- Bitcoin registered double-digit development during the last seven days.

- Market indicators remained bullish within the king of cryptos.

Bitcoin [BTC] has remained bullish all through the final week, as its weekly and every day charts have been each inexperienced. Issues can get even higher for the king of cryptos if it manages to remain above a crucial mark earlier than ending this week.

Let’s discover out what metrics recommend relating to BTC closing above that degree.

Bitcoin’s street to $100k

CoinMarketCap’s information revealed that BTC’s value elevated by greater than 11% within the final seven days. The king of crypto’s every day value chart additionally remained inexperienced.

On the time of writing, BTC was buying and selling at $66,998.13 with a market capitalization of over $1.32 trillion.

Whereas BTC bulls have been pushing the coin’s value up, Titan of Cryptos, a well-liked crypto analyst, not too long ago posted a tweet revealing an attention-grabbing replace.

As per the tweet, if Bitcoin manages to shut this week above $65.1k, then it’d set off one more bull rally. If that occurs, then anticipating BTC to the touch $100k within the coming days or perhaps weeks gained’t be an extended shot.

Supply: X

The opportunity of BTC touching $100k didn’t look very bold, as a key indicator additionally hinted at that risk.

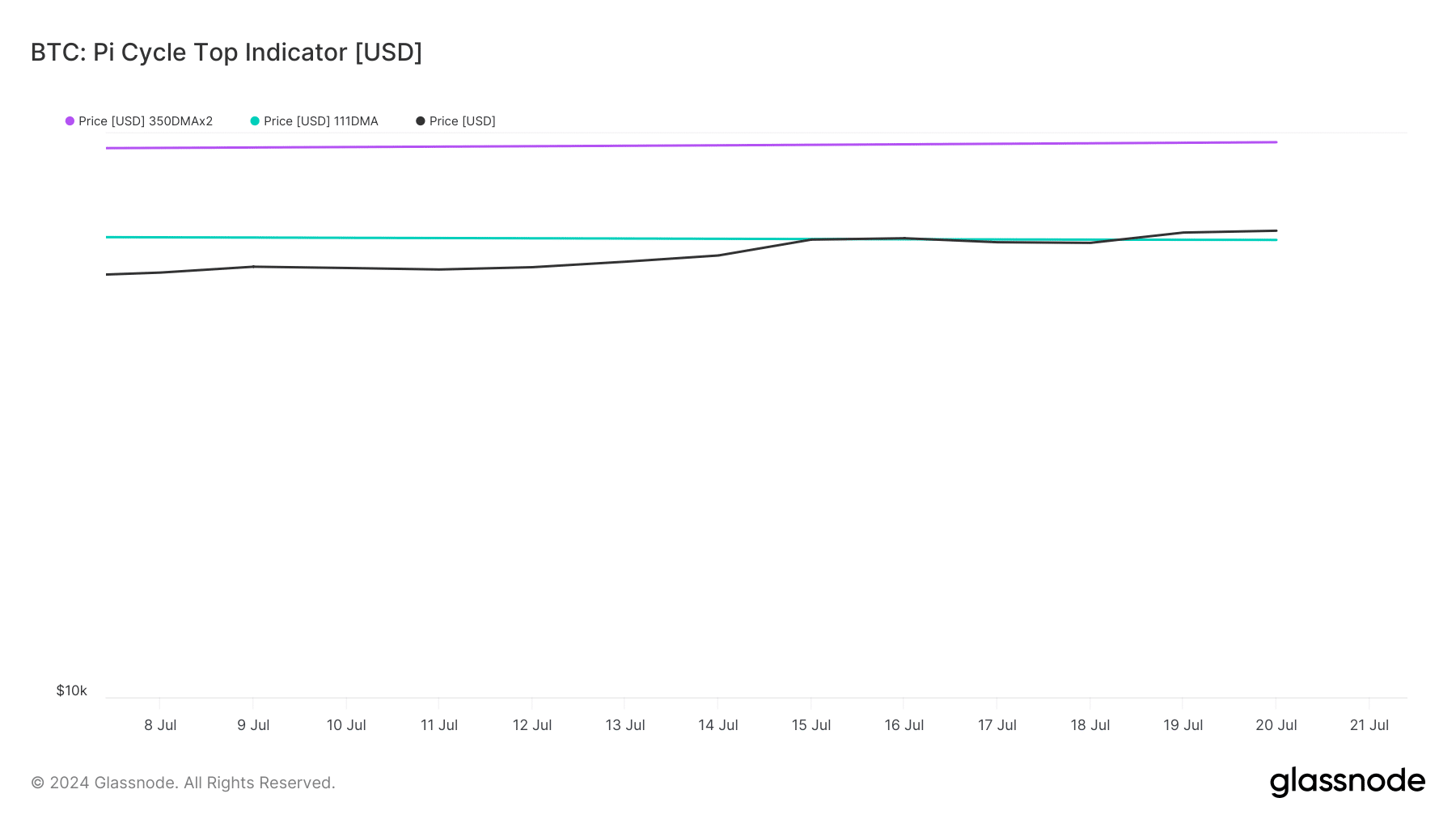

AMBCrypto’s take a look at BTC’s Pi Cycle prime indicator revealed that BTC’s value was lastly buying and selling above its market backside. If the indicator is to be believed, then BTC’s doable market prime can be $96.4k.

Supply: Glassnode

Will BTC maintain its bullish momentum?

AMBCrypto then checked CryptoQuant’s information to see whether or not metrics supported the potential for a continued bullish value motion. As per our evaluation, BTC’s change reserve was dropping, which means that promoting stress was low on the coin.

Each its energetic addresses and transactions additionally elevated within the final 24 hours, which might be thought-about bullish.

On prime of that, miners have been additionally assured in BTC. This was evident from its inexperienced Miners’ Place Index (MPI), which means that miners have been promoting fewer holdings in comparison with their one-year common.

Nevertheless, its aSORP was pink, suggesting that extra buyers have been promoting at a revenue. In the course of a bull market, it could actually point out a market prime.

Supply: CryptoQuant

On the time of writing, BTC’s worry and greed index had a studying of 72%, which means that the market was in a “greed” section. Each time the metric hits this degree, it means that the possibilities of a value correction are excessive.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

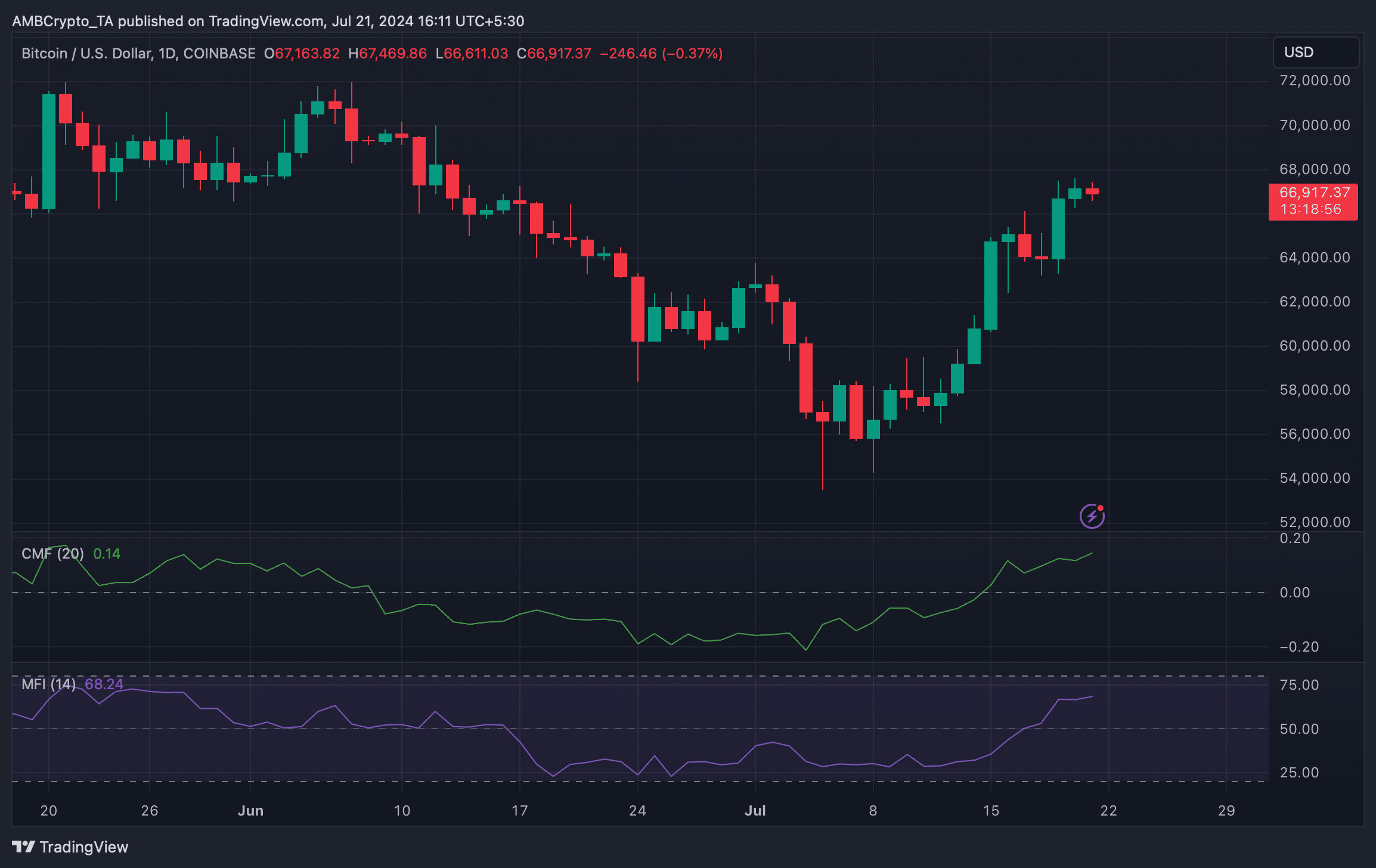

To see whether or not that’s doable, AMBCrypto then checked BTC’s every day chart. In contrast to the aforementioned metrics, market indicators remained bullish.

For instance, BTC’s Cash Circulation Index (MFI) and Chaikin Cash Circulation (CMF) registered upticks, hinting at a continued value rise.

Supply: TradingView