- The Blockchain Group confirmed a 580 BTC purchase, boosting its inventory by 226% amid rising institutional Bitcoin curiosity.

- Whale accumulation tendencies aligned with the agency’s transfer, suggesting broader market confidence in Bitcoin’s subsequent leg up.

The Blockchain Group has confirmed the acquisition of 580 Bitcoin [BTC], valued at roughly $40 million, in a strategic transfer that has despatched its inventory hovering by 226% over the previous week.

The announcement, made on the twenty sixth of March by way of Euronext, marks a pivotal flip within the firm’s Bitcoin technique and comes simply as whale exercise throughout the BTC community accelerates.

With retail buyers hesitating, whales are making decisive performs, and The Blockchain Group seems to be following swimsuit.

Strategic accumulation meets market timing

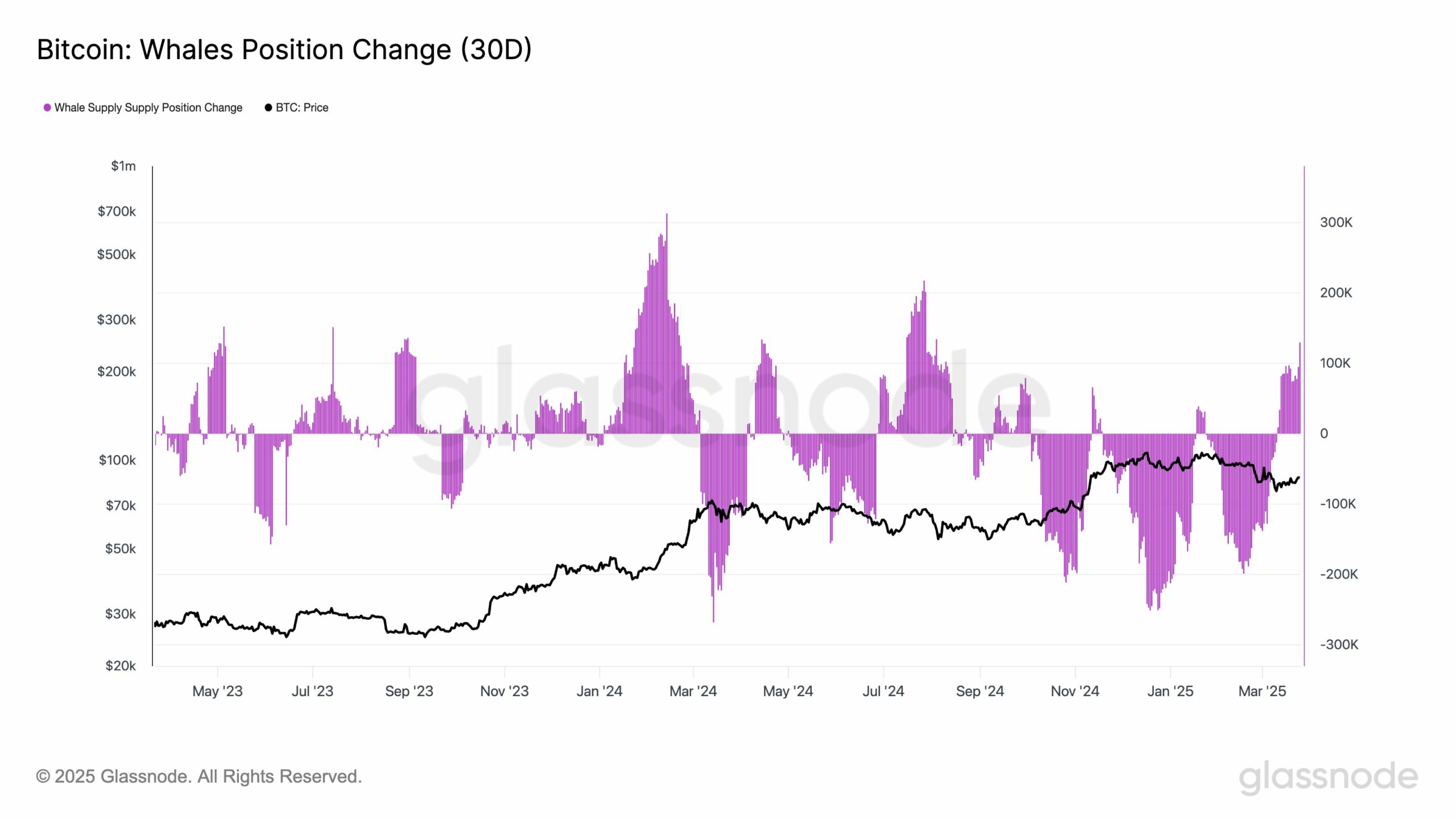

The agency’s acquisition, which started in early March, aligns with a surge in accumulation by the most important whale wallets.

Wallets holding over 10,000 BTC have elevated their Accumulation Pattern Rating to above 0.5, reflecting renewed confidence within the asset.

The Blockchain Group seems to be capitalizing on this sentiment shift, following the momentum created by sensible cash buyers.

Supply: Glassnode

The corporate additionally said its intention to broaden its Bitcoin treasury place, reinforcing long-term bullishness. This mirrors broader macro tendencies, the place corporations like MicroStrategy have normalized BTC as a stability sheet asset.

The Blockchain Group’s pivot might thus appeal to institutional consideration, notably as conventional markets proceed to grapple with inflation and macro uncertainty.

Inventory value and quantity surge

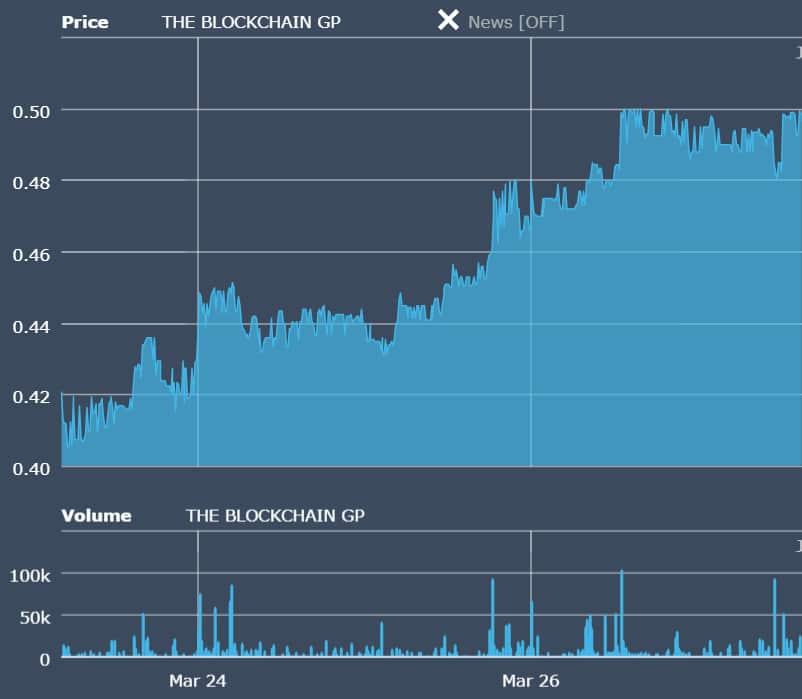

Following the acquisition information, The Blockchain Group’s inventory has skilled a outstanding value surge, rising from under €0.42 to over €0.51 inside a matter of days.

Buying and selling quantity additionally spiked sharply, with a number of days clearing the 100k mark.

Supply: Euronext

This value motion, mirrored within the connected chart, suggests robust market conviction within the firm’s Bitcoin-focused technique.

Bitcoin whales: The broader context

Past The Blockchain Group, whale habits is popping heads. The Whale Place Change (30D) metric reveals a web influx approaching 100K BTC, a pointy reversal from the persistent outflows that started in January.

The Provide per Whale metric can also be climbing once more, reinforcing that giant holders will not be solely shopping for again in however are additionally growing their publicity.

Supply: Glassnode

With BTC buying and selling close to $87,000 at press time, bulls are testing resistance just under $88K. The 200-day MA sat larger at $94,443, whereas the RSI remained impartial.

As whales accumulate and institutional gamers like The Blockchain Group sign confidence, the potential of BTC retesting its earlier highs turns into extra credible.

Conclusion

The Blockchain Group’s daring acquisition of 580 BTC has not solely despatched its inventory hovering but additionally aligns with a broader accumulation development led by whales.

This synergy between company treasuries and whale wallets might set the stage for the following leg of Bitcoin’s rally.

Because the market digests these developments, The Blockchain Group’s actions stand out as each well timed and doubtlessly transformative.