Picture supply: Getty Photos

The FTSE 100‘s residence to all kinds of remarkable shares. By constructing a balanced portfolio of various shares, traders can steadiness danger and luxuriate in sturdy and secure returns over time.

Worth shares present traders with the potential for vital long-term capital appreciation, in addition to a margin for error. Progress shares also can outperform the market by rising earnings at breakneck velocity. And dividend shares can ship common revenue and stability, even throughout market downturns.

Listed below are three Footsie shares from every class to contemplate in the present day. I feel every has the potential to ship vital long-term returns.

Worth

Vodafone Group (LSE:VOD) affords wonderful worth throughout quite a lot of metrics. It trades on a ahead price-to-earnings (P/E) ratio of 10.1 instances, which is without doubt one of the lowest throughout the telecoms sector.

The corporate additionally carries a market-beating 7.2% dividend yield for this 12 months, even after its vow to chop dividends.

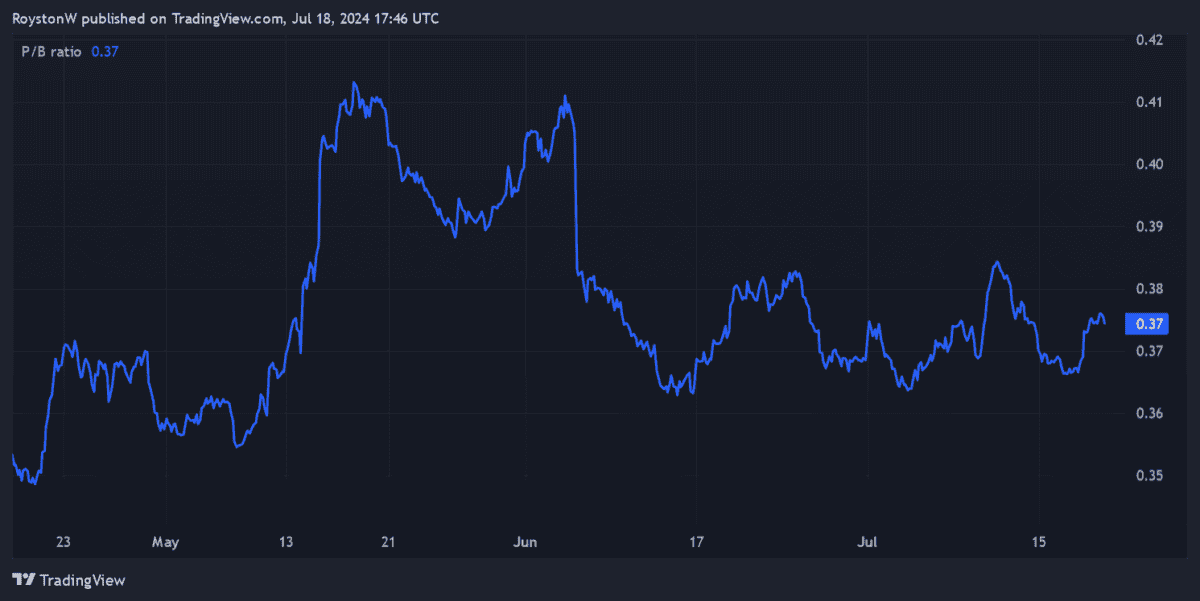

And eventually, Vodafone shares commerce on a price-to-book (P/B) worth of round 0.4. Any studying beneath 1 signifies a share’s low-cost relative to the worth of its belongings.

Vodafone’s been underneath stress extra not too long ago as a consequence of adjustments to German telecoms legal guidelines. However extra encouraging buying and selling in its single largest market suggests now could possibly be the time to purchase.

It’s additionally present process an enormous transformation to chop its headcount and increase funding in areas like Vodafone Enterprise. This carries execution danger, however it may additionally result in vital earnings development over the long run.

Progress

Firms that function in Nigeria have been hit by a sequence of forex revaluations not too long ago. This has been the case with Airtel Africa (LSE:AAF), a telecoms operator that gives cell cash and knowledge companies throughout 14 nations.

Additional falls within the Nigerian naira are doable. But Metropolis analysts nonetheless imagine Airtel’s earnings will rebound sharply from this 12 months onwards.

It’s tipped to swing from a $63m pre-tax loss within the final monetary 12 months to earnings of $805m this 12 months. In fiscal 2026, the underside line’s tipped to extend an additional 71% too, to £1.4bn.

With wealth ranges and inhabitants sizes hovering throughout its markets, I feel Airtel may ship beautiful earnings development in the long term. Telecoms trade physique GSMA, for example, believes 4G adoption in Sub-Saharan markets will double within the subsequent 5 years.

Dividend

Bunzl (LSE:BNZL) doesn’t carry the biggest dividend yields on the market. For the following three years they vary 2.2-2.5%.

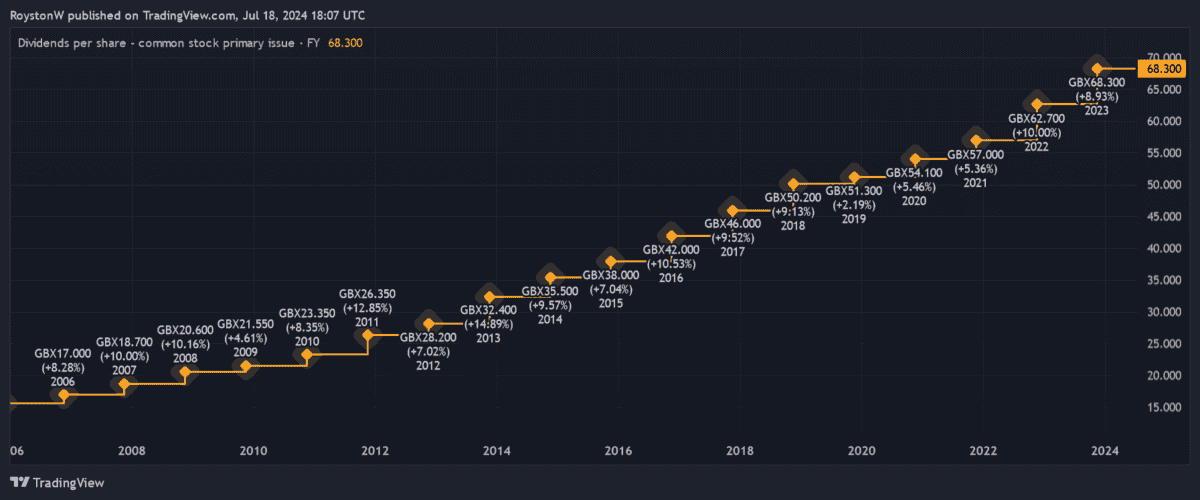

Nevertheless, the assist companies supplier’s beautiful dividend development file nonetheless makes it a passive revenue hero, in my view. Annual rewards have risen for 31 years on the bounce, illustrating the agency’s distinctive money era and talent to climate financial downturns.

These will increase have been fairly beneficiant too, at round 9% each year by the interval.

Bunzl’s extremely profitable, acquisition-based development technique has offered the bedrock to develop dividends 12 months after 12 months. An M&A-led technique like this may be dangerous, however the agency’s wonderful file helps soothe any fears I could have.