Picture supply: Getty Photos

Authorized & Common’s (LSE:LGEN) confirmed to be one of many FTSE 100‘s biggest dividend shares to purchase in current occasions.

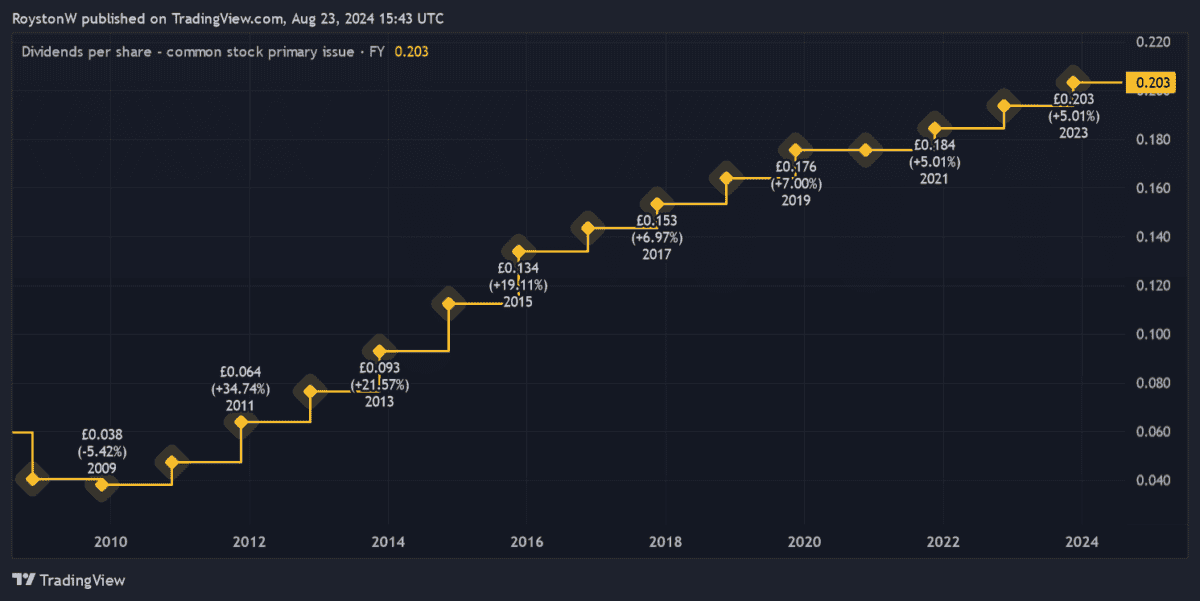

Because the chart reveals, it’s steadily grown annual payouts for the reason that 2008/2009 monetary disaster. The one exception got here in 2020. Again then, the corporate froze dividends in response to the worldwide pandemic.

Its resilience is thanks partly to its diversified enterprise mannequin. Its presence throughout the life insurance coverage, pension, and asset administration sectors helps shield its earnings and helps regular money circulation which might be important for dividends. It’s additionally because of the agency’s robust monetary foundations.

Pleasingly, the corporate’s vowed to boost dividends to 2027, at the very least. Based mostly on their plans, shareholder payouts will appear like this:

| 12 months | Dividend per share | Dividend development | Dividend yield |

|---|---|---|---|

| 2024 | 21.36p | 5% | 9.5% |

| 2025 | 21.79p | 2% | 9.6% |

| 2026 | 22.23p | 2% | 9.8% |

As you’ll be able to see, dividend yields transfer to inside a whisker of double digits, which is a tantalising prospect. Nonetheless, earlier than shopping for any dividend share, I would like to consider how sensible these forecasts are.

I additionally want to think about whether or not additional share worth weak spot may happen that offsets extra giant dividends. Right here’s my tackle the monetary companies large.

Steadiness sheet energy

At first look, Authorized & Common doesn’t seem like the most secure dividend share on the market. That is primarily based on the simple-to-calculate dividend protection ratio.

Any studying of two and above supplies a large margin of security. Sadly, cowl over at this Footsie share ranges at 1 occasions to 1.2 occasions by means of to 2026.

On paper, this leaves nearly no room for error if earnings disappoint. Nonetheless, Authorized & Common nonetheless has a rock-solid steadiness sheet it will probably name upon to assist it pay giant dividends.

As of June, the corporate’s Solvency II capital ratio was a powerful 223%. It has a lot money that the enterprise has additionally introduced a £200m share buyback programme, and vowed related repurchases within the coming years.

Encouragingly, weak dividend cowl is a long-running characteristic of Authorized & Common shares. However this hasn’t proved a hurdle to the corporate reliably rising dividends for greater than a decade, as I described above.

Sturdy fundamentals

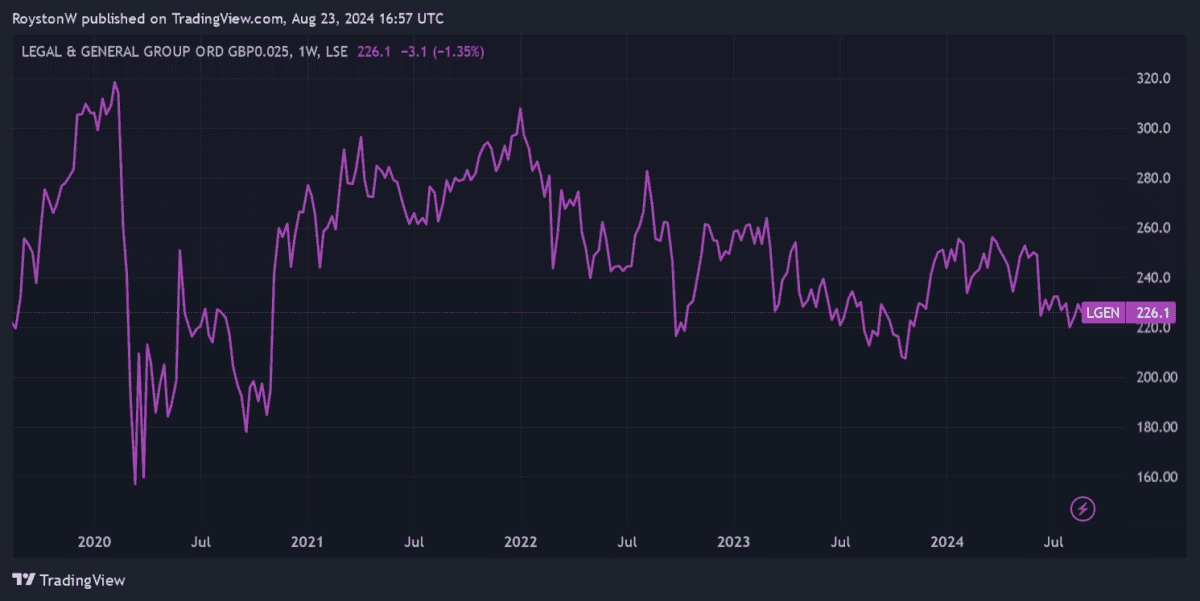

As I additionally talked about, I’m additionally searching for shares that may keep or ideally develop their share worth. You’ll see from the chart above that Authorized & Common’s share worth has fallen sharply of late.

This mainly displays investor unhappiness over the corporate’s plans to develop dividends at a slower charge between 2025 and 2027. Traders are additionally involved over potential execution dangers because it revamps its asset administration division.

However I strongly imagine Authorized & Common’s shares will rebound strongly. This will likely be pushed by hovering demand for its merchandise on account of demographic modifications throughout its markets.

Particularly, I’m inspired by the agency’s formidable objectives for the fast-growing pension danger switch (PRT) market. It plans to put in writing between £50bn and £65bn price of enterprise within the UK alone by 2028.

Authorized & Common should overcome robust competitors to understand its development potential. However its standing as a market chief throughout a number of product segments reveals it is aware of learn how to thrive in a troublesome local weather. I feel this is likely one of the Footsie’s enticing dividend shares to think about proper now.