Picture supply: Getty Pictures

What’s the distinction between a dividend yield of three.1% (the FTSE 250 common) and certainly one of 9.8%? Within the brief time period, it’s £6.70 per 12 months for every £100 I make investments.

I’m a long-term investor although. Over the long run, that distinction is gigantic.

Think about I make investments £1,000 at the moment and compound it at 3.1% yearly for 3.1%. After 30 years, it must be price £2,499. If I make investments that £1,000 at the moment and compound it at 9.8% yearly for a similar interval, after 30 years it must be price £16,522!

Seeking to the long run

Compounding partly works on the idea of the value at which I could make a share buy in future. In follow, no person but is aware of that. However it additionally depends on a given dividend yield, on this case, a gradual 9.8% for 30 years.

One well-known FTSE 250 share that at present affords such a yield is abrdn (LSE: ABDN). Can it preserve that payout in a long time to return?

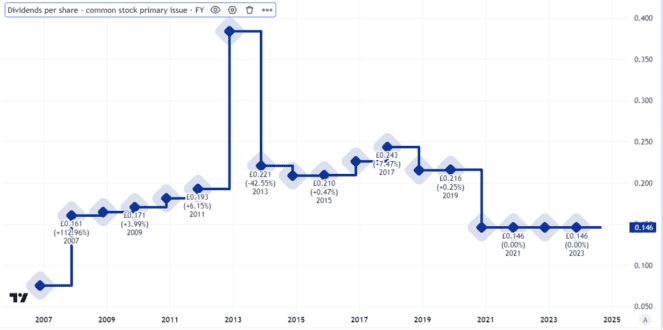

Patchy observe file on dividends

Though previous efficiency is just not essentially a information to what might occur in future, it may possibly present buyers with helpful context.

Over the previous seven years, the FTSE 250 monetary companies agency has not raised its dividend per share in any respect, however has minimize it twice.

Created utilizing TradingView

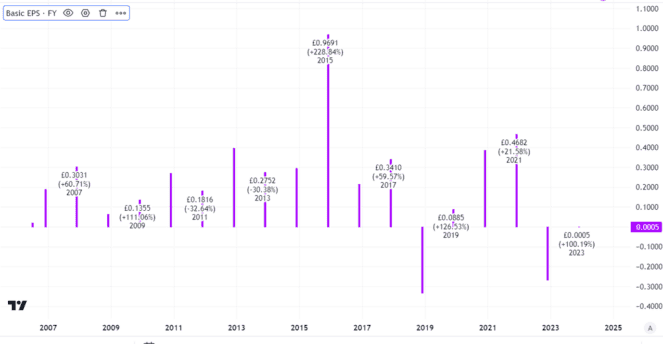

The rationale? Principally, the enterprise efficiency has been very inconsistent. Certainly, a fast take a look at the agency’s historical past of fundamental earnings per share makes the purpose.

Created utilizing TradingView

Laborious to evaluate the place issues would possibly go

On one hand, earnings per share usually are not a fantastic metric to make use of when assessing a monetary companies firm. Elements like asset valuation adjustments can have an effect on earnings dramatically, regardless that they might not have an effect on money flows.

Then again, such inconsistent earnings (together with some notable losses) don’t strike me as in step with a profitable, well-run firm plotting a path to the sunlit uplands of sustaining or rising shareholder payouts. There’s a motive abrdn has minimize its dividend repeatedly over the previous seven years.

I believe that has partly mirrored an underperforming enterprise technique that has been modified alongside the way in which. As its daft title displays, the agency has suffered one thing of an identification disaster, which might not be a great way to draw shoppers in an business the place consistency is valued extremely.

Nonetheless, the agency has a sizeable consumer base. Within the first quarter of the 12 months, property beneath administration and administration grew barely in comparison with the prior quarter, reaching over half a trillion kilos. That is no FTSE 250 minnow.

A price-cutting programme might assist increase profitability (although I additionally see a threat it might backfire if it reduces workers productiveness). The interactive investor platform might assist increase abrdn’s long-term potential as extra buyers select to speculate digitally.

Potential for ongoing excessive earnings

A monetary downturn might damage that efficiency although, if buyers lose their enthusiasm similar to abrdn misplaced its vowels.

Nonetheless, though the dividend might fall once more if enterprise is weak, if the corporate maintains its efficiency, the excessive payout might keep.

So from an earnings perspective, I see abrdn as a FTSE 250 share buyers ought to take into account shopping for.