- Despite the fact that the worth has decreased, knowledge confirmed BTC has not but hit its backside.

- A deep-dive confirmed that the coin can attain $64,688 so long as demand will increase.

It’s been 83 days for the reason that prestigious Bitcoin [BTC] halving occasion, but the coin has not displayed any glimpse of its conventional post-halving rally. This 12 months, the halving, which reduces the cash created and miners’ rewards, happened on the nineteenth of April.

Throughout that interval, Bitcoin’s value modified fingers round $63,976. This was after it hit an all-time excessive of $73,750 in March. As anticipated, the broader market took the occasion as an important one to drive greater BTC costs.

Endurance is the secret

A few month later, BTC retested $71,000. However it didn’t take lengthy for the worth to retrace. 83 days for the reason that Bitcoin halving, the worth of the crypto has undergone notable corrections, and lose about 12.76% of its worth.

Whereas Bitcoin traditionally goes by a downturn after the halving, this one appears to be extraordinary. Notably, it is because the worth motion has been underwhelming for about three months.

At press time, BTC’s value was $57,908. Based on AMBCrypto’s evaluation of the Puell A number of, the anticipated bull run won’t be right here but.

Puell A number of reveals the distinction between the short-term Bitcoin miners income and that of the long run. It does this by dividing the each day issuance of BTC by the 365-day issuance.

Sometimes, if the ratio is between 1 and 6, it signifies that costs are greater. Values over 6 point out that the worth might need hit the highest.

Then again, if the Puell A number of is decrease than 1, it signifies that costs are down with values decrease than 0.40 suggesting the underside.

Supply: CryptoQuant

Based on CryptoQuant, Bitcoin’s Puell A number of was 0.64, indicating that correction remains to be ongoing. Nonetheless, if the ratio reaches 0.40, it may point out a backside for Bitcoin, and a rebound may very well be subsequent.

Nonetheless, it’s noteworthy to say that it may take one other month or so for Bitcoin to succeed in its backside. If so, the bull run won’t occur till the beginning of the fourth quarter (This fall) or near the tip of Q3.

HODLers gained’t simply surrender

However it is usually vital to notice that issues can change rapidly. Ought to this occur and demand will increase, AMBCrypto’s prediction of $75,000 by the tip of July may come to go.

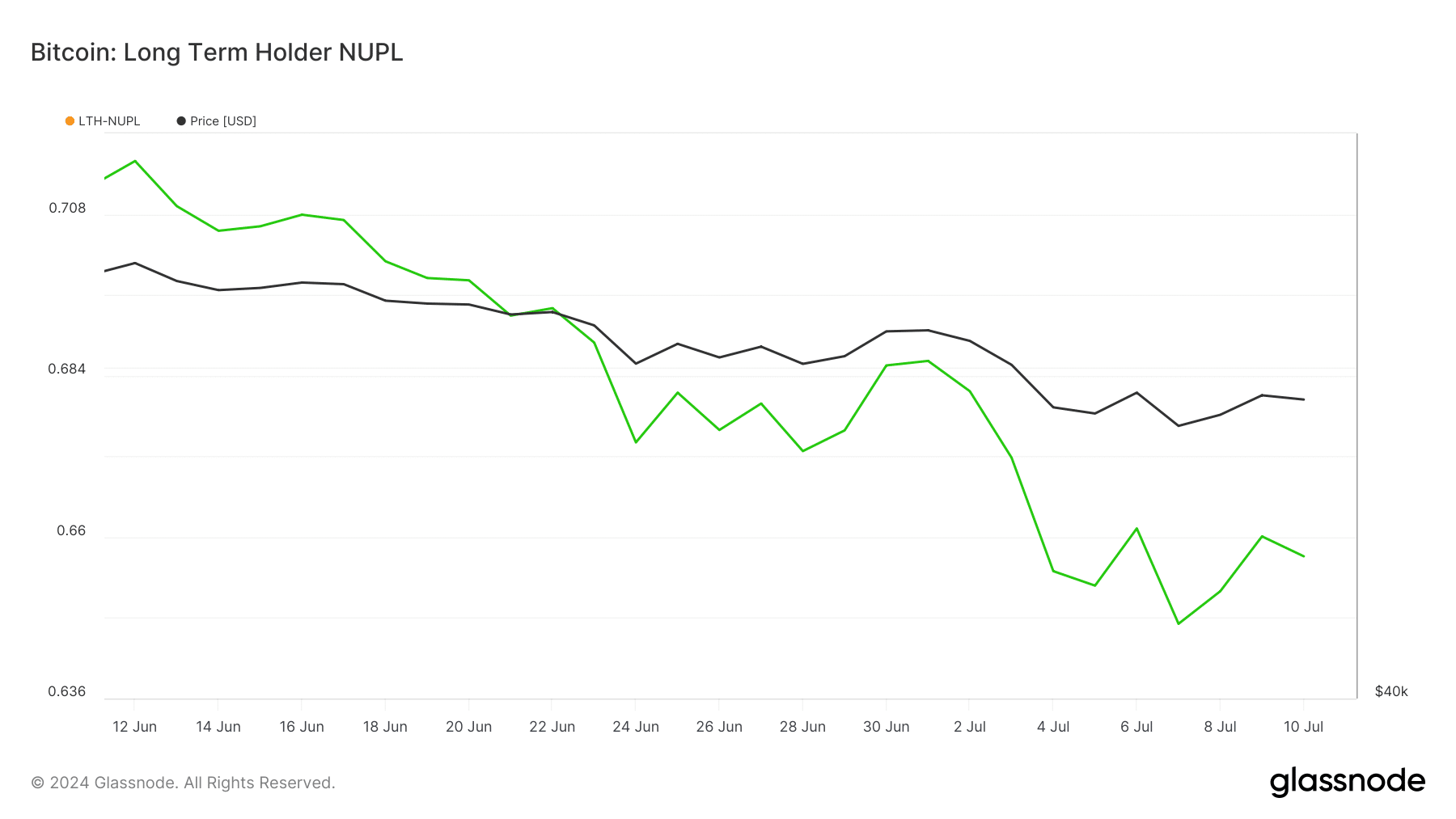

Regardless of the unimpressive value motion for the reason that halving, long-term holders are displaying confidence within the coin’s potential. We noticed this after inspecting the LTH-NUPL.

LTH-NUPL stands for Lengthy Time period Holder- Web Unrealized Revenue/Loss. This on-chain metric analyzes the conduct of Bitcoin holders who’ve owned the coin for a minimum of 155 days.

Based on Glassnode, the LTH-NUPL was within the inexperienced zone, indicating perception within the long-term potential of BTC. Ought to this stay the identical going ahead, demand for Bitcoin may improve, probably pushing the worth greater.

Supply: Glassnode

Nonetheless, if it retraces to the optimism or worry degree, Bitcoin’s momentum may decelerate. Between the sixth of June and seventh of July, Bitcoin’s value has decreased 21.46%.

Is a retest of $71,000 potential quickly?

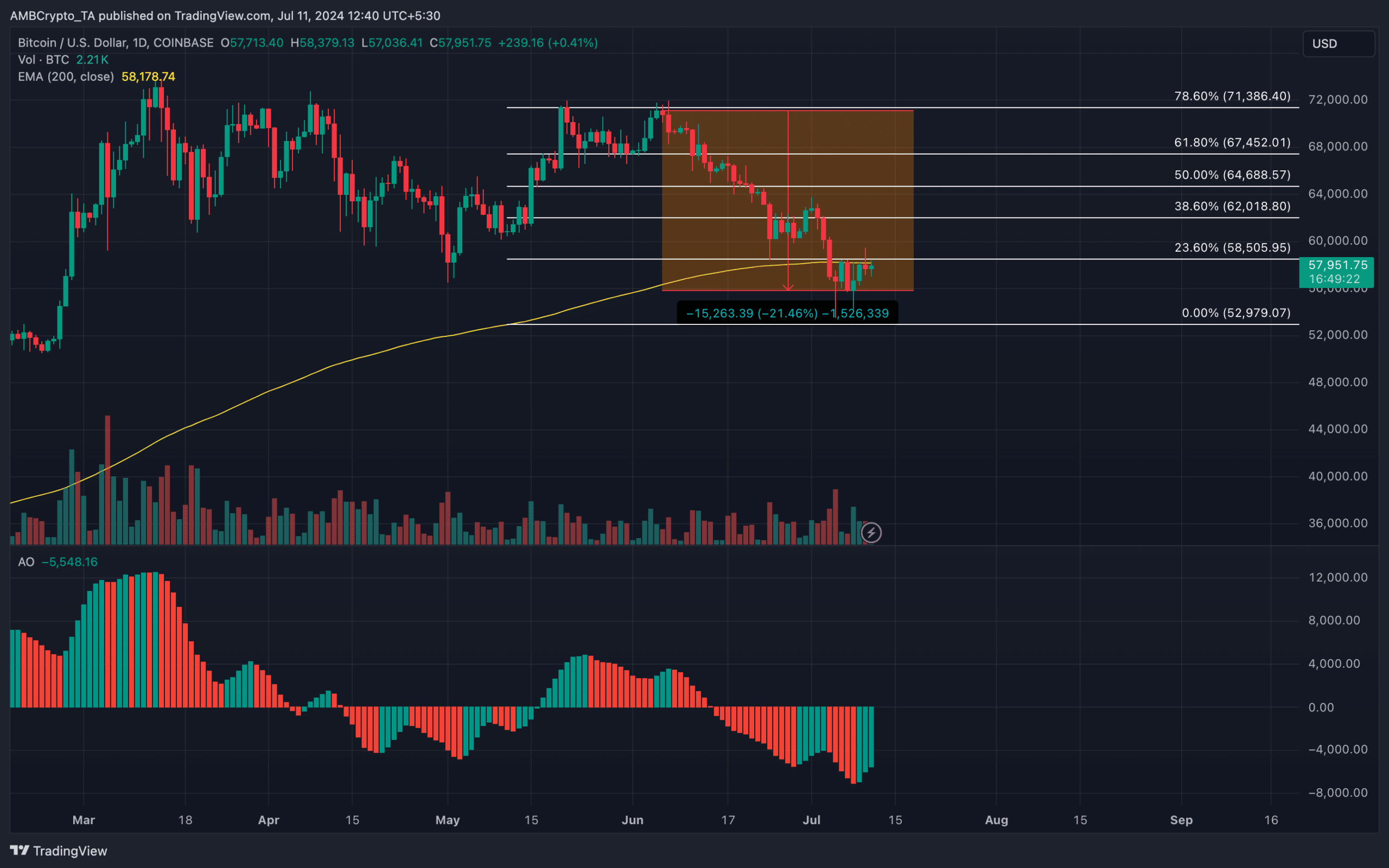

Whereas the worth was near retesting $58,000, it nonetheless trades under the 200 EMA (yellow). EMA stands for Exponential Transferring Common (EMA). This indicator measures pattern route over a given interval.

If the worth trades above it, it means the pattern is bullish. However whether it is under it, it signifies a bearish pattern. However it was totally different for Bitcoin contemplating that the worth was near flipping the zone

Ought to this occur, accompanied with indicators of accelerating upward momentum from the Superior Oscillator (AO), Bitcoin may return to its bull section.

Particularly, this might drive Bitcoin to retest its halving and potential commerce round $64,688.

Supply: TradingView

In a extremely bullish case, the worth may leap to $71,386, doubtlessly setting the stage for a bull run that takes the worth towards $80,000.

Is your portfolio inexperienced? Test the Bitcoin Revenue Calculator

In the meantime, there was feedback from analysts per Bitcoin’s value motion. Certainly one of them was from pseudonymous deal with on X Rekt Capital. Based on Rekt Capital, it would take some time earlier than the bull run begins as he talked about that,

“Bitcoin is not ready to break the downtrend just yet”