Picture supply: Getty Photographs

Whereas many individuals’s minds drift to sunny summer time enjoyable in August, the inventory market stays open for enterprise. Listed below are three FTSE 100 shares, every yielding at the very least 8%, that I’d contemplate shopping for for my portfolio subsequent month if I had spare money to take a position.

M&G

I already personal shares in asset supervisor M&G (LSE: MNG). However because the share worth continues to go nowhere quick – it has fallen 4% for the reason that begin of the 12 months – its yield stays enticing to me. At present it sits at 9.2%.

The share worth efficiency has lengthy been weak – certainly, M&G shares at present are 5% under the value at which the agency listed in 2019. However that has been greater than made up for by dividends throughout that interval. The corporate goals to develop or preserve its payout per share annually and up to now has delivered on that.

Over the previous couple of years, the enterprise has printed its interim ends in both August or September, so we should always have an replace pretty quickly on how the agency is performing. An ongoing threat is a weakening financial surroundings main purchasers to pulling out funds, hurting income.

So why would I contemplate including to my M&G holdings?

With its robust model, massive buyer base, and confirmed money technology capability, I see the earnings share because the type of funding I’m joyful to carry in my portfolio for years to try to earn passive earnings.

Phoenix

One other monetary providers share, one which I don’t maintain, is Phoenix (LSE: PHNX).

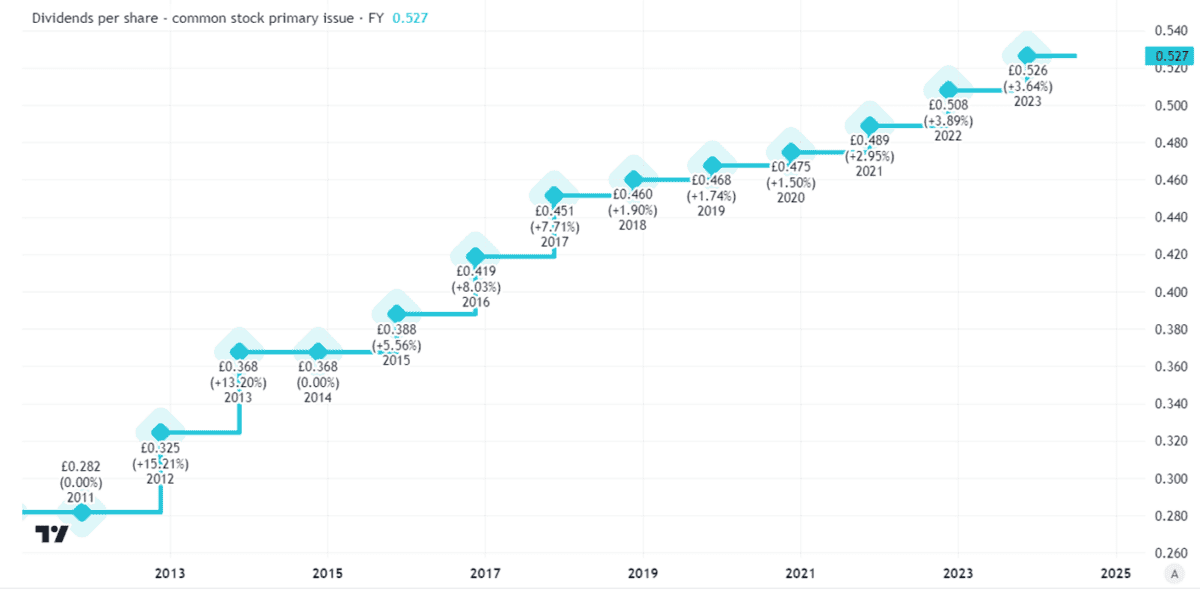

Like M&G, it has raised its dividend per share yearly lately. Its yield is even greater, at 9.7%. Meaning it is among the highest-yielding shares of the FTSE 100.

Like M&G once more, Phoenix typically appears little liked by buyers. Regardless of that robust dividend, its share worth has fallen 19% previously 5 years.

Partly I feel that displays the complexity of its enterprise. Pricing liabilities on long-term monetary merchandise similar to pensions could be a troublesome factor to get proper. If a monetary downturn sends property values down, for instance, Phoenix’s mortgage e book might become value lower than it thinks now.

However the enterprise has an enormous buyer base and I count on it to learn from long-term insurance coverage demand. Like M&G, it has confirmed money technology potential on a big scale and once more like M&G, it has constantly confirmed keen to make use of that spare money to assist fund massive dividends.

Created utilizing TradingView

Authorized & Basic

As my portfolio is already diversified throughout enterprise areas, I’d be joyful so as to add three shares from the monetary providers sector to it subsequent month. Alongside M&G and Phoenix, the third can be one I’ve purchased in current months: Authorized & Basic.

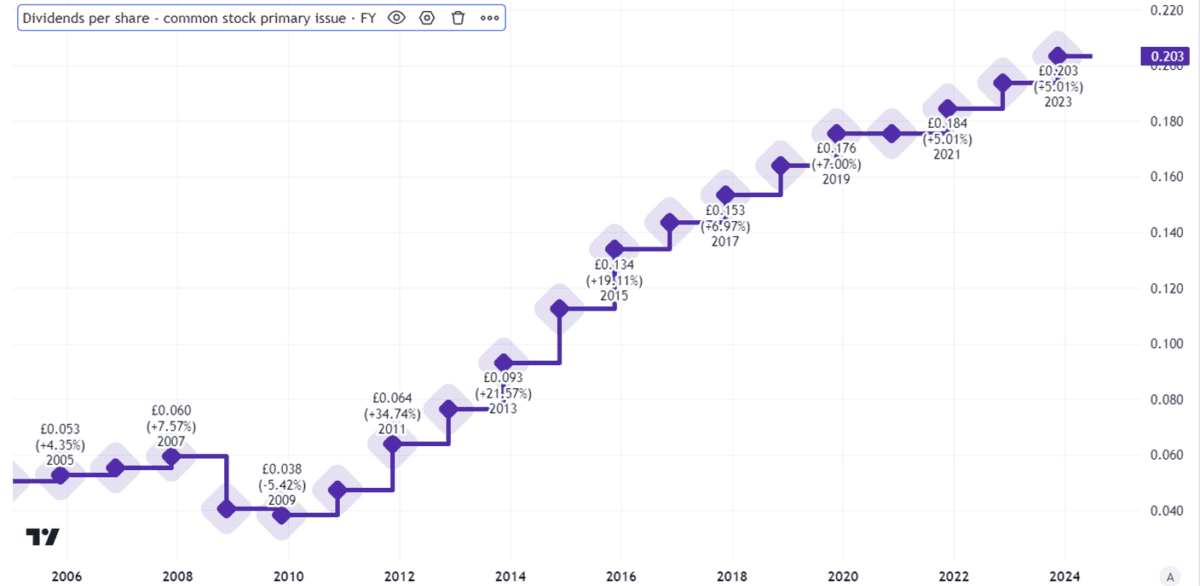

The points of interest are comparable: resilient long-term buyer demand, a powerful model, and a big buyer base. Authorized & Basic has additionally been a strong dividend payer, with its final lower being again in 2008 amid the monetary disaster.

Created utilizing TradingView

Earnings fell sharply final 12 months and one other extreme market drop might imply one other dividend lower. As a long-term investor, although, I just like the 8.7% yielding FTSE 100 share.