- A key indicator revealed that BTC would possibly go above $90k.

- If BTC reaches an ATH, altcoins like ETH and SOL are more likely to observe.

The latest value uptrend sparked hopes amongst buyers about Bitcoin [BTC] reaching an all-time excessive.

Subsequently, AMBCrypto deliberate to have a greater take a look at what’s occurring to see what the crypto week forward would possibly seem like.

Bitcoin highway to an ATH

Bitcoin bulls gained management over the market as they pushed BTC in direction of the $70k. Since this worth was a lot nearer to its all-time excessive, BTC might retest that mark and even go above it on this week.

Based on CoinMarketCap, BTC’s value had risen by greater than 2% within the final 24 hours. On the time of writing, BTC was buying and selling at $69,630.41 with a market capitalization of over $1.37 trillion.

AMBCrypto’s take a look at Glassnode’s information revealed an indicator that instructed that it was very possible for the king of cryptos to achieve a brand new excessive.

BTC’s Pi Cycle Prime indicator identified that BTC’s value was resting simply close to its doable market backside.

If the indicator is to be believed, then BTC’s doable market high was $98k, additional suggesting a breakout above its present ATH.

Supply: Glassnode

What metrics recommend

Our evaluation of CryptoQuant’s information revealed that BTC’s internet deposit on exchanges was dropping in comparison with the final seven days’ common. This meant that purchasing strain was rising.

Aside from buyers, BTC miners had been additionally reluctant to promote their holdings. BTC’s Miners’ Place Index indicated that miners had been promoting fewer holdings in comparison with its one-year common.

Supply: CryptoQuant

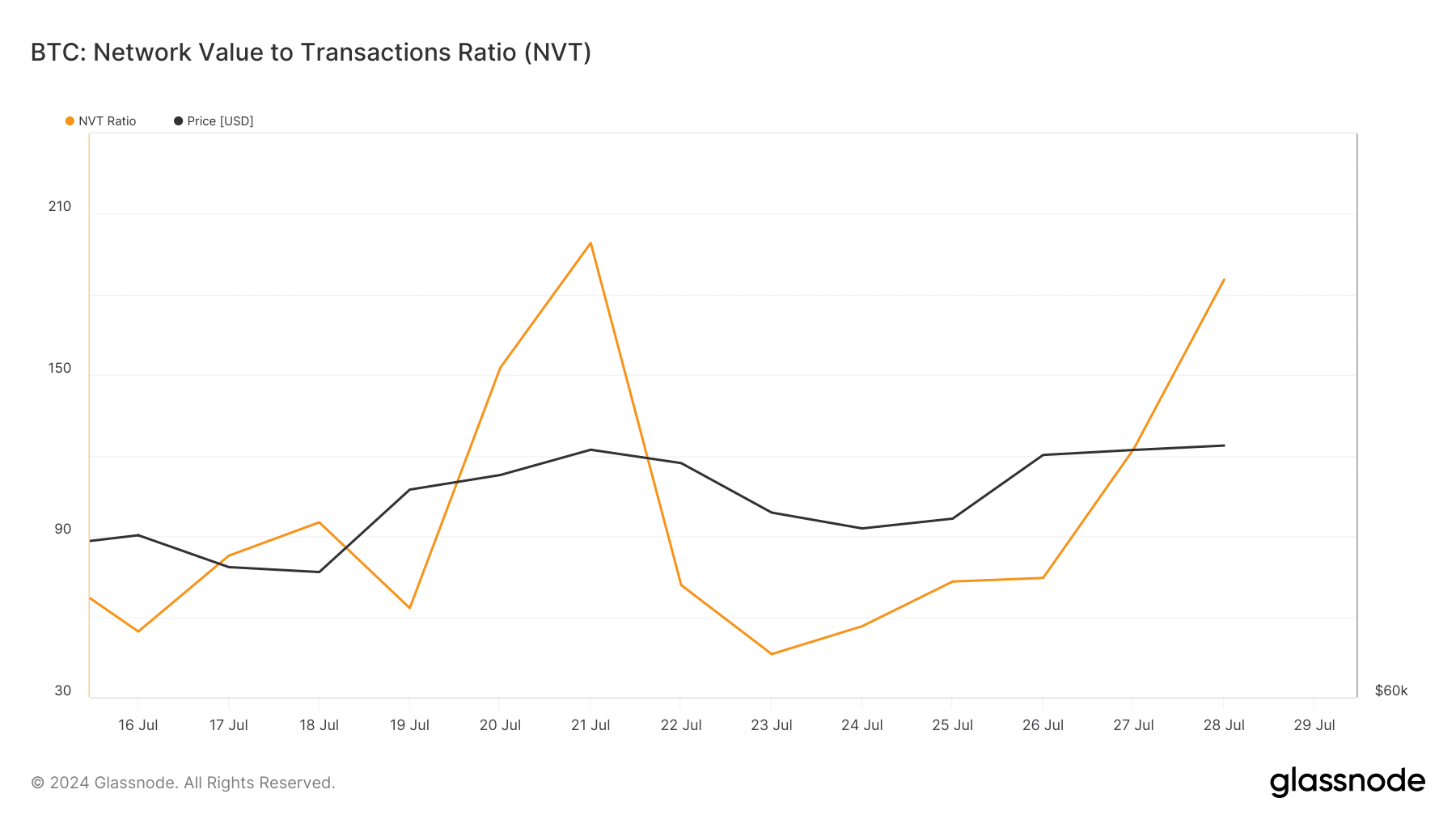

Nevertheless, not every little thing seemed optimistic. The king of cryptos’ NVT ratio registered a pointy enhance. An increase within the metric implies that an asset is overvalued, which usually ends in value corrections.

If that occurs, then BTC would possibly take longer to achieve an ATH.

Supply: Glassnode

Furthermore, on the time of writing, BTC’s Concern and Greed Index had a price of 71%, which means that the market was in a “greed” section. Every time the metric hits that stage, it means that the possibilities of a value correction are excessive.

How will the market be affected?

Contemplating a utopian scenario through which BTC reaches an ATH this week, there isn’t a doubt that the whole market can be affected.

Traditionally, altcoins have, nearly all of the time, adopted Bitcoin’s value development. On this event, high altcoins like Solana [SOL] displayed promising efficiency as its worth surged by over 6% final week.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Different high alts like Ethereum [ETH] additionally seemed bullish. If BTC manages to achieve an ATH, it’s possible that these tokens can even stay bullish.

Nevertheless, high memecoins like Dogecoin [DOGE] and Shiba Inu [SHIB] weren’t following the development, as their weekly charts remained within the purple on the time of writing.