- The U.S. authorities transferred BTC price billions of {dollars} throughout a time when promote stress was already excessive.

- Nevertheless, a bullish divergence appeared on BTC’s chart, hinting at a development reversal.

Bitcoin [BTC] had showcased a promising efficiency over the previous few days, because it inched nearer in direction of $70k. Nevertheless, bears stepped up within the final 24 hours and pushed the king coin’s worth down.

Let’s take a better have a look at the market to seek out out why Bitcoin is down in the present day.

Why is Bitcoin down in the present day?

As sellers took management, BTC’s worth dropped by over 4% within the final 24 hours, per CoinMarketCap. AMBCrypto had earlier reported that there have been probabilities of BTC dropping to $66k.

On the time of writing, BTC was buying and selling at $66,672.03 with a market capitalization of over $1.32 trillion.

On the twenty ninth of July, IntoTheBlock had identified a attainable cause behind BTC’s newest dip. As per the tweet, nearly all BTC holders had been in revenue.

Although this seemed optimistic on the floor, it might need as a substitute motivated traders to promote their holdings to earn income, inflicting this worth correction.

The function of the U.S. authorities

Lookonchain revealed one more attainable cause for Bitcoin’s worth decline. On the twenty ninth of July, the U.S. authorities transferred BTC price greater than $2 billion to a brand new pockets.

At press time, the U.S. authorities held 179,155 BTC, price $12.14 billion.

Usually, when governments make such big transfers, it impacts market sentiment and causes volatility. For instance, just a few weeks in the past, the German authorities bought all of its BTC holdings, which impacted Bitcoin’s worth.

Because the U.S. is a significant marketplace for crypto, it’s not a shock to see BTC’s falling due to a significant switch made by its authorities.

There’s hope for bulls

Nevertheless, AMBCrypto’s evaluation of CryptoQuant’s knowledge revealed that BTC’s trade reserve was rising. This recommended that promoting stress on BTC was excessive.

Additionally, its aSORP turned purple, which meant that extra traders had been promoting at a revenue at press time. In the midst of a bull market, it may well point out a market prime.

Supply: CryptoQuant

Whereas BTC bears continued to push the king of cryptos’ worth, a key indicator hinted at a attainable development reversal.

Ali, a preferred crypto analyst, lately posted a tweet highlighting that BTC confirmed bullish divergence in opposition to the RSI within the decrease time frames.

The TD sequential, one more distinguished indicator, flagged a purchase sign, signaling a worth enhance. On the time of writing, BTC’s Concern and Greed Index had a studying of 37%, which means that the market was in a “fear” section.

Every time the metric hits this stage, it means that the probabilities of a worth enhance are excessive.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

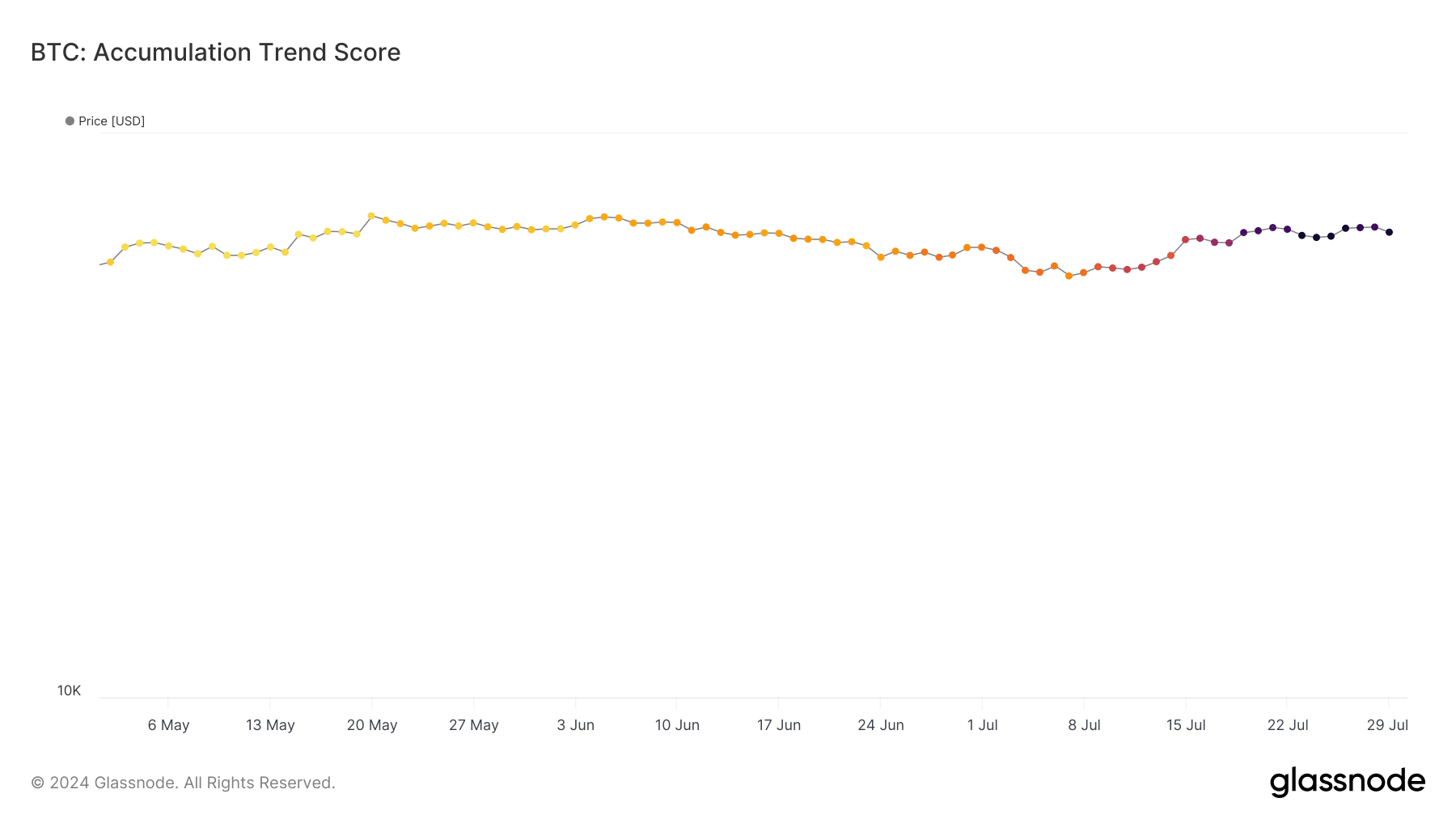

AMBCrypto then checked Glassnode’s knowledge. We discovered that regardless of the current selloffs, BTC’s accumulation development rating had a price of 0.99.

A quantity near 1 signifies that traders are contemplating accumulating extra, which is mostly thought of bullish.

Supply: Glassnode