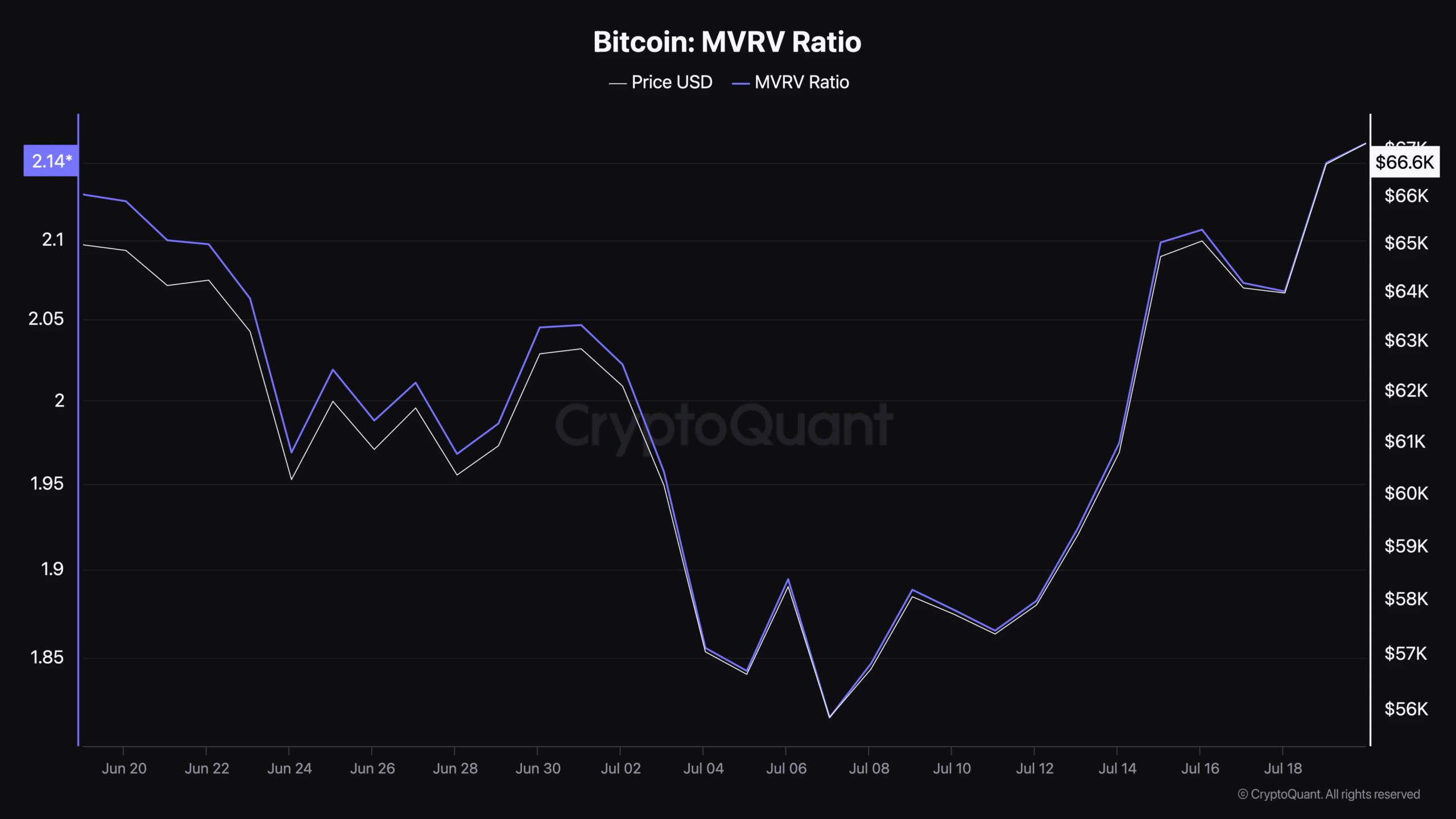

Including to the dialogue, information from CryptoQuant confirmed that Bitcoin’s Market Worth to Realized Worth (MVRV) ratio— used to evaluate revenue or loss by evaluating market worth in opposition to realized worth—was 2.1 at press time.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Value Prediction 2024-25

An MVRV ratio better than 1 prompt that Bitcoin was overvalued in comparison with its realized worth, hinting that buyers are holding cash at a revenue, which might affect their promoting choices and have an effect on market stability.

Including to this outlook, AMBcrypto has lately highlighted in a report that promote strain for BTC mounts.