- Bitcoin is down shut to three% after climbing to a neighborhood excessive at $69.4k.

- The Bitcoin dominance and liquidity charts maintain clues concerning the subsequent worth transfer.

Bitcoin [BTC] reached the $69k resistance zone. In an earlier report, it was highlighted that the liquidity pool at this degree would seemingly entice costs to it earlier than a possible bearish reversal.

Over the previous 24 hours of buying and selling, BTC reached $69.4k and fell 2.7% to commerce at $67.5k at press time. The metrics had been bearish within the brief time period earlier this week. Monday’s buying and selling session might arrange the pattern for the following week.

Potential situations for Bitcoin this week

Supply: Hyblock

AMBCrypto analyzed the 7-day look-back interval on the liquidation heatmap. A cluster of liquidation ranges have been current across the $70k degree and on the $66.4k degree.

Over the previous few hours, the worth reversal from the $69k zone has helped add to the liquidity pool round $70k.

This makes it an attention-grabbing worth goal for Bitcoin on Monday. A transfer to the $70k space to brush the liquidity and create hope amongst bulls earlier than a reversal might unfold.

This worth bounce would possibly precede a dip to the $66.4k degree. A transfer past both degree would seemingly sign whether or not this week can be bullish or bearish.

Clues from the Dominance chart

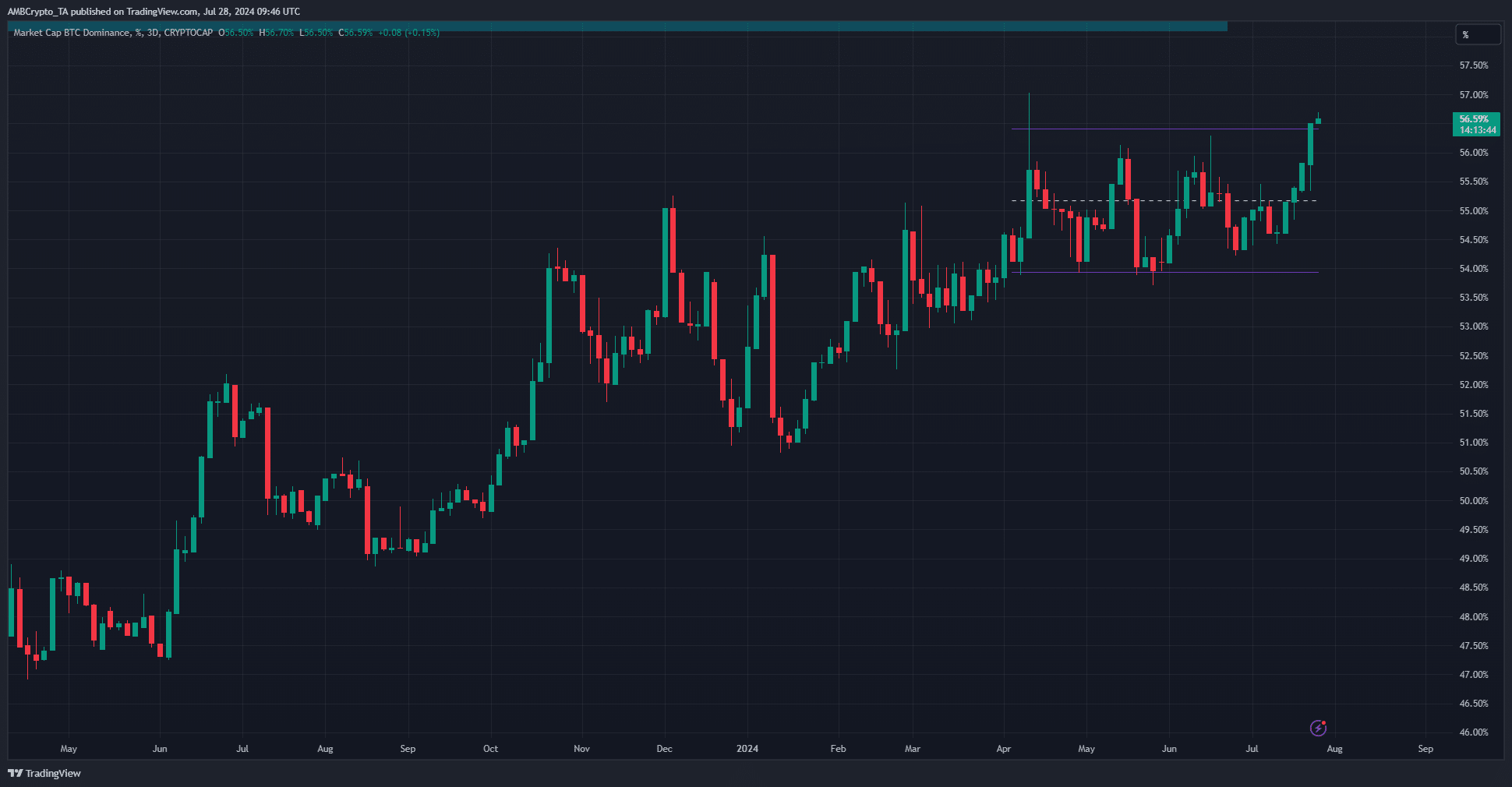

Supply: BTC.D on TradingView

The Bitcoin Dominance chart confirmed a breakout above the vary highs. This meant that Bitcoin was performing higher than the main altcoins. In case of a market-wide droop, altcoins would undergo disproportionately.

Merchants can use this info to resolve what belongings to commerce primarily based on Monday’s directional clues.

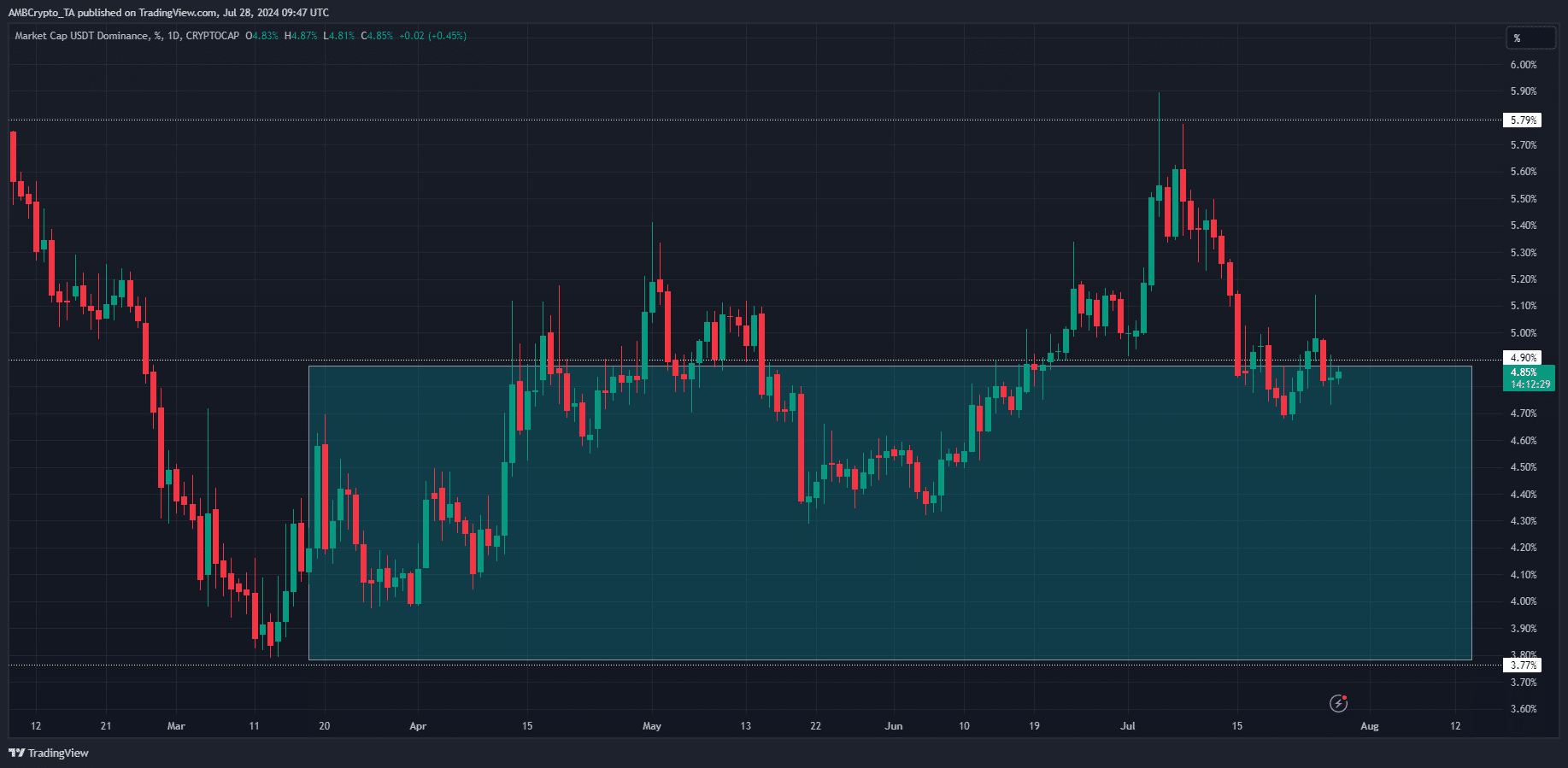

Supply: USDT.D on TradingView

The Tether Dominance chart is inversely associated to crypto market worth strikes. When USDT.D goes up, it’s an indication that traders are shifting to stablecoins and promoting their crypto.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Based mostly on the Tether Dominance pattern, a transfer downward would possibly ensue this week. Merchants can watch Monday’s efficiency intently and construction their directional bias accordingly.

Over the previous month, USDT.D motion on Mondays has usually set the tone for the upcoming week.