- After a euphoric rise final week, Bitcoin has fallen, influenced by detrimental information.

- Bitcoin’s longs began getting liquidated, which might be one other troubling signal for the king coin.

Final week, Bitcoin’s [BTC] pleasure soared to nearly euphoric ranges. Granted, there was quite a lot of hype round it, significantly as a result of Bitcoin 2024 convention.

In distinction, the market has adopted a slower tempo this week, which can also be evident in BTC’s worth motion.

Simply as Bitcoin’s rally was pushed by general optimistic information, the cryptocurrency’s efficiency this week has been influenced by detrimental information.

This fed into Bitcoin’s bipolar temper, as evidenced by its worth motion, which dipped nearly 6% to its $66,042 press time ranges.

Supply: TradingView

BTC bounced again by roughly 30% from its July lows. Brief-term merchants that purchased into the dip could thus have an incentive to promote, contributing to the continuing retracement.

However how lengthy can this development final?

AMBcrypto’s evaluation utilizing the Fibonacci retracement revealed that the following pivot may come between $61.921 and $59,693. That’s, if the promote stress continues.

Bitcoin goes on a hype recess

There was quite a lot of politically charged hypothesis final week, however now the hype has died down. As an alternative, the market gave the impression to be taking a cautious stand this week owing to the FOMC knowledge and the FED’s upcoming assembly.

Uncertainty round financial bulletins tends to affect funding choices. Due to this fact, many merchants are inclined to exit their place and anticipate clearer skies earlier than making the following transfer.

This will clarify the profit-taking.

The next promote stress on account of a cautious stance could have been amplified by new Mt. Gox knowledge. In response to Lookonchain, Bitcoin transferred 47,229 BTC to nameless wallets within the final 24 hours.

This improvement additional sparked extra promote stress considerations out there. If the moved BTC have been to be dumped into the market, it might set off roughly $3.8 billion price of promote stress.

Longs liquidated?

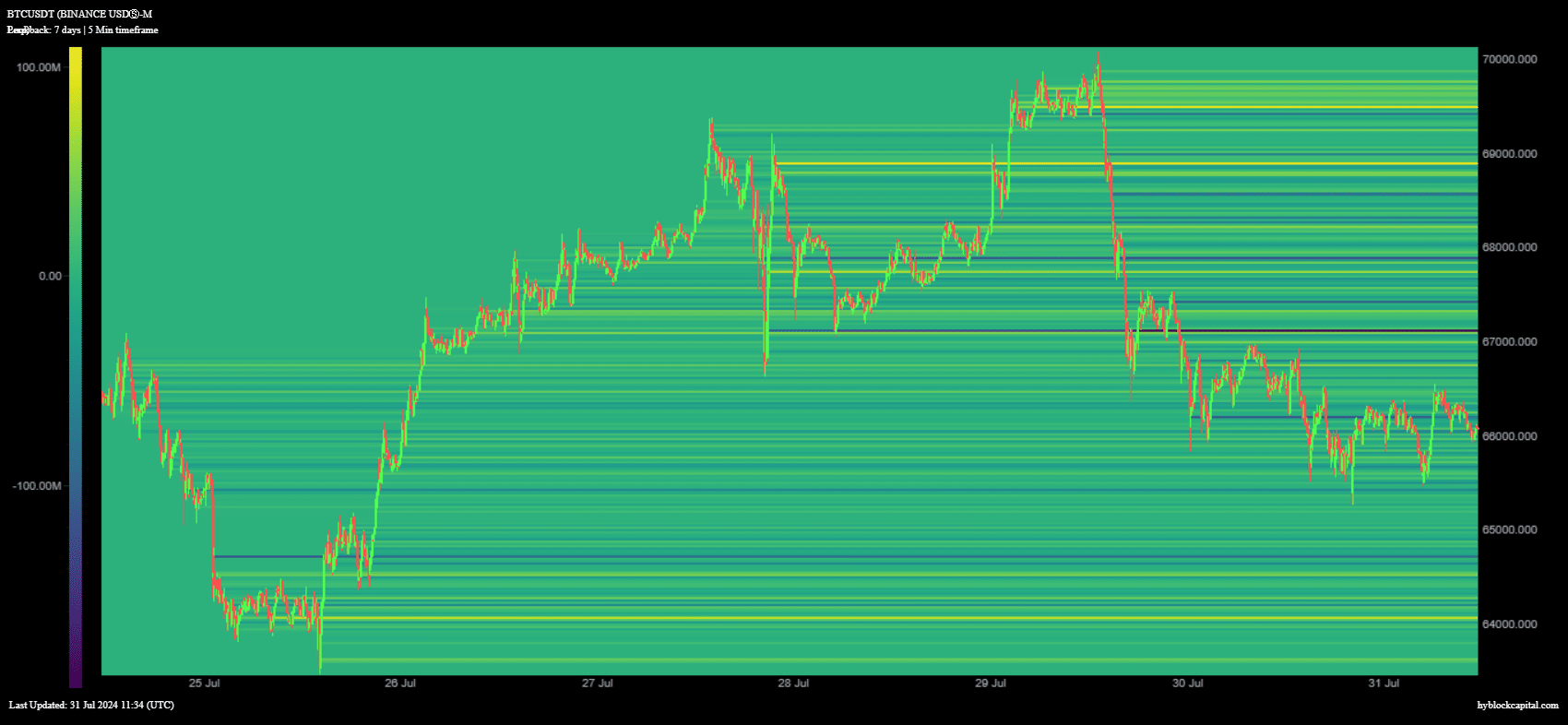

Bitcoin lengthy positions could have contributed to the fast pullback this week. AMBCrypto’s longs heatmap evaluation revealed that there have been two main zones.

The primary was on the $68,875 and $68,901 worth ranges, the place BTC longs soared to $101.8 million. The second main zone was between $69,472 and $69,500.

Supply: Hyblock Capital

BTC dipped rapidly under the 2 leveraged lengthy positions, which can have offered extra draw back liquidity for brief sellers.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

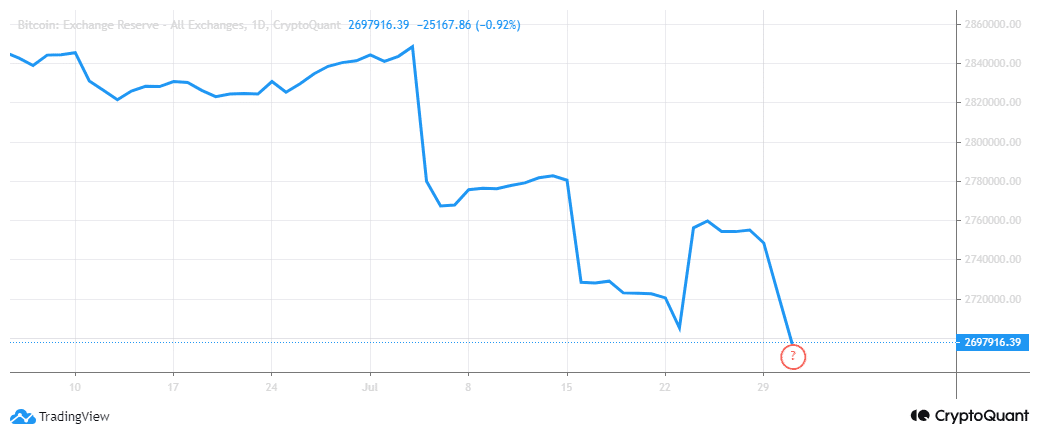

Will Bitcoin dip a lot decrease? This stays to be seen, particularly as a result of market dynamics can change any time. However, Bitcoin reserves Simply concluded July at their lowest ranges since 2018.

Supply: CryptoQuant

The alternate reserve metric confirmed that roughly 2.6 million BTC remained on exchanges at press time.