- Huge accumulation of Bitcoin by establishments as retail traders panic-sell.

- USDT dominance bearish reversal sample to set off Bitcoin rally.

404,448 Bitcoin [BTC], price $23 billion, had been moved to everlasting holder addresses over the previous 30 days, in accordance with on-chain information, indicating important accumulation.

Retail traders, distracted by issues such because the German authorities promoting or Mt. Gox points, could remorse not shopping for the dip. This missed alternative is highlighted as establishments are believed to have purchased through the latest market dip.

Supply: CryptoQuant

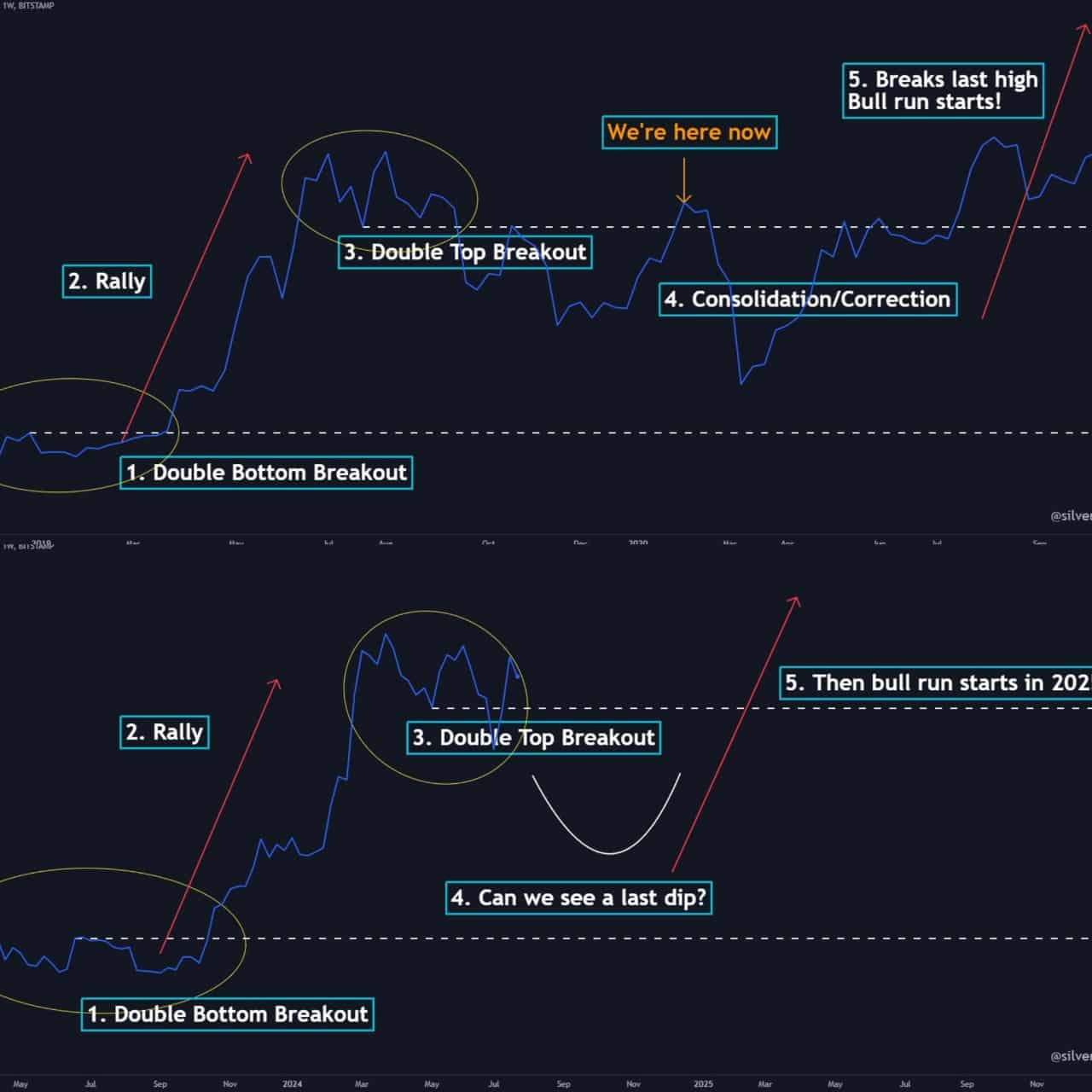

BTC weekly chart mirrors 2019/20 BTC cycle

For weeks, warnings have emerged about traders and merchants changing into overly optimistic, ignoring indicators on the BTC weekly chart.

This 12 months’s chart resembles the 2019-20 cycle, displaying a double backside, a peak with a double high, a break, a low, after which a rally.

Presently, BTC is in a correction section, probably having its final dip earlier than one other rally. This section has attracted important institutional investments, with many Bitcoins shifting to everlasting holder addresses.

Are we seeing historical past repeat itself?

Supply: TradingView

USDT dominance falls, Bitcoin rises

When USDT dominance drops, crypto costs typically rise. This was evident on ‘Crypto Black Monday’ when $1.7 billion in belongings had been liquidated.

USDT dominance examined a key resistance and was rejected, indicating a possible shift in market course.

The 50-day exponential shifting common was additionally retested, confirming the pattern reversal. This occasion highlighted the excessive volatility of the crypto market and the inherent dangers concerned.

Supply: TradingView

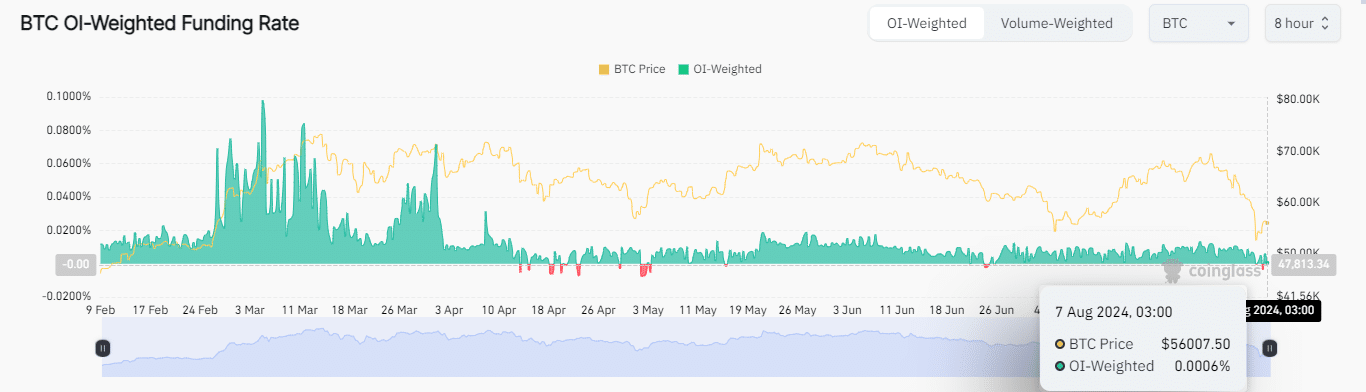

Bitcoin volume-weighted funding price vs institutional buys present divergence

Divergence happens when two associated metrics transfer in numerous instructions, signaling a possible market reversal.

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

A falling Bitcoin funding price suggests a bearish pattern, however heavy institutional shopping for outpacing retail promoting signifies a potential reversal.

This market correction may final 4 to eight weeks, adopted by a possible rally in Q3 2024.

Supply: Coinglass