- MicroStrategy to launch Q2 earnings report.

- Preview reveals uncertainty and decline in internet revenue.

Over the previous 4 years, MicroStrategy has been actively accumulating to extend it holdings and subsequent inventory worth.

Over the previous, MicroStrategy has made Bitcoin [BTC] purchases each month besides in July, 2024 and September, 2020. This accumulation has pushed the corporate to turn into the biggest company BTC holder on the planet.

After BTC skilled an especially unstable few months, MicroStrategy is anticipated to report its earnings on 1st August 2024 for Q2. With the awaited Q2 earnings report, there’s heightened hypothesis over the true monetary standing of MicroStrategy and its future.

MicroStrategy is all about Macrostrategy

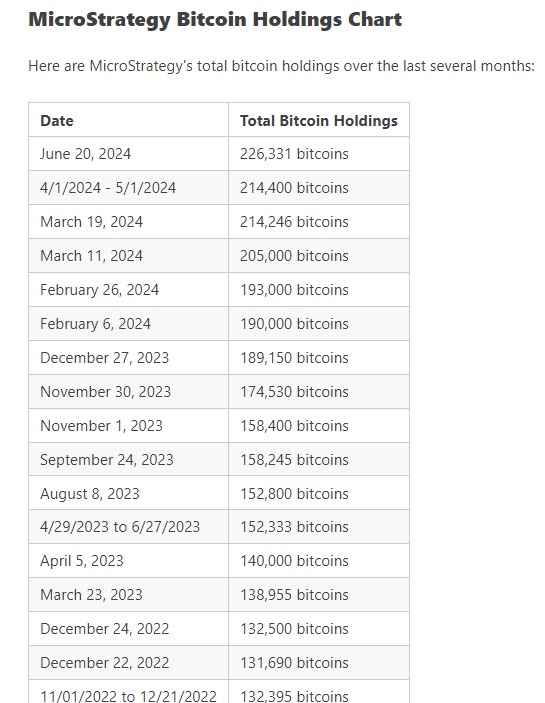

The quantity of Bitcoin it holds makes MSTR a invaluable and engaging firm for buyers. In all its operations, MSTR has acquired 226,331 BTC tokens collected over the previous 4 years.

This BTC holding makes a compelling case for MSTR to drive its market cap to $28.65 billion, a big rise from $9 billion a 12 months in the past.

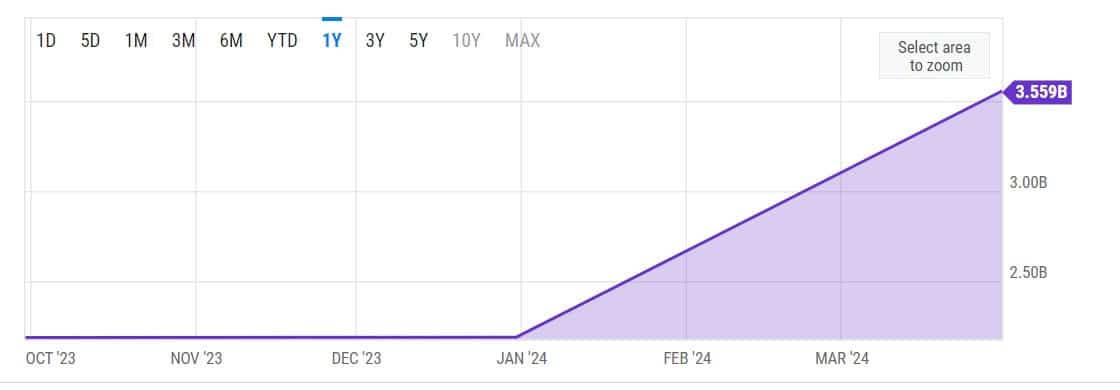

Supply: Y Charts

Nonetheless, MicroStrategy accumulates its holdings by way of long-term, low curiosity and share insurance coverage. Based on the Q1 2024 incomes stories, the corporate has long-term liabilities of $3.5 billion.

The liabilities are a guess on BTC that earns worth in opposition to fiat that loses worth over time. Though buyers favor MSTR, particularly over the crypto method, its subsidiary Macrostrategy owns a lot of the BTC holdings.

Supply: Y Charts

Due to this fact, MicroStrategy purchases BTC however transfers a lot of the holdings to Macrostrategy. Based on a earlier report, Macrostrategy holds probably the most BTC with 175,721 BTC tokens, whereas MicroStrategy holds solely 38,679 BTC tokens.

This method provides buyers an phantasm that MicroStrategy holds most BTC whereas it doesn’t. This can be a enormous danger to collectors, particularly if the corporate goes bankrupt. Such might occur as a result of Macrostrategy is shielded from recourse if its mother or father agency, MicroStrategy, goes bankrupt.

This means that fairness holders solely have belongings held by the mother or father agency. In case of chapter, collectors can’t declare BTC held by Macrostrategy, though it holds most of MicroStrategy’s BTC holdings.

This reveals how little BTC is held by MicroStrategy, and within the occasion of liquidation, collectors would undergo huge losses.

Q2 earnings: What to anticipate

Supply: Bitcoin Treasuries

As of this writing, BTC was buying and selling at $64,462 after a 2.8% decline over the previous 24 hours. Thus, based mostly on information from bitcoin treasuries, MSR holds 226331 BTC, an funding of $8.37 billion at a median of $36,990.

Due to this fact, based mostly on the present charges, MSR funding has gained over $6 billion with over 70% in positive factors.

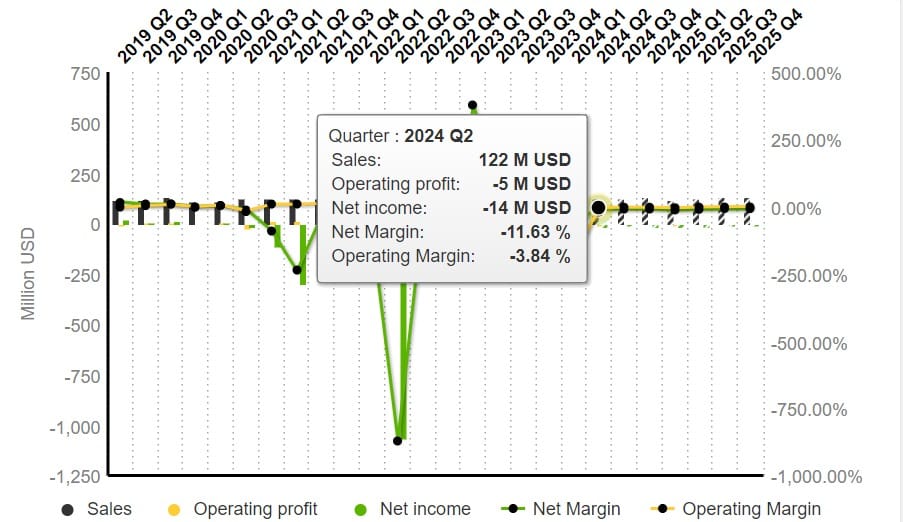

Supply: Market Screener

With these positive factors, the agency is anticipated to report a increased income this fiscal 12 months than the earlier 12 months with $122 million in opposition to $115 million.

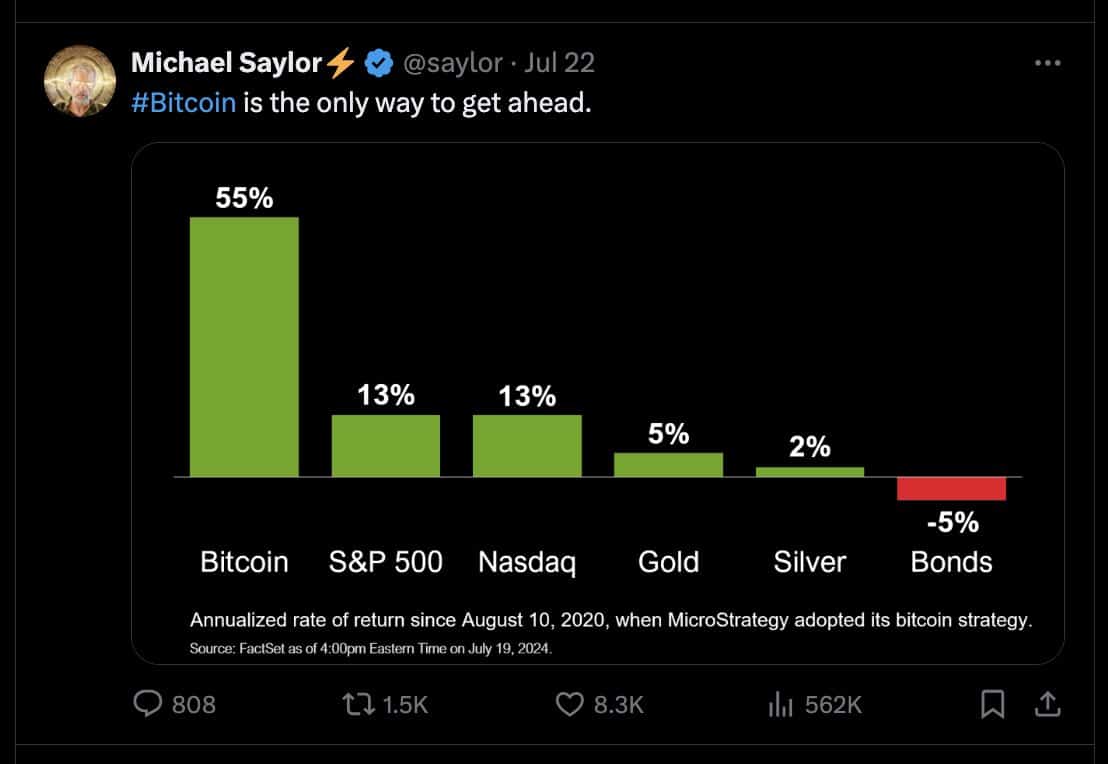

MicroStrategy’s case for BTC

Supply: X

Regardless of the prevailing considerations, MicroStrategy has massive expectations for BTC. Michael Saylor, the Chairman, predicts BTC will hit $13 million in 2045.

Based on the agency’s projection, the BTC market cap will surge to $273 trillion, surpassing Gold and all main firms. In such a state of affairs, Microstrategy’s portfolio would hit $3 trillion from $8 billion preliminary investments.

Supply: X