Picture supply: Getty Photographs

Ferrari (NYSE: RACE) shares have carried out splendidly since itemizing in 2015. We’re taking a look at 720% rise general, and 177% in simply the previous 5 years.

The inventory raced 8% larger this week, which implies it’s up round 126% since I first invested in 2022. Nonetheless, I reckon it could actually hold climbing within the years forward and is value contemplating. Listed here are 4 explanation why.

Really distinctive

As arguably the world’s premier ultra-luxury model, Ferrari has a novel enterprise mannequin. It includes limiting provide to maintain demand and costs extremely excessive (exclusivity).

CEO Benedetto Vigna has mentioned that seeing a Ferrari out on the highway needs to be like encountering a uncommon and unique animal. And except you reside in Monaco, Dubai or Beverly Hills, it most likely nonetheless is for most individuals.

Warren Buffett as soon as remarked: “If you gave me $100bn and said ‘take away the soft-drink leadership of Coca-Cola in the world’, I’d give it back to you and say it can’t be done.”

This additionally applies to Ferrari, if no more so. The Prancing Horse model possesses a wealthy heritage and has a legendary historical past in motor racing, each of which make it actually distinctive.

Unimaginable pricing energy and margins

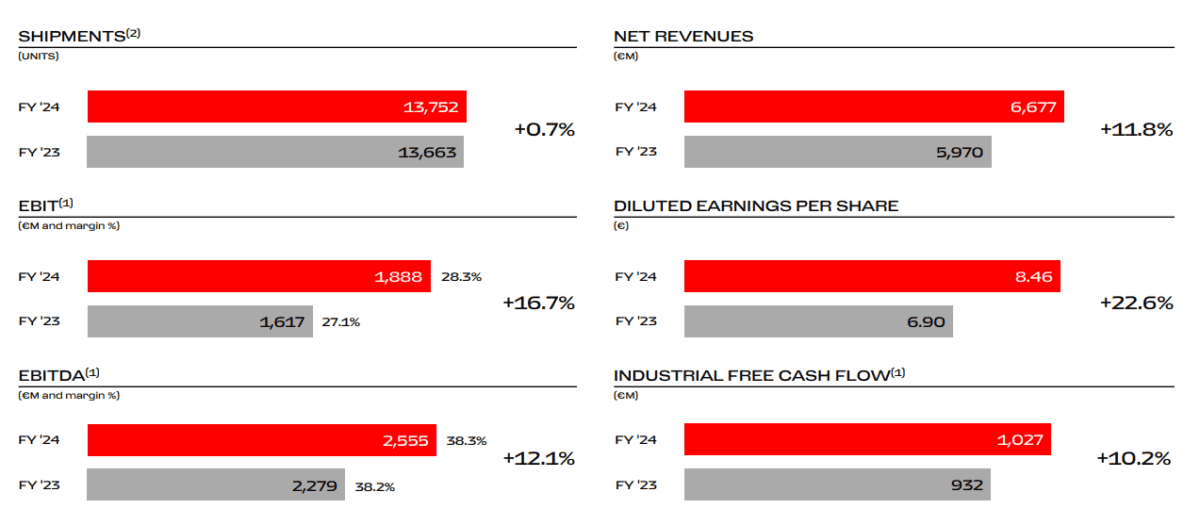

In 2024, the corporate shipped 13,752 autos, which was simply 0.7% greater than the 12 months earlier than. But income elevated 11.8% 12 months on 12 months to €6.7bn whereas internet revenue jumped 21.3% to €1.5bn. Annual industrial free money circulate topped €1bn for the primary time regardless of capital expenditure peaking at slightly below €1bn.

How’s this doable with such little quantity development? The reply is sort of limitless pricing energy, together with insatiable demand for automobile personalisation amongst its uber-wealthy clients.

High quality of revenues over volumes: I imagine this finest explains our excellent monetary leads to 2024, because of a powerful product combine and a rising demand for personalisations.

Ferrari CEO Benedetto Vigna.

The common promoting value of a Ferrari is now above $500,000, up from $324,000 in 2019. And at 28.3%, the corporate’s working margin stays industry-leading.

A historical past of outperformance

Another excuse I’m bullish is that the Italian luxurious carmaker has a behavior of beating Wall Avenue’s estimates. Working example was Q4, the place income of €1.74bn topped expectations for €1.66bn. Earnings per share additionally rose 32% to €2.14, additionally larger than anticipated.

Certainly, administration now anticipates reaching the high-end of its profitability targets for 2026 a 12 months forward of schedule!

Shortage

Presently, the inventory’s ahead price-to-earnings ratio’s 49. That’s actually a premium valuation.

In the meantime, the corporate’s set to launch its first totally electrical automotive later this 12 months. However that is new territory for Ferrari and will current actual challenges if clients aren’t completely happy. It’d harm the model. So this danger’s value monitoring.

Trying forward nonetheless, I see a remaining motive why the inventory ought to head larger. That’s primary provide and demand. Final 12 months, 81% of gross sales had been to current purchasers. So lower than 3,000 persons are getting their palms on a brand new Ferrari for the primary time every year.

Because the variety of high-net-worth people grows worldwide, demand ought to proceed to outstrip provide, bolstering pricing energy. I intend to carry the inventory long run, including to my holding on share value dips and occasional market panics.